It will be a holiday-shortened trading week, with markets in the US Closed today for Memorial Day. We had some typical holiday-like price action on Friday, with light trading volumes and the typical implied volatility selling that you tend to see ahead of a three-day weekend.

This coming week will have plenty of data, starting Tuesday with the S&P Corelogic home prices reading and ending with the PCE report. In that 1 p.m. time slot, we will also get 2-year, 5-year, and 7-year Treasury auctions and more Fed speakers.

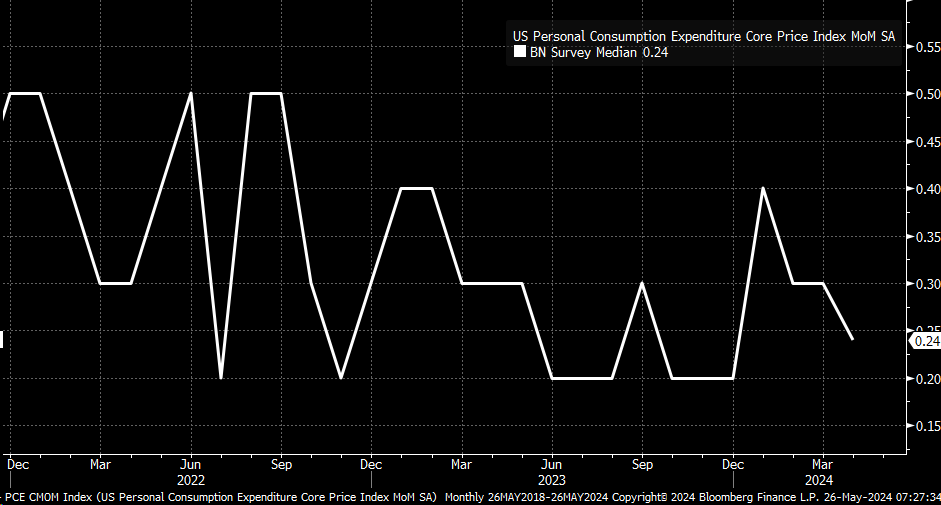

The core PCE is expected to increase by 0.2% m/m, down from 0.3% in March, and rise by 2.8% y/y in line with March. Right now, the estimates seem pretty mixed between the 0.2% and 0.3% m/m increase, but when you move the median to two decimal places, we see the estimate is 0.24%.

So 0.01% separates a 0.2% from a 0.3% from flashing on the screens on Friday, and a number coming in line vs. a hotter than expected. Of course, revisions to last month’s data will also come into play, so those must be watched closely.

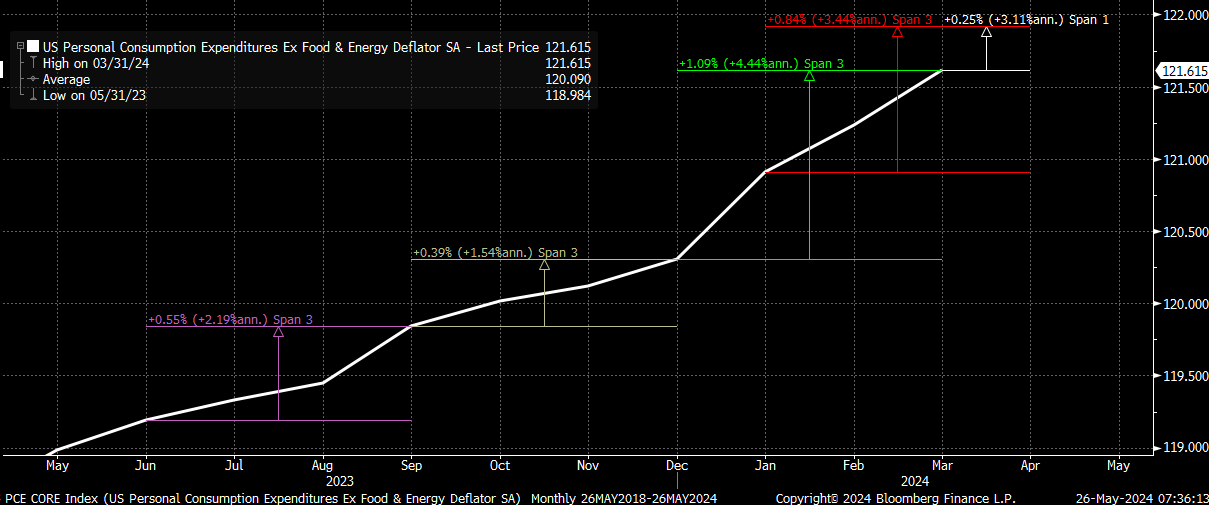

Even if the number were to come in at 0.24%, or the surveyed average of 0.25%, the 3-month annualized rate of change for core PCE would dip to about 3.4%, down from 4.4%, but still higher than the 2.2% annualized rate from June to September and the 1.5% rate from September until December.

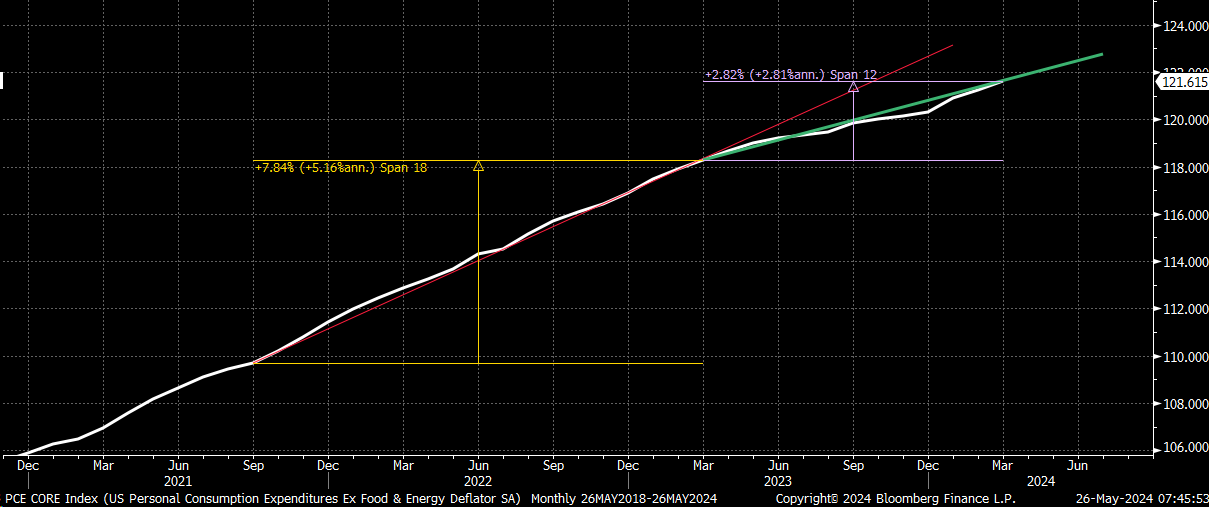

While there was a notable change in trend for Core PCE around March 2023, it isn’t clear whether the new trend will persist at this pace or accelerate further; the current trend of the past 12 months has been around an annualized rate of 2.8%. This will make the April reading important.

Can S&P 500, Nasdaq 100 Gap Higher?

Friday’s price action in the market seemed rather holiday-like, and it was not unexpected, given the three-day weekend and the usual volatility selling we see on long weekends. Additionally, while the S&P 500 was higher on Friday, it only managed to reverse 61.8% of the decline on Thursday and held all day.

It was similar for the Nasdaq 100, which found resistance at the 78.6% retracement level on Friday.

So, on Tuesday, for Friday’s trends to continue, both indexes must gap higher and overtake those resistance levels from the start. If not, Friday’s price action will likely be chalked up to holiday-implied volatility selling and the retracement of Thursday’s decline, opening a path to lower levels.

US Dollar, Yields, and Oil Face Resistance

The dollar was also weaker on Friday, with the USD/CAD falling to the 50-day moving average and bouncing some. The move down in the USD/CAD was somewhat surprising given a weaker-than-expected retail sales data point in Canada Friday morning. But, for now, the trends in the USD/CAD seem to remain upward.

2-year yields moved up a bit but are still in that 4.95% range, which is where they have been for some time. Following the weaker job and CPI reports, the 2-year had moved lower, testing the 50-day moving average two times. For now, that moving average has been supporting, and in the past, when the 2-year has bounced off the 50-day, it has resulted in it making a higher high, so perhaps at this point, the 2-year is looking at making a move back above that 5% level.

Oil is on the radar this week after it tested support and bounced off $76 last week. Also, the RSI has formed a bullish divergence, with a higher lower on the RSI and a lower low on the price. We probably need to see it clear the $80 to have greater confidence that a change in trend has occurred.

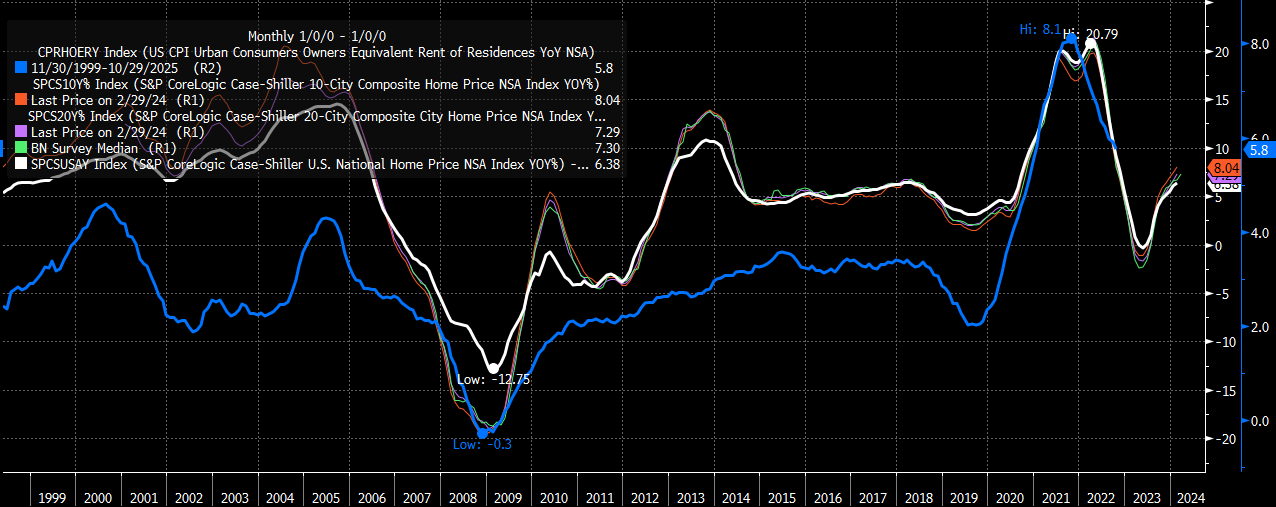

Finally, this week, we will also get the S&P Core Logic/Case Shiller home prices data, which matters significantly because it tends to lead the CPI OER index by around 18 months. The Case Shiller data has moved sharply higher in recent months, and the important thing here is that the CPI OER data is coming to a point where it should start to turn higher based on the Case Shiller data.

See you on Tuesday.