This week will be noticeably slower, given that there are hardly any data points until Wednesday, the 20-year Treasury auction doesn’t happen until Wednesday, the Fed minutes come Wednesday, and Nvidia (NASDAQ:NVDA) earnings come Wednesday. Wednesday morning will, of course, be VIX options expiration. So, Wednesday looks really busy, but Monday and Tuesday will be as dull as it gets.

Of course, if you enjoy listening to Fed speakers, and Raphael Bostic is your Favorite Fed official, and you are often caught walking around town wearing his jersey on the weekends and Atlanta Fed cap, then you are in luck.

Monday will be filled with Raphael Bostic, who will kick things off on Bloomberg TV at 7:30 AM ET, followed by some opening remarks at the Atlanta Fed Financial Markets Conference at 8:45, and finish the day at 7 PM ET. Bostic will return on Tuesday with some comments at 9:10 AM and a little panel moderation at 7 PM. He will close out his appearances for the week on Thursday with some Q&A from MBA students at 3 PM.

Fed Governor Chris Waller is also going to have a busy week. He will discuss the economic outlook at 9 AM ET on Tuesday and then spread his hawkish wings on Friday when he talks about R* at 9:35 AM ET. I would be surprised if he didn’t mention R*, otherwise known as the neutral rate, on Friday as being higher than previously thought.

When you see what has been happening in the markets recently, you can’t help but think that the neutral rate is higher than the Fed thinks. I feel like I have been saying that a lot over the past two years, and it seems that I am being proven correct more and more as time goes by. All you have to do is look at the parabolic move in copper to see how policy isn’t all that restrictive.

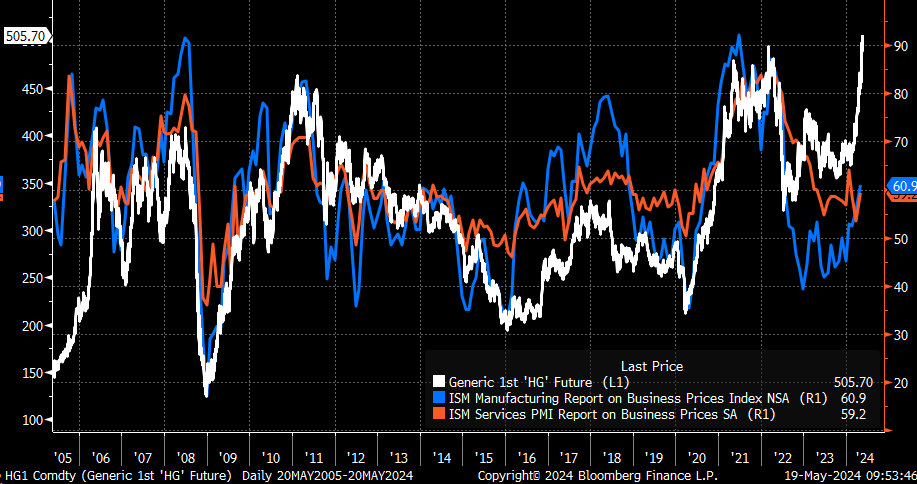

Copper prices surged to over $5 on Friday and are now up nearly 40% since early February. If that isn’t inflationary, then I do not know what is. I tend to think of copper as third on my list when it comes to inflationary force, behind oil and gasoline in the number 1 and 2 spots. Historically, when copper prices rise, it pushes the prices paid indexes for the ISM manufacturing and services sector higher.

If copper is correct, and ISM service and manufacturing prices surge higher in May and June, then team disinflation is in big trouble. If monetary policy were restrictive and R* was as low as some think it is, then what we see in copper prices right now, or for that matter, in all asset prices, would not be happening.

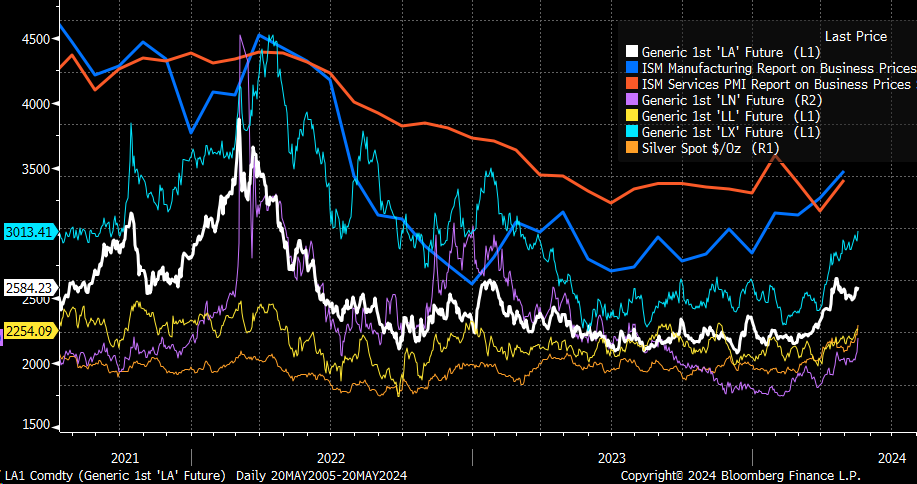

Meanwhile, the same thing is happening in silver, lead, zinc, and nickel.

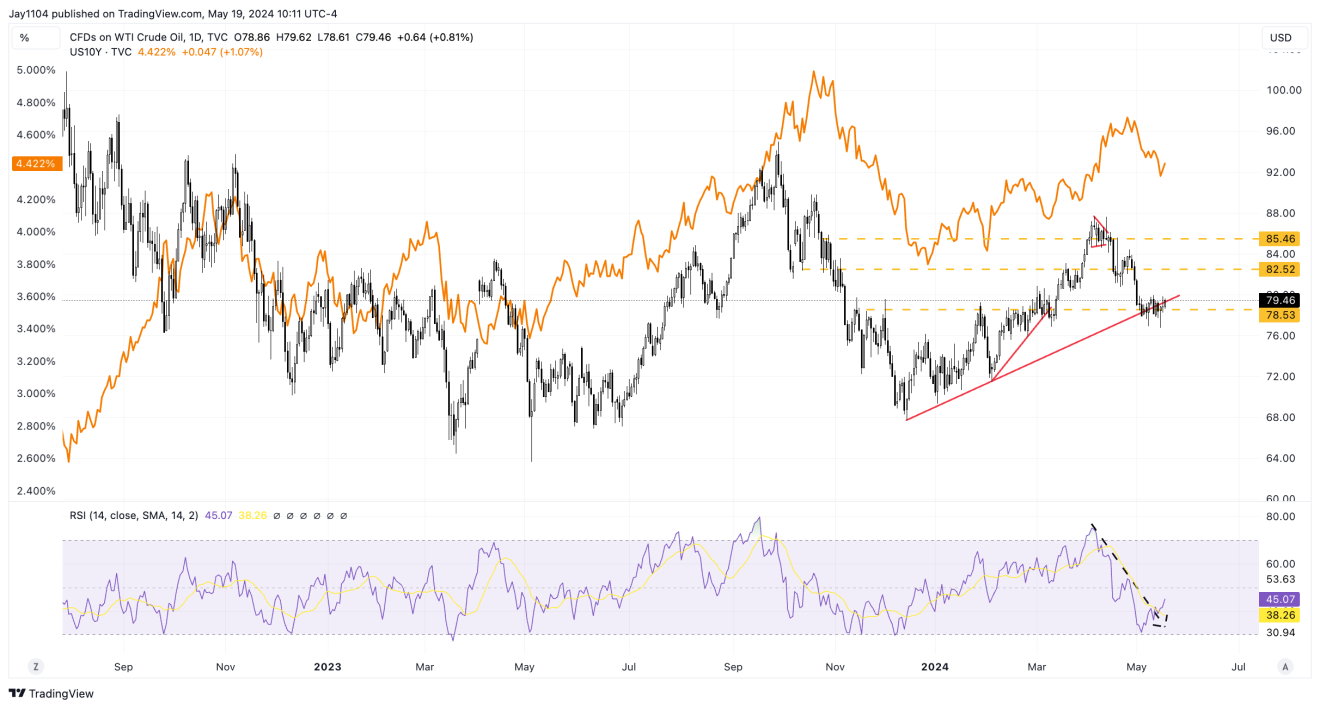

Right now, the only thing we are waiting for is oil to surge, and that looks like it may be close to happening, too. Oil has seen its RSI break a downtrend and start moving up, while prices have held on to support at $78.50. If it starts to move again to the upside and heads back towards $85, things will really start to get interesting on the inflation and interest rate front.

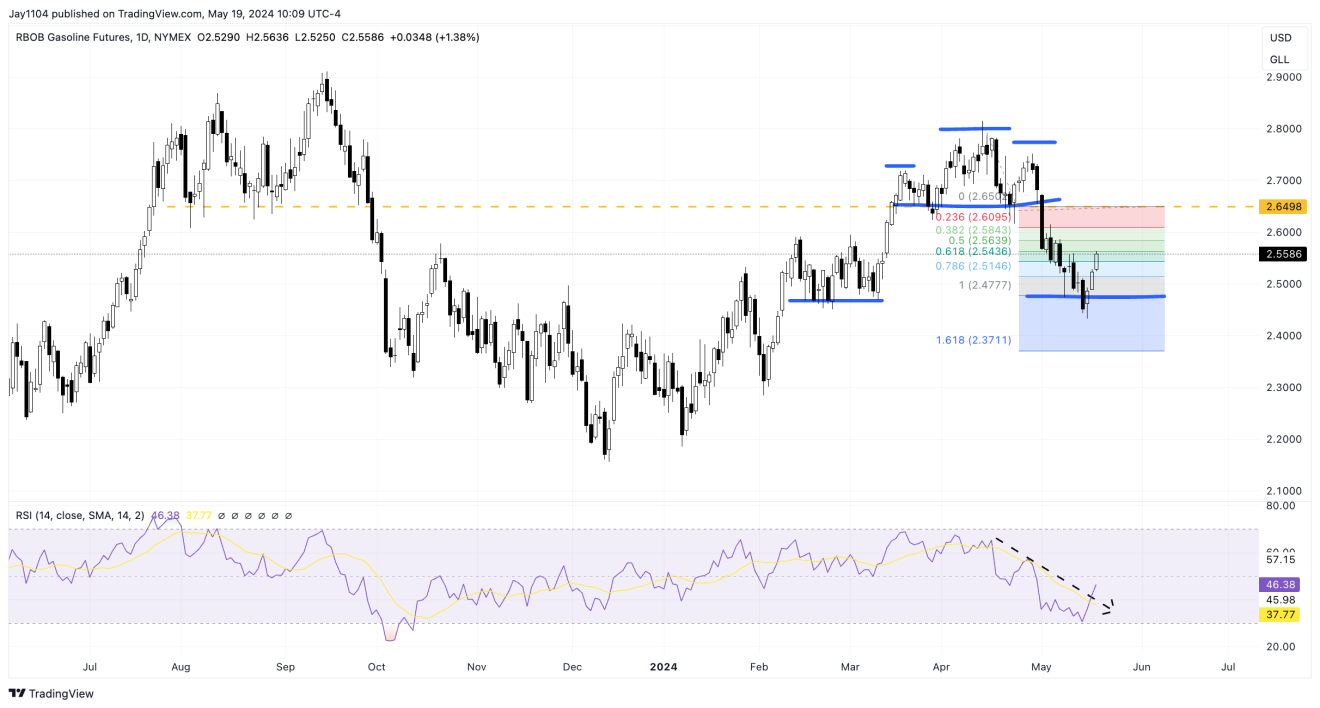

Even gasoline is showing signs of moving higher, with a break out on its downtrend in the RSI and a clear rebound in price following the completion of a head and shoulders pattern.

These will feed directly into 10-year rates moving higher because the 10-year has been glued to the price of oil for months, with a minor lag. So if we see oil prices go up, 10-year rates will be moving up along with oil, and the higher oil goes, the higher the 10-year rate shall go.

Of course, natural gas prices are also rising and appear to be breaking out.

This is why the XLE looks so bullish and appears to have broken a downtrend. It is probably heading much higher coming out of a bull flag.

This past week, we also saw a jump in shipping rates based on the WCI Composite Freight Benchmark. So right now, we have metal prices and shipping rates going higher, energy prices on the verge of going higher, with an already hot services inflation, and you have to wonder where inflation rates will be in 2 or 3 months times if these trends in commodities continue to move higher or get stuck at present levels. I bet that inflation rates go higher and that this idea of monetary policy being restrictive changes because, from the looks of it, the policy isn’t restrictive because the neutral rate is higher than we thought.

So pay attention to what Waller says about R*; if he says it is probably higher, then it means the policy isn’t restrictive enough actually to do anything about inflation and that inflation’s second coming has only started.