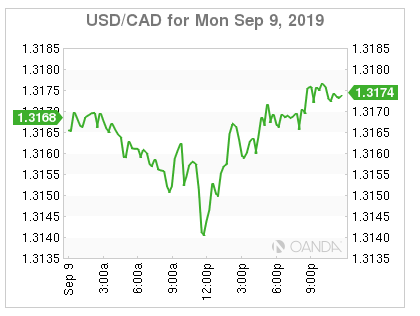

The Canadian dollar started the week on a positive note and was aiming to break below the 1.3140. The loonie was trading at 1.3164 Monday despite a rebound of 2% in oil prices as the U.S. dollar advanced later in the session. The Canadian economy impressed last week with a monster jobs reports that beat expectations by adding 81,000 jobs. The Bank of Canada remains confident and, given the performance of the economy, can afford the patience to keep rates on hold.

The big story this week is the European Central Bank (ECB) rate decision. The BoC is becoming an outlier by holding rates as other central banks are putting together more quantitive easing alternatives as rates near negative territory. The Fed has gone full 180 on its monetary policy, and after raising rates four times in 2018, is now on track for its second rate cut when the FOMC meets next week.

The economic calendar is light on data for Canada this week, but as risk appetite returns and central banks pump more stimulus, the loonie could trade higher and break out of the current range after Monday’s trading session.

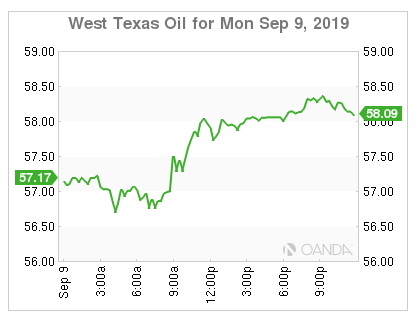

OIL

Oil prices rose as trade optimism gave way to the announcement of Saudi Arabia’s new energy minister. Khalid al-Falih appears to have fallen out of place with the kingdom, perhaps its primarily with how low oil prices have been despite all the Saudi-led production cuts. Al-Falih will be replaced as the Saudi energy minister, a signal that we could see a possible shift in strategy at the Sept. 12th OPEC+ strategy meeting in Abu Dhabi. His replacement, industry veteran Prince Abdulaziz bin Salman, is seen as very capable to maintaining all the relationships, especially the one Al-Falih brokered with Russian energy minister Novak. Last week Al-Falih was removed at chairman of Saudi Aramco.

The new energy minister, Abdulaziz is half-brother to the Crown Prince Mohammed bin Salman. This move could suggest that there will be more pressure from the Saudis for OPEC + to stabilize prices with further cuts.

GOLD

Gold prices traded higher as demand for safe-havens have tentatively eased up. It seems gold will continue to rise with massive stimulus measures that will stem from bad news with the global economy. Gold could struggle this week if we don’t see a clear path for lower rates and the expansion of bond purchases by the ECB. With many of the ECB hawks becoming vocal, a sign that could mean they are ready to concede on Thursday, we could see this rate decision deliver a strong dovish message that will include steps for QE2.

Gold’s bullish trend has had many pullbacks and the current one might not be over with. Yesterday's move higher is hardly a rally and could fizzle out. Key support for gold remains the $1,470 to $1,500 zone.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.