Despite challenges from a strong currency, Switzerland's economy remains strong, with significant industrial growth driven by specialized sectors. This resilience contrasts with stagnation seen in many neighboring countries.

Swiss Industry Not Afraid of the Strong Franc

In his last appearance before the press as President of the Swiss National Bank, Thomas Jordan warned that the franc is likely to appreciate against the euro, regardless of the SNB’s actions. To stay afloat, Swiss exporters will need to continue cutting costs to remain competitive with foreign competitors.

This is hurting the morale of Swiss companies. Over the past few months, Swissmem, the trade association for the machinery, equipment, and metalworking industries, has warned about the negative impact of the CHF's rise on exports. Now, the watchmaking industry is also raising concerns, urging the Swiss National Bank to intervene in its foreign exchange reserves.

Despite this, the figures demonstrate a reality that continues to impress the world: despite globalization and the franc's continuing appreciation against most currencies, the Swiss economy is holding up. Remember, in the 70s, it took 10 Swiss francs to buy 1 sterling, and 4.5 francs to buy 1 US dollar.

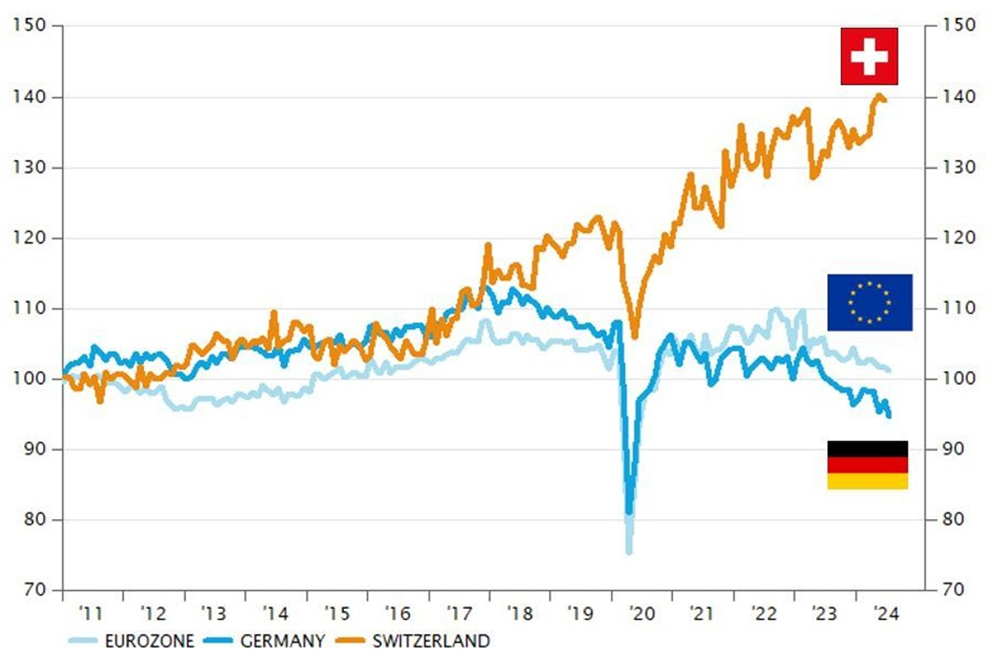

In fact, as the graph below shows, Swiss industrial production has grown by almost 40% since 2011, despite the franc's 25% appreciation against the euro. Have our neighboring countries benefited from the euro’s depreciation? Not at all. In fact, industrial production has hardly grown in 15 years. In Germany, it has even declined since 2011. The contrast with Switzerland is striking.

Industrial Production

(Index rebased to 100 on January 1, 2011)

What Accounts for Switzerland's Outperformance of the Eurozone?

In simple terms, this divergence can be explained mainly by the presence in Switzerland of a few important sectors with very high added value, which still stand out from the competition from emerging economies. These include pharmaceuticals, watchmaking, and chemicals.

Despite the 39.6% aggregate increase in Swiss industrial production since 2011, many sectors have seen their output decline over this period, due to the loss of market share to more competitive emerging producers. For example, production fell in the textile (-27%), electrical equipment (-11%), metal products (-12%) and machinery (-16%) sectors.

However, the three aforementioned high-value sectors recorded strong production increases over the period, pulling up the Confederation's industrial output: pharmaceuticals (+189%), watchmaking (+37%) and chemicals (+67%).

Swiss industry is being driven upwards by these three sectors, whereas industry in the Eurozone has not been able to rely in the same way on less competitive, high-value-added sectors of excellence.

In the Eurozone, particularly in Germany and Italy, the currency union's two main industries, growing competition from emerging producers has caused industrial production to stagnate or even decline since 2011.

Switzerland Versus the Rest of the World

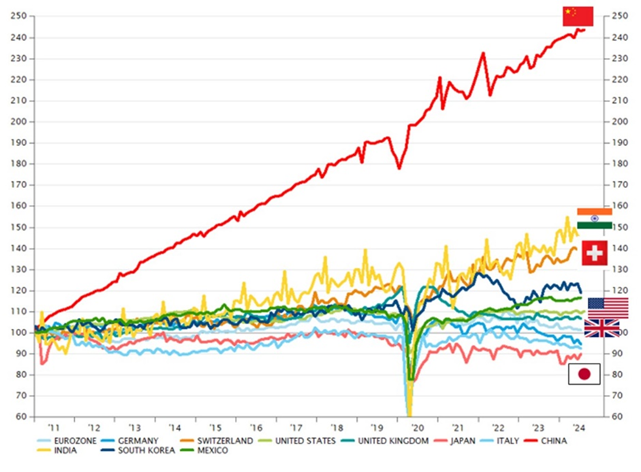

To broaden the debate and perspective, here's the same chart on industrial production (base 100 on 01.01.2011) including all major economies.

Industrial Production

(Index rebased to 100 on January 1, 2011)

It is important to note the following:

- Unsurprisingly, China has experienced the strongest growth in industrial production, although the rate of increase has slowed in recent years.

- The USA and the UK have recently seen industrial production return to pre-Covid-19 levels. However, growth over the last 15 years has been weak, barely better than the downward trend in Europe.

- Some emerging economies have performed well (e.g. India, Mexico), particularly in recent years thanks to the phenomenon of “friendshoring” and “nearshoring”. South Korea's performance in recent years has been more mixed.

The de-industrialization trend in developed economies is clear, especially in Europe and the United States. The efforts to “reindustrialize” (like Trump and even Harris plan in the USA, or the Draghi report in Europe) will require major investments and significant policy changes.

China is no longer “the world's only workshop”, even if it remains the largest one, with over 30% of the world's industrial output is produced in China. India, buoyed by its domestic growth and the opening of its economy to trade, and Mexico, which benefits from American reshoring and friendshoring, are experiencing strong growth in their industrial sectors.

Switzerland is a remarkable exception, with its highly specialized, high-value-added sectors enabling it to maintain its industrial base despite the decline in the production of lower value-added goods, which are suffering from growing competition from emerging countries.