-

Target's stock jumps 12% on better-than-expected Q4 earnings and revenue, with an optimistic earnings forecast for fiscal 2024, leading to analyst upgrades.

-

Costco shares fall 4% after missing revenue forecasts for Q2.

-

Marvell shares drop over 5% due to disappointing Q1 guidance, amidst weakened demand.

-

Subscribe to InvestingPro now for under $9 a month and never miss another bull market again!

In this week's earnings recap, we delve into the latest quarterly reports from four industry giants— Target, Costco, Marvell, and DocuSign.

Target stock jumps following Q4 beat & strong outlook

Target's (NYSE:TGT) shares soared 12% on Tuesday after the company reported its Q4 results, with earnings of $2.98 per share, notably surpassing the predicted $2.41. The retail giant also reported quarterly revenue of $31.9 billion, beating the forecast of $31.83B. Looking ahead, Target forecasts EPS for fiscal 2024 to range between $8.60 and $9.60, above analyst expectations of $8.44.

This robust performance and optimistic guidance prompted several analysts to upgrade Target’s rating and increase their price targets. Deutsche Bank lifted its rating from Hold to Buy, setting a new price target of $206, up from $149, citing potential for at least 20% upside given Target's current valuation relative to peers. HSBC also shifted its rating from Hold to Buy, with a revised price target of $195, up from $140.

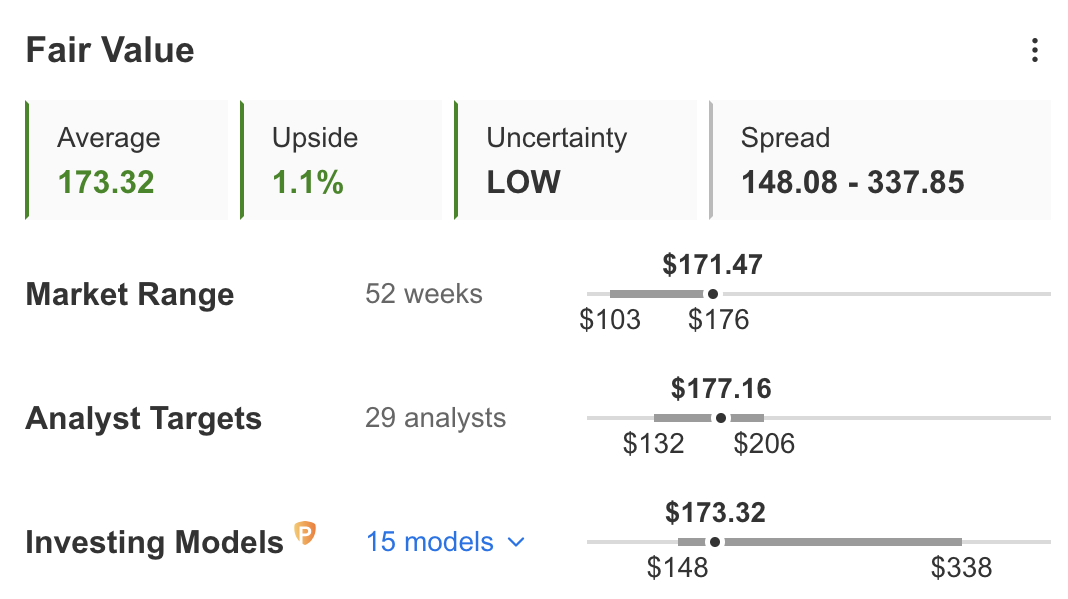

Despite these positives, InvestingPro's Fair Value analysis indicates just a modest 1.1% potential upside for Target's stock, according to Investing models, while analyst targets predict a 3.3% gain.

Costco drops on revenue miss

Costco (NASDAQ:COST) shares experienced a 4% decline in pre-market trading today following the announcement of its mixed Q2 results. The company outperformed earnings expectations with a Q2 EPS of $3.92, surpassing the predicted $3.62 by analysts. However, quarterly revenue of $57.33B fell short of the anticipated $59.11B, attributed to weaker demand for higher-margin products.

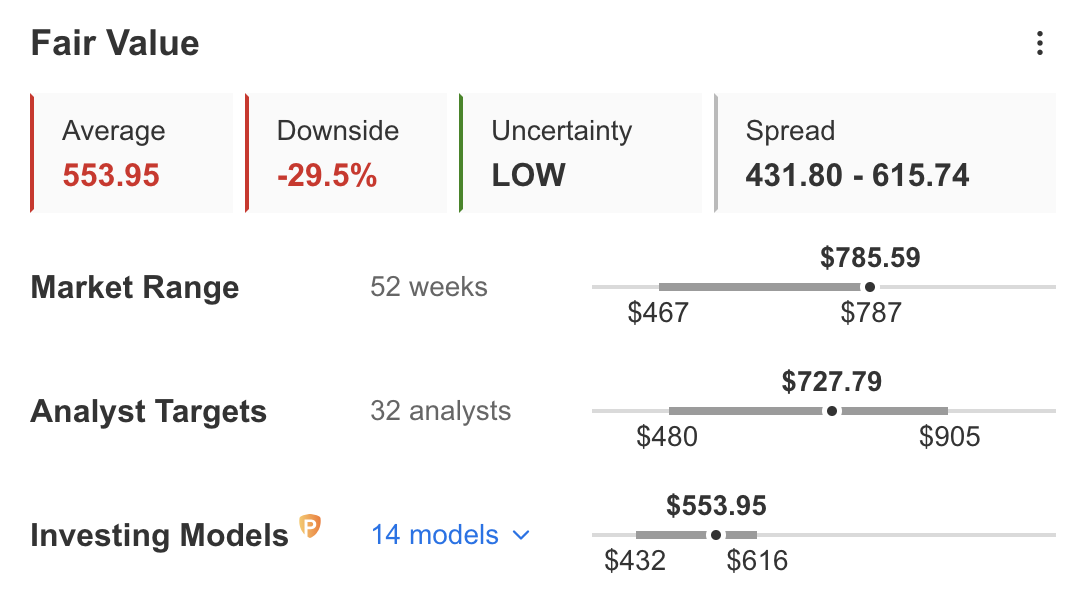

According to InvestingPro's Fair Value analysis, Costco appears to be overvalued, estimating its fair value at $553.95. This analysis indicates a potential 29.5% decrease in stock price, based on Investing models. In contrast, analyst projections suggest a more conservative 9.4% decline.

Marvell Technology plunges on guidance miss

Marvell Technology (NASDAQ:MRVL) shares dipped over 5% pre-market today, as the company's Q1 earnings and revenue projections fell short of analysts' expectations amid weakened demand across its wireless infrastructure, consumer, and enterprise markets. For Q1/25, Marvell anticipates EPS to be between $0.18 and $0.28, significantly below the analyst consensus of $0.40. The company also expects Q1 revenue to be around $1.15B, missing the forecasted $1.37B.

Marvell reported its Q4 earnings at $0.46 per share, aligning with market estimates. The quarterly revenue was $1.43B, slightly above the expected $1.42B.

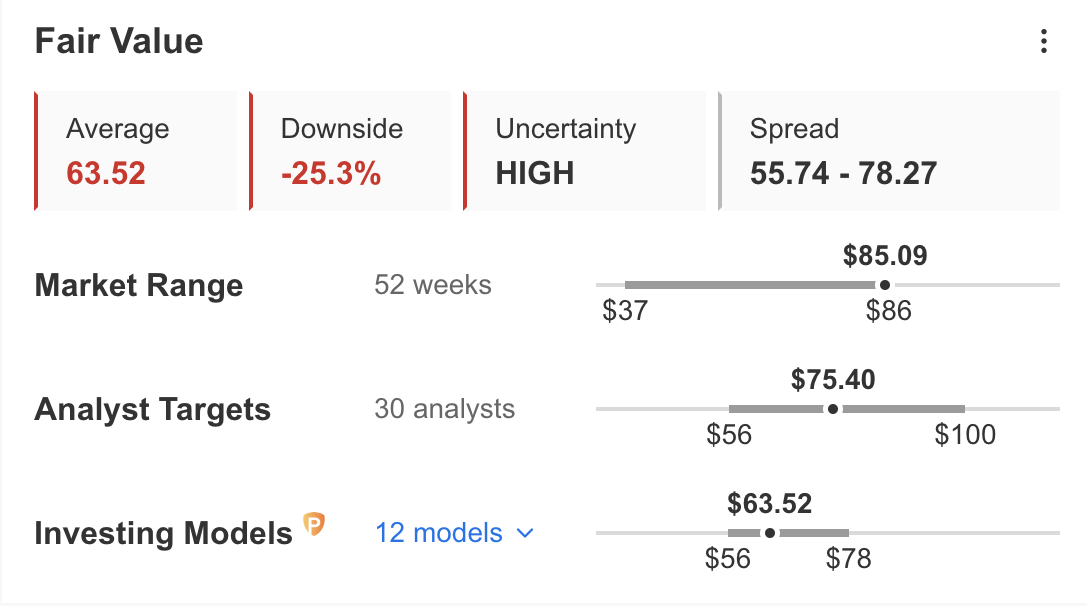

According to InvestingPro's Fair Value analysis, Marvell's stock might see a potential 25.3% downside, based on Investing models. Analysts, however, foresee a more modest 11.3% decrease in the stock price.

DocuSign shares jump following Q4 beat

Shares of DocuSign (NASDAQ:DOCU) experienced a notable jump of nearly 9% pre-market today, following the announcement of its Q4 financial results. The company outperformed expectations with EPS of $0.76, exceeding analyst predictions by $0.11. The reported revenue of $712.4 million also surpassed the anticipated $698.35M.

Looking ahead to Q1/25, DocuSign projects its revenue to be between $704M and $708M, slightly above the analyst consensus of $699.1M. For the full fiscal year 2025, the company anticipates revenue to range from $2.915B to $2.927B, compared to the consensus of $2.92B.

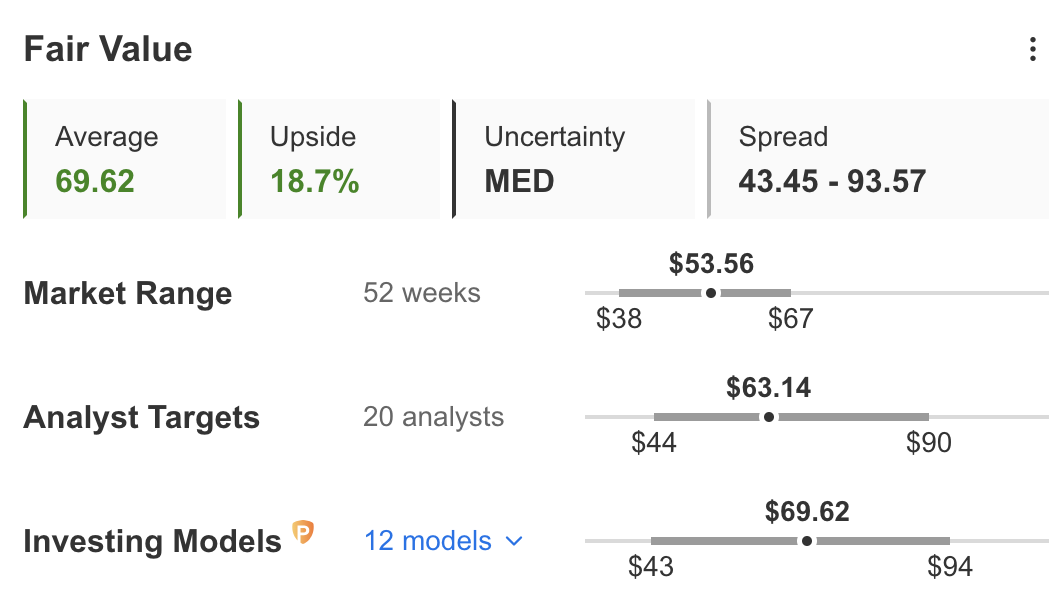

InvestingPro's Fair Value analysis indicates a promising 18.7% potential increase in DocuSign's stock price, based Investing models.

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. As with any investment, it's crucial to research extensively before making any decisions.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Subscribe here for under $9/month and never miss a bull market again!

*Readers of this article get an extra 10% off our annual and 2-year Pro plans with codes OAPRO1 and OAPRO2.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.