By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

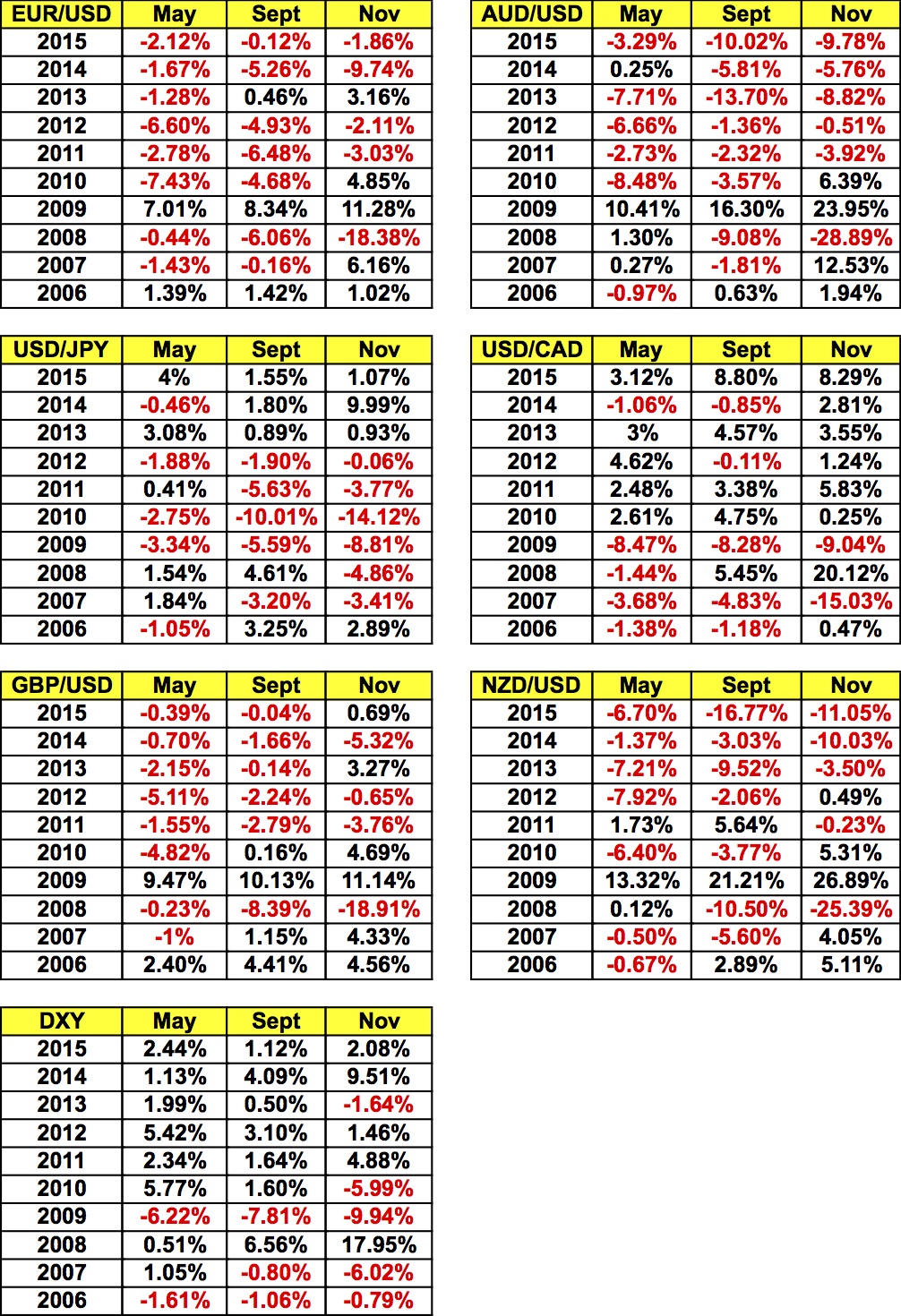

On Monday, we presented our readers with a table illustrating the U.S. dollar's seasonal performance in the month of May. According to the data (shown again below), May tends to be a very good month for the dollar and as the first week of the month progresses, USD bulls are regaining control. In 8 out of the last 10 years, the Dollar Index appreciated in the month of May with particularly consistent gains seen in EUR/USD and GBP/USD. Interestingly enough, these are two of the currencies that have seen the smallest losses against the dollar. Nonetheless, the greenback is rising and enjoying particularly strong gains versus the commodity complex. USD/CAD rose another 1.25% while NZD/USD and AUD/USD extended their losses. Stronger-than-expected U.S. data helped to drive the dollar higher Wednesday but the primary catalyst for the greenback's reversal has been the decline in commodity prices, which explains why commodity currencies experienced the greatest losses.

Although private payroll provider ADP reported lower employee additions in March, ISM reported stronger job growth in the services sector. Investors chose to put greater weight on the ISM number and rightfully so because it is the strongest leading indicator for nonfarm payrolls. With service-sector activity growing at its fastest pace in 4 months and the employment component also rising to a year-to-date high, we’re looking for accelerated job growth in April. Factory orders also rose strongly and the trade deficit shrank to its smallest level in 7 years. While it's highly doubtful that the Fed will change its mind about leaving rates unchanged in June, regardless of how strong Friday’s jobs report is, the U.S. dollar is leading the charge. And when positive momentum is met with confirming data, it could actually accelerate gains in the currency. Whereas if the dollar was weak and the jobs number strong, the impact on the dollar would be limited.

USD/CAD was driven sharply higher after Canada reported a record-breaking trade deficit. The country reported its worst trade deficit ever as exports hit the lowest level in more the 2 years. The strength of the Canadian dollar and the previous decline in oil prices weighed heavily on Canadian–U.S. trade activity. The surplus with Canada’s largest trade partner narrowed to its smallest level since December 1993. The plunge in exports creates big headaches for the Bank of Canada, which had been banking on a recovery in the non-export sector to stabilize the economy. The only saving grace is the rise in oil prices last month and the Fed’s slower pace of tightening. Unfortunately, CAD is still poised for further losses as Canada’s employment report on Friday will most likely show a slowdown in job growth after the previous month’s exceptionally strong reading.

The New Zealand dollar traded lower on the back of Tuesday night’s mixed employment numbers. Although employment change grew by 1.2% in the first quarter, which was double expectations, the unemployment rate rose to 5.7% from an unrevised 5.3%. An increase in the first quarter was expected but not by this magnitude. While the increase can be largely attributed to the rise in participation rate -- good news for New Zealand’s economy -- investors still worry that hiring decisions will deteriorate in the coming months as weaker Chinese and Australian economic performance weighs on New Zealand growth. Average hourly earnings also fell short of expectations, increasing the pressure on the RBNZ to ease.

For the second day in a row, the Australian dollar closed below 75 cents. Tuesday night’s slightly higher-than-expected service-sector PMI report failed to renew demand for the currency as investors prefer to interpret the sub-50 reading as justification for the Reserve Bank’s surprise rate cut. As Trade and retail-sales numbers were due Wednesday evening, the weakness of the PMI manufacturing report signaled the potential for a disappointing trade number while the sales component of PMI services increased. That contradiction puts retail sales at risk for a downside surprise as well.

Euro ended the day unchanged against the U.S. dollar as softer retail sales and downward revisions to German and French PMI service reports were offset by slightly less-dovish comments from the ECB. According to “ECB sources”, there’s no desire for action before September -- if at all. Considering that few in the market expect additional stimulus from the central bank in the near term, the impact on EUR/USD was limited.

Sterling continued to fall versus the U.S. dollar and most other major currencies as a softer construction-sector PMI report followed Tuesday’s disappointing manufacturing release. Data for the more important service sector is scheduled for Thursday and if it falls short of expectations as well, we could see GBP/USD fall to the 100-day SMA at 1.4400.