Since its IPO in late 2021, Upstart Holdings' (NASDAQ:UPST) stock has experienced a bumpy ride. At the peak of the COVID boom, the stock appreciated up to $390, which was significant considering that it went public at $26. After that, the story was similar to other fintechs, with the stock brutally correcting roughly -97% to $12.10 in the economic period of high global inflation, elevated interest rates, and supply chain disruptions.

While it would seem like a miracle for the stock to return to a valuation of over $30 billion, in 2024, it had a magnificent performance of over 60%, which outperformed the KBX Nasdaq Financial Technology Index (KFTX) by approximately 21%.

For investors, the previous valuation amplifies the anchoring bias; therefore, the focus should be on whether the stock could move higher from its actual valuation of $5.8 billion and not whether it can return to the previous level.

UPST Data by GuruFocus

Upstart: The Lending Platform That Trades on Nasdaq

In essence, Upstart is an online lending platform powered by artificial intelligence that predicts borrowers' credit riskiness. Its algorithm collects independent variables from customers to determine the credit riskiness and lending rates available. Although Upstart also invests its own capital, its job is mostly to match customers' loan demand with capital from partnered banks and earn an intermediation fee.The company describes its algorithm as more accurate than traditional lending models, including more than 1,600 independent variables. This allows customers to receive a lower annual percentage rate ("APR") and banks to absorb more applicants at a lower risk of default. Simultaneously, Upstart has a pretty high net promoter score of 83 and a smooth application process, as 92% of the loans are analyzed automatically.

As of Q3 of 2024, Upstart reported achieving over 3 million customers, $40 billion in originations, and more than 100 partnerships with lending institutions since its foundation. Simultaneously, they reported having proprietary loans valued at $6.56 billion.

Upstart: A Business That is Highly Sensitive to the Credit Cycle

The best way to analyze Upstart's performance is to explore its core KPIs. In this case, I identified two.| Q3'24 | Q3'23 | Q3'22 | Q3'21 | Q3'20 | |

| Transaction Volume, Number of Loans | 188,149 | 114,464 | 188,519 | 362,780 | 80,893 |

| Transaction Volume, Dollars | 1,582M | 1,219M | 1,851M | 3,130M | 909M |

For example, the peak of volume transactions occurred in Q3 2021 when the company helped originate $3.130 billion in loans. Three years later, that KPI reverted to half of this to $1.520 billion. Clearly, the rise in interest rates was a headwind to the company as loan demand started to shrink significantly.

This drop in key performance indicators figures was directly translated into revenue, implying that take rates have been consistent over the years. In Q3 2021, Upstart achieved a record revenue of over $300 million. Yet, according to the latest quarterly figure reported, the company obtained just $162 million in Q3 2024.

Upstart: A Stock That Is Hard To Value

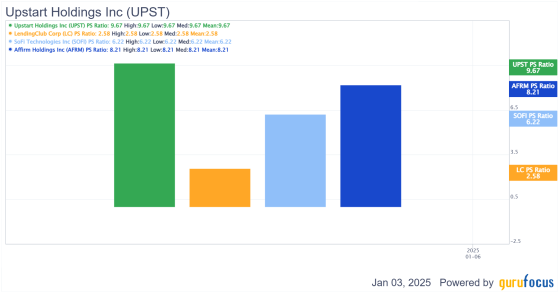

The valuation of Upstart is tricky. First, its bottom line is negative. Therefore, a PE multiple will provide unmeaningful results. Second, it securitizes many of its loans, so the book value component figure won't be as stable as a classical bank. Last, a price-to-sales valuation is the only metric remaining. Although it is far from perfect, it is the best metric available to analyze Upstart at its current state of unprofitability.Still, the results are not that compelling. For example, based on the current multiple of 9.7x price-to-sales, the stock looks fairly valued based on the historical average since the IPO. However, compared to its three-year history, it appears to be significantly overvalued by approximately 84.9%.

UPST Data by GuruFocus

In addition, there aren't many publicly listed companies with a similar business model to Upstart's. Still, when compared to other fintech, they have the highest price-to-sales multiple compared to SoFi Technologies (NASDAQ:SOFI), Affirm Holdings (NASDAQ:AFRM), and LendingClub (LC), for example.

Conclusion: Recovery Opportunity (SO:FTCE11B) From Lower Interest Rates

UPST Data by GuruFocus

At this point, the market probably doesn't care about stock multiples on this stock but rather about its promises of becoming profitable again, which is what sell-side analysts expect for 2025. At the same time, with interest rates dropping, the company's stock price is set to continue recovering, as that is a solid catalyst for loan demand originations, which is ultimately the company's core KPI.

With a high degree of cyclicality, Upstart's stock offers an interesting spot for a tactical position in a portfolio. This opportunity may have been clearer six months ago, but it remains present despite the stock recovery of the past months. Ultimately, history has demonstrated that Upstart's financials offer high uncertainty, and investors should be aware of this characteristic before analyzing a tactical position on the stock.

This content was originally published on Gurufocus.com

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.