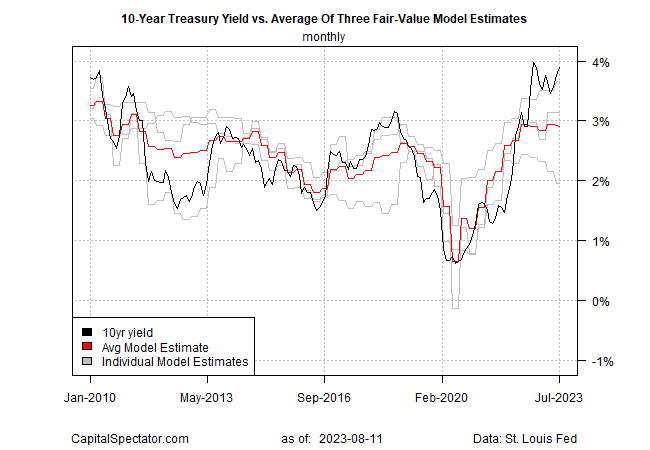

The 10-year Treasury yield continues to trade at a level well above CapitalSpectator.com’s fair-value estimate, but the gap suggests that further increases in the benchmark rate are facing stronger headwinds.

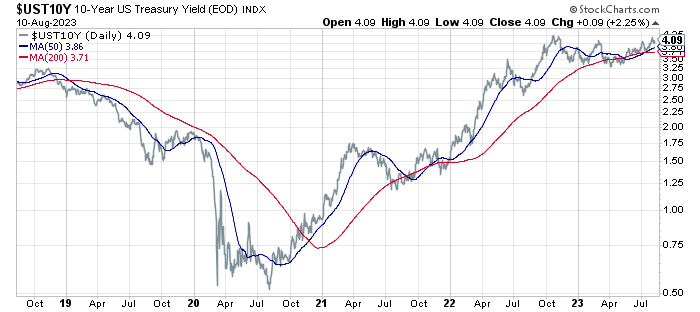

The 10-year rate closed at 4.09% yesterday (Aug. 10), modestly above the level when last month’s fair-value estimate was updated (3.86%). That compares with today’s average model estimate of 3.90% (as of July), which is slightly above the previous month’s estimate of 3.75%.

The model’s average estimate can be used as a forecasting tool for the market rate, but history reminds us that a gap will usually persist between the theoretical and actual yield through time.

The value of the model is that the gap (i.e., the model’s errors) varies semi-regularly around zero. In turn, that implies that the current gap will eventually narrow and then reverse, although the timing is highly uncertain.

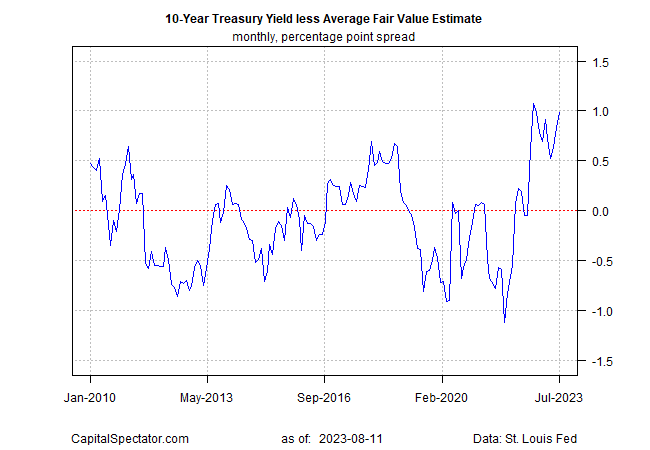

The 10-year market rate continues to reflect a relatively wide premium over the fair-value estimate. The scenarios that will narrow the gap: are 1) a decline in the market rate, 2) a rise in the model estimate, and 3) a combination of both.

Although there’s no guarantee that the market will trade in line with the model’s estimate, history suggests it will, eventually, and that some degree of normalization from the current extreme is likely and overdue.

Reviewing the spread between the market rate less the average model estimate reflects an unusually high difference. In turn, that implies growing pressure that a narrowing will, at some point, unfold, leading to a reversal into negative terrain (market rate below average model estimate).

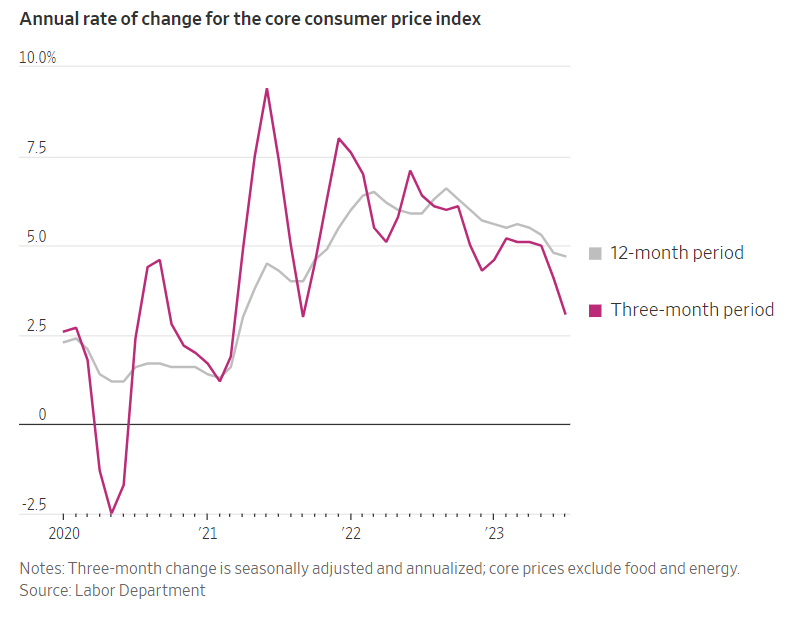

One scenario for expecting that the 10-year rate will move closer to the average model: inflation continues to ease. Although yesterday’s consumer inflation at the headline level ticked up in July for the one-year trend – the first increase in over a year – core CPI was steady, offering a somewhat more encouraging profile.

Some analysts advise that looking at the 3-month annualized change for core CPI offers a more reliable measure of recent inflation behavior and on that front disinflation is strengthening. Notably, the 3-month pace fell sharply to 3.1% in July, down from 5.0% previously.

“My God, that’s incredible,” says Laurence Meyer, a former Fed governor, of core CPI’s sharp decline for the 3-month change. “There’s absolutely no question that core inflation has turned the corner faster” than the Fed anticipated, he tells The Wall Street Journal.

Y-Parthenon senior economist Lydia Boussour also reads the latest inflation data as encouraging, telling Yahoo Finance: “The July CPI report offered more convincing evidence that inflation pressures are abating.”