By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

If we could use one word to summarize Wednesday’s rate decisions, it would be 'DISAPPOINTMENT'. The market did not have high hopes going into the Federal Reserve and Bank of Japan monetary policy announcements but somehow both central banks managed to fall short of expectations. Fed Chair Janet Yellen was a reluctant hawk whose forward guidance failed to convince investors that a 2016 rate hike is still coming -- even after 3 policymakers dissented from the decision and voted to tighten immediately. To be clear, Janet Yellen said the case for a hike has strengthened and that she sees one rate hike this year, if labor gains. She even confirmed to a reporter that every meeting is a live meeting but the tone of her voice and body language suggests that her outlook is far more cautious. Given the recent slowdown in job growth, wages, manufacturing and service-sector activity, Yellen could be worried about weak economic momentum, particularly in light of low productivity gains. It is also difficult to justify tightening on the same day as they lowered their 2016 GDP forecast and hiked their unemployment-rate forecast. That's why the dollar struggled to rally post FOMC and with the Bank of Japan falling short, we see USD/JPY targeting 100.

However, if USD/JPY falls to 100, it becomes an extremely attractive buying opportunity because as cautious as Yellen may be, a rate hike is still coming in December -- especially with 3 FOMC members supporting an immediate move. Fed funds futures are currently forecasting a 60% chance of a hike in December and as fresh US data is released and we near the December meeting date, speculation will increase, pushing US yields higher and lifting USD/JPY along with it. Right now, the pair is trading primarily on technical considerations as shorts want to run the stops at the psychologically important 100.00 level. But once done, we think the pair will rebound quickly as fundamentals take hold of the market. Technically there’s also no support in USD/JPY until 100, but parity is a very important level for the currency pair.

Meanwhile, the Bank of Japan made only modest changes to monetary policy Tuesday night. They relaxed the framework for bond purchases by dropping their average maturity target and altered the mix of equity purchases to include more TOPIX. They also maintained their 2% inflation target and left interest rates unchanged, which was widely expected. While the yen initially declined sending USD/JPY to a high of 102.79, the rally fizzled quickly as investors saw the announcement as a big disappointment. There was nothing surprising -- let alone impressive -- in Wednesday’s decision and it will be difficult for the central bank to reach its inflation target without additional easing. More rate cuts are likely but there was nothing in the monetary policy statement suggesting that it would happen soon. Instead, Japanese officials could be waiting for the Fed to do the heavy lifting because rising U.S. rates will take USD/JPY higher, easing pressure on the Japan’s export sector and the central bank.

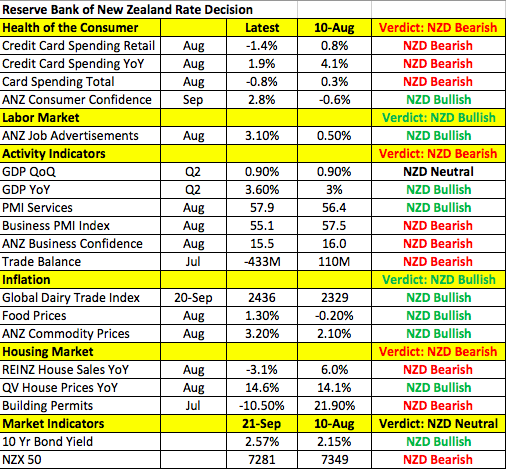

There’s still one more monetary policy announcement this week from the Reserve Bank of New Zealand and having just lowered interest rates in August, no changes are expected in September. When the RBNZ last met, they were optimistic about the economy but indicated that rates “will” (not "may") be eased further. Since then, we’ve seen mixed performance in New Zealand’s economy (see table below) with consumer spending falling, business activity slowing and house sales declining. The New Zealand dollar is also trading 3% higher versus the Australian dollar compared to August 10 -- the last RBNZ meeting. However job ads and consumer confidence have been on the rise and inflation appears to be ticking up. With all of this in mind, we expect the RBNZ to maintain its dovish monetary policy bias and for any initial gains in NZD to fizzle. USD/CAD experienced its strongest one-day rise in 10 trading days as the U.S. dollar tanked and oil prices rose 3%. AUD/USD also marched higher.

Euro and sterling took their cue from the U.S. dollar with both currencies trading higher against the greenback. No economic reports were released from the Eurozone and on Thursday we only have the ECB’s economic bulletin plus Eurozone consumer confidence scheduled for release. From the U.K. we had better-than-expected data with Public Sector Net Borrowing reporting a deficit of 10.1b vs. 10.5b expected. GBP/USD appears to have found a bottom but needs to clear 1.31 before stronger gains can occur. Until then, the next level of support below Wednesday’s low is at the August low of 1.2866.