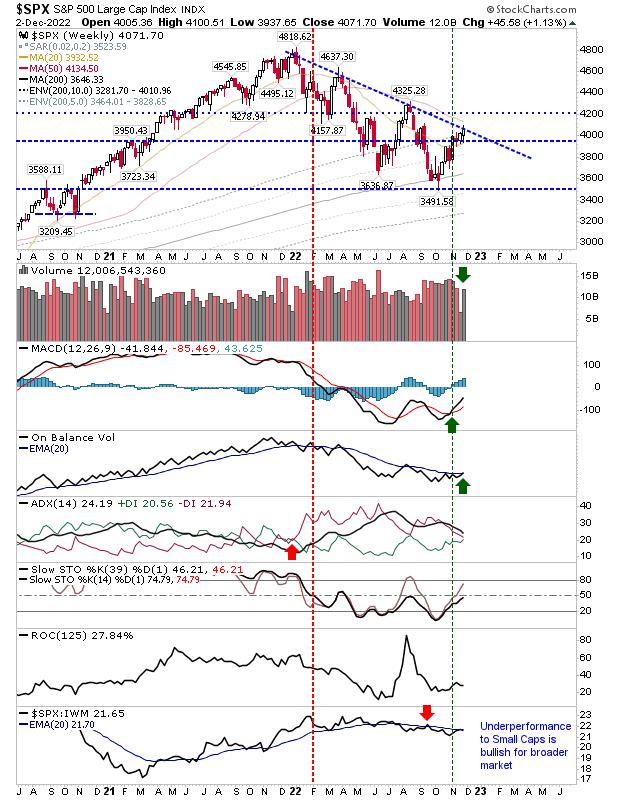

With the end-of-year fast approaching, all eyes will be on the S&P 500 next week. This index finished the week on resistance in a set-up which offers a good chance by the close of business on Friday there will be a breakout. On the weekly chart, there was a MACD trigger 'buy' and On-Balance-Volume 'buy' to go with an upcoming out-performance against peer indices. Even if there is no price breakout this week, a close above the mid-line of Stochastics [39,1] would suggest a price breakout will be along soon enough.

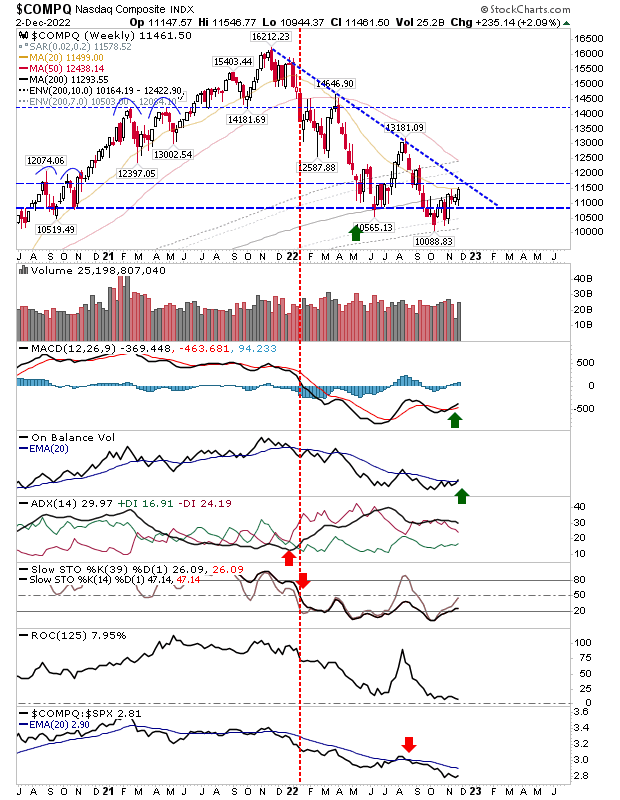

The Nasdaq has yet reached the heights of the S&P, but it's getting there - helped by the close above the 200-week MA (effectively a yearly average). It too has the benefit of a MACD and On-Balance-Volume 'buy' trigger, but momentum (stochastics) is a long way off.

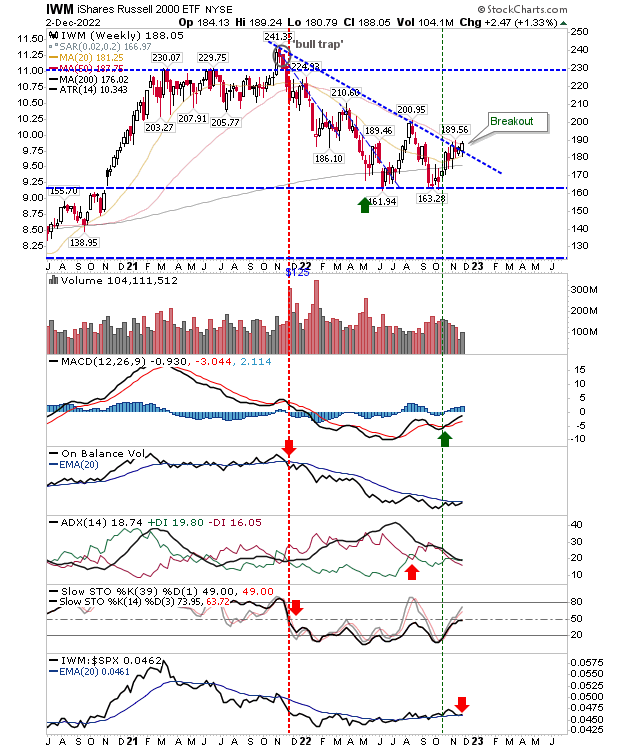

The Russell 2000 is a trickier call. There was a resistance break after a recovery of its 200-week MA, helped by a MACD trigger 'buy'. On-Balance-Volume is on the verge of a new 'buy' trigger but it hasn't enjoyed the same level of buying as the S&P or Nasdaq. Where things get more interesting is that it's very close to a bullish cross of the stochastics mid-line.

The set-up for the coming week is bullish, but what happens at the end of the week is more important than what happens at the beginning.