Canada’s trade deficit widens even as U.S. trade surplus grows

‘Similar in spirit, different in approach’ describes how one can view these investment approaches. While both strategies are based on the low volatility anomaly, the way each executes this objective differs meaningfully.

Low volatility investing focuses on the volatility of individual equities within a benchmark, ranking them on their past volatility measures, and then forming a portfolio accordingly. Conversely, minimum volatility portfolios determine the historical return volatilities and correlations of all the individual stocks in the benchmark, then utilize an optimization approach to construct the least volatile portfolio, based on their weightings and observed relationship over time.

Simply put, for low volatility portfolios, the absolute focus is ensuring that only low volatility stocks are present, whereas minimum volatility portfolios may include stocks deemed volatile – but their overarching relationship in the portfolio is what takes precedence.

Different approach, different exposures

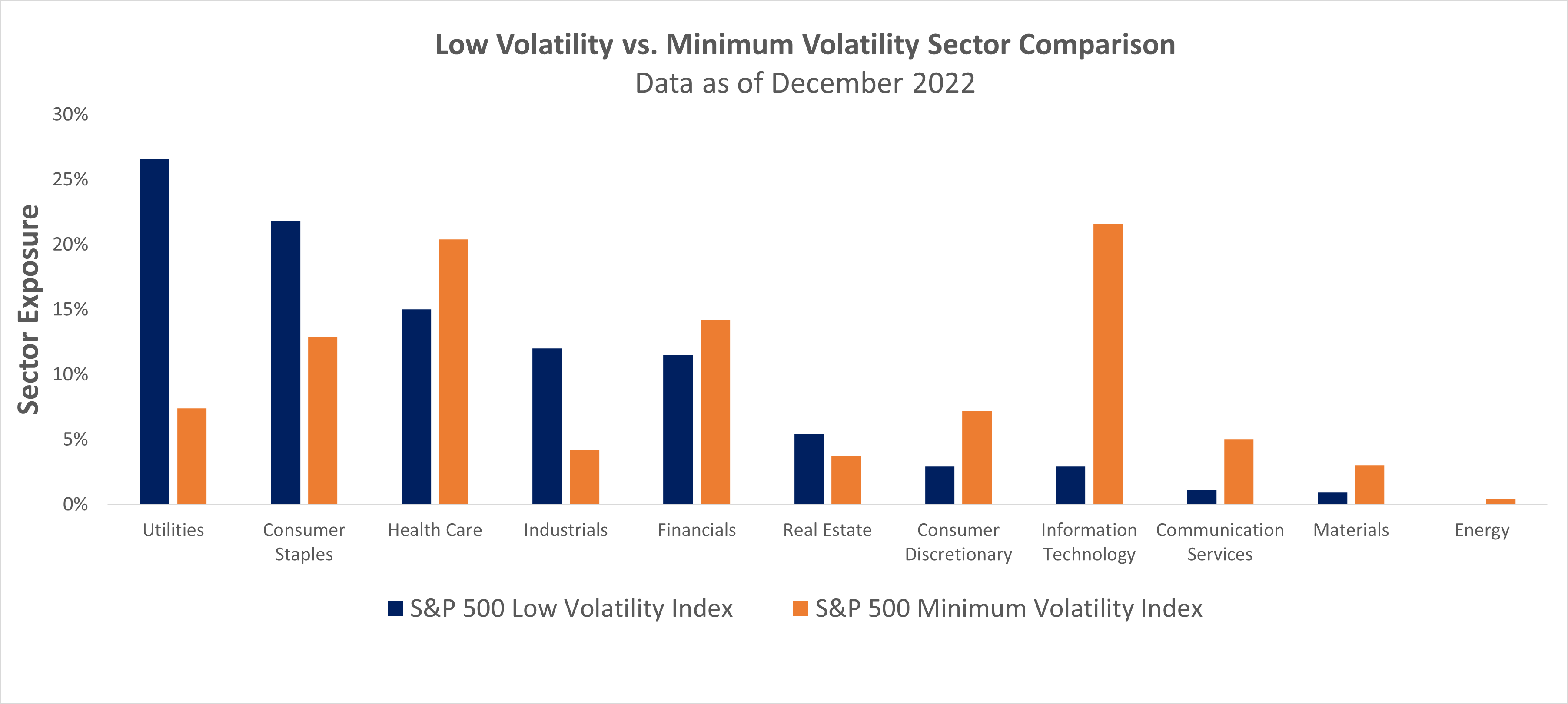

The difference in each investment strategy’s approach is very much reflected within their sector allocations. Using the S&P 500 Low Volatility Index and S&P 500 Minimum Volatility Index as references, low volatility strategies will lean more towards defensive sectors, such as Utilities and Consumer Staples, whereas minimum volatility tilts towards cyclical sectors, such as Information Technology and Financials. It is worth noting that the exposure to the energy sector is non-existent or negligible across both strategies, as of December 2022, given the volatility that is inherent within the sector – particularly over the past 3 years.

The difference in sector allocation truly demonstrates how distinct each investment approach is and where the sources of return (and risk mitigation) are derived from by the portfolio.

A look at performance

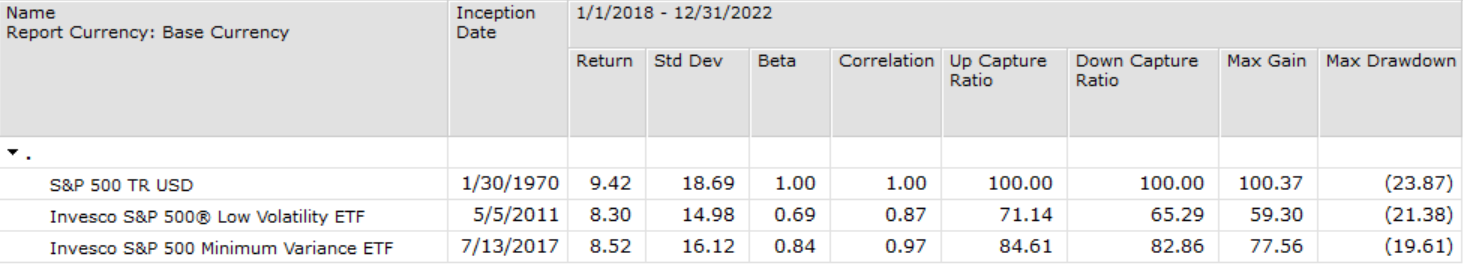

In contrasting the performance of Invesco’s S&P 500 Low Volatility ETF (SPLV) and Minimum Variance ETF (SPMV), each proxies for the S&P 500 Low Volatility Index and S&P 500 Minimum Volatility Index, respectively, the difference of both investment strategies is truly exemplified.

Over the 5-year period in question, Invesco’s Low Volatility Index ETF has marginally underperformed its Minimum Variance/Volatility counterpart – but has fulfilled its object of being less risky, by having a materially lower standard deviation. In further comparing the performance of both solutions, utilizing the S&P 500 Index as a benchmark input, the low volatility portfolio has demonstrated its ability to reduce its similarity exposure to the broader market index and provide above-adequate risk-adjusted performance across distinct categories. It should be noted that the max drawdown of the low volatility portfolio was greater than the minimum variance portfolio for the period in question. Given the market-moving events that occurred over the past 3 years (i.e., COVID, supply chain disruptions, Russia-Ukraine War, rising inflation) and the sectoral composition of low volatility investing, they undoubtedly are cause for the slightly large drawdown number.

For investors, while both strategies are guided by a similar objective, the outcome derived is different for each. Based on the data, low volatility investing allows for investors to meaningfully mitigate their risk exposure and still participate in the upside. Whereas, minimum volatility portfolios will provide a lower risk exposure, relative to the parent index, and allow investors to beneficially participate in market gains.

This content was originally published by our partners at ETF Central.

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI