Bombardier stock rises as Canada orders six Global 6500 jets

There are no absolutes in economic forecasting. Thinking otherwise eventually leads to trouble. Case in point: the recession warning triggered nearly two years ago by an inverted Treasury yield curve almost certainly amounts to a false signal.

The 10-year less 3-month curve went negative two years ago this month, spawning analysts to warn that a US recession was lurking on the near-term horizon–a forecast that some (many?) considered to be a near-infallible signal.

Although the economy wobbled at times, to date the expansion has continued, according to The National Bureau of Economic Research, the official arbiter of US business cycle dates.

Business-cycle indicators from other sources tell a similar story. Yesterday’s September report for the S&P Global (NYSE:SPGI) US Composite PMI, a GDP proxy, is “still signaling a solid monthly improvement in business activity at the end of the third quarter,” advises S&P Global Market Intelligence.

Several GDP nowcasts also reflect a solid rate of growth in Q3. The Atlanta Fed’s current estimate for output over the three months of September is 2.5% (as of Oct. 1). If anything close to that number is accurate, Q3 will remain recession-free by a wide margin.

The main takeaway: the yield curve forecast of recession has failed. It’s no surprise that indicators issue false signals. The yield curve was supposed to be different, or so some analysts suggested. With the benefit of hindsight, however, it’s clear that there are no certainties with recession forecasting.

Some forecasters seemed to argue otherwise when the yield curve first went negative. There was also a school of thought that favored using multiple yield curves to build a more robust signal. But this too has failed.

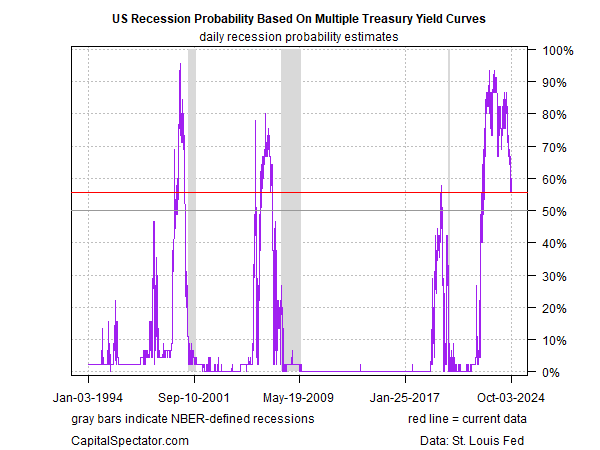

In July 2022, CapitalSpectator.com reviewed results for an indicator based on multiple yield curves. At the time, the implied recession risk was rising and looked set to top the 50% mark, which arguably is the tipping point.

Updating the multiple yield-curve signal today shows that the indicator issued a clear recession warning starting in late 2022—a warning that continues through yesterday (Oct. 3).

A US recession, however, hasn’t started and doesn’t appear imminent. That’s not to say that yield-curve analytics are worthless. Rather, the error is assuming that any one indicator is flawless.

A superior methodology is monitoring a broad, diversified set of indicators that filter out much of the noise and maximize signal. Granted, this approach isn’t perfect either – nothing is – but it avoids many if not all of the pitfalls that trip up single-indicator analytics.

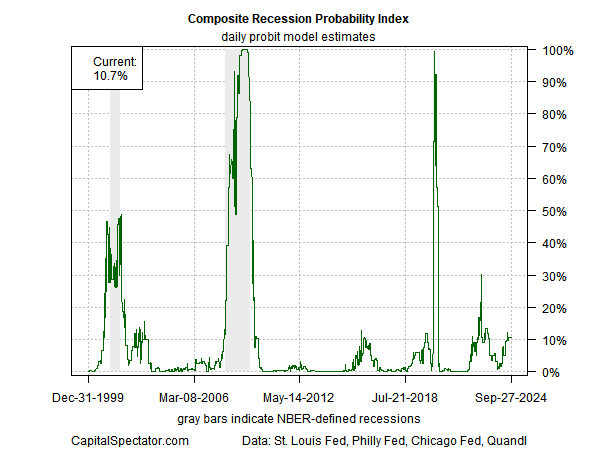

As an example, the composite business-cycle indicator features in the weekly updates of The US Business Cycle Risk Report have sidestepped the false warnings of the past two years.

Why? It’s not betting the farm on any one indicator. By the way, the current reading of the Composite Recession Probability Index (CRPI) continues to estimate low recession risk (roughly 11% as of Sep. 27).

The yield curve is part of the CRPI mix, but it’s only one component.

You still can’t build a flawless recession model by using a broad set of indicators, but you can substantially reduce the noise by doing so, as the yield curve’s failure over the past two years reminds us.