By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

It was a relatively quiet day in the foreign-exchange market with the exception of big moves in the Canadian dollar. There was very little consistency in the performance of the greenback, which extended its slide versus the Japanese yen, Australian and New Zealand dollars while ticking higher versus the euro, sterling and the loonie. At the start of the week, we said the dollar would take a backseat to all of the major event risks abroad and that is exactly what we have seen so far. Wednesday morning’s mixed housing-market reports had no major impact on the greenback but the Federal Reserve’s Beige Book managed to inspire some USD/JPY buying. According to the Beige Book, the job market is tight and the outlook mostly positive. Most Fed districts saw an uptick in spending and housing activity. As a result, U.S. yields stabilized after falling for two straight days while USD/JPY rebounded off its lows as a result. The Philly Fed survey, existing home sales and jobless claims are scheduled for release on Thursday -- none of which should have a major impact on the U.S dollar, which is due for a stronger recovery against many currencies such as the euro, yen and New Zealand dollars.

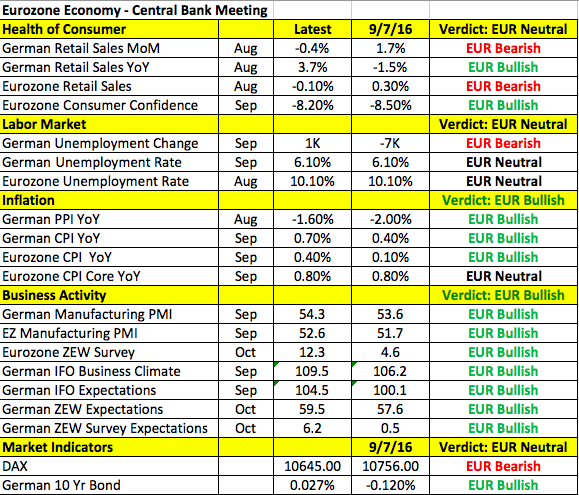

Thursday's focus will be on the euro with the European Central Bank monetary policy announcement on the calendar. EUR/USD has fallen within arm's reach of its post-Brexit low and many traders are hoping the ECB will rescue the euro. The currency pair dropped to a 2-month low on Wednesday, to 1.0955. The move has confounded many investors because the 2-year German – U.S. yield spread bottomed this month and is moving higher, which should be positive for the currency. There also hasn’t been many market-moving Eurozone or U.S. releases this week. In order for the euro to rally, we need ECB President Draghi to suggest that he’s comfortable with the current level of monetary policy. Taking a look at the table below, there’s been significantly more improvement than deterioration since the last ECB meeting -- so there’s a case to be optimistic. The lower euro also goes a long way in supporting the economy through trade and inflation. Yet we’ve seen a lot of conflicting headlines over the past few weeks. There was a story on tapering asset purchases and also a story on extending / tweaking QE. Everything that we’ve heard from policymakers tells us they are comfortable with the current level of stimulus but stand ready and willing to increase it if the economy weakens. The last time the ECB met, President Draghi expressed more confidence about the outlook for the Eurozone economy, using the word "resilience" on numerous occasions. However they also lowered their growth forecasts and announced Eurosystem committees to further evaluate stimulus options. If Mario Draghi puts greater emphasis on the need for more stimulus, further losses are likely. But if he’s optimistic and emphasizes resilience -- and we think he will given recent data -- EUR/USD could find its way back to 1.11.

The Canadian dollar experienced hefty intraday swings on Wednesday. USD/CAD dropped to an intraday low of 1.3005 after the Bank of Canada’s monetary policy announcement -- only to rebound to a high of 1.3140 after Governor Poloz’s press conference. The initial pop was unusual considering that the dovishness of the BoC statement -- the central bank lowered its growth and inflation forecasts for 2016 and 2017. They also pushed out their projection for closing the output gap to mid 2018 from late 2017. This should have been the first sign that the central bank is gearing up for more easing but clearly investors anticipated more at the onset because instead of falling, the loonie soared after the statement was released. Part of this had to do with oil, which jumped on lower inventories despite the fact that the lowered forecasts should have overshadowed the moves in crude. Eventually it did when BoC Governor Poloz took to the podium. He expressed his frustration with exports and said the central bank actively discussed more stimulus and indicated that housing measures won’t stop them from easing monetary policy. USD/CAD shot higher as a result, erasing all of its earlier losses in the process. While this dovish monetary-policy bias is likely to limit losses for the currency pair in the near term, oil will continue to be a key driver of the currency’s flows.

The Australian and New Zealand dollars extended their gains versus the greenback. Aussie booked its sixth day of gains, recapturing the 0.77 level in the process. Strength in the Aussie and Kiwi was mainly due to the weakness in the greenback. Chinese data failed to provide a further lift as the reports came in mixed. Chinese Q3 GDP came out in line with expectations with an increase with 1.8%, QoQ. Retail Sales for the country also met expectations with a 10.7% increase reported. The disappointment came from industrial production, which rose only 6.1% versus 6.4% forecast. The miss in industrial production was especially concerning given that the country is so dependent on the manufacturing sector. Australia’s employment report was due Wednesday evening. We expect job growth to rebound as the employment component of manufacturing, services and construction PMIs all moved higher.

Meanwhile, sterling weakened against the greenback Wednesday on mixed labor data. Jobless claims rose less than anticipated with claims rising by 0.7k versus 3.2k forecast. Average weekly earnings growth slowed to 2.3% from 2.4% but excluding bonuses they grew to 2.3% versus a 2.1% forecast. The ILO unemployment rate held steady at 4.9%. U.K. retail sales are scheduled for release Thursday and between the uptick in wage growth plus earnings and the rise in shop prices / consumer confidence, we believe that consumer spending rebounded in the month of September.