By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

The first week of May is generally a difficult one for forex trading. Many markets are closed on May Day (May 1) and Japan closes part of the week for Golden Week holiday. This reduces participation, volume and liquidity, which can mean consolidation OR exaggerated moves. Add to that 2 central bank rate decisions, ISMs, PMIs and 4 employment reports and it will most certainly be an active trading week. No changes are expected by the Federal Reserve or the Reserve Bank of Australia but their respective guidance could have a significant impact on how the U.S. and Australian dollars trade, especially the greenback as the dollar’s performance, Fed fund futures and bond yields diverge with U.S. data. Every single piece of U.S. data that was released Monday missed expectations and yet the dollar refused to fall. USD/JPY is particularly resilient as it eyes 112. Although some of the currency’s strength stems from the relief that a government shutdown was averted, most of its resilience comes from the market’s optimistic views for the Fed. Clearly investors are hoping that the Fed will signal a rate hike in June but it is hard to believe they would when there’s been significantly more weakness than strength in recent reports. Take Monday’s numbers for example, personal income growth slowed, personal spending stagnated, construction spending turned negative and manufacturing activity grew at its slowest pace this year according to the ISM. The Fed could still leave the door open to June tightening but given the proximity of this quarterly meeting, they may not want to fuel unnecessary expectations. Of course we could be wrong as the Fed fund futures show a 69% chance of tightening next month but recent economic reports hurt rather than help the case for an earlier rate hike. With that in mind, despite the resilience of USD/JPY, we still see a rejection of 112 and a move back down to 110.

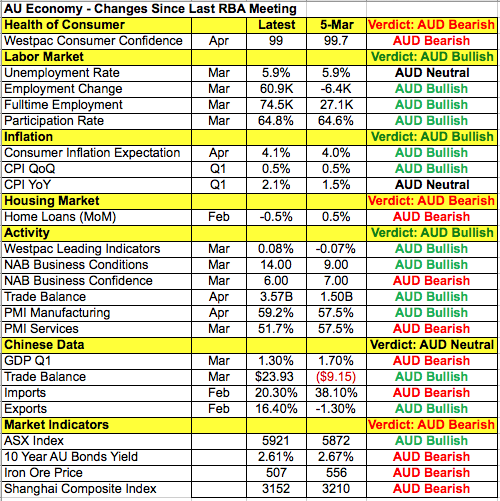

The Reserve Bank of Australia was due to meet Monday evening and the Australian dollar rose strongly ahead of the announcement. While the RBA is in no position to change interest rates, they could acknowledge the recent improvements in Australian data. On Sunday night we learned that manufacturing activity accelerated and last month we saw improvements in the labor market, inflation and business conditions. The RBA is skeptical of the strength in the labor market (they think the data is volatile) but there’s no question that they have less to worry about in April compared to March. The last time the RBA met, it expressed caution about the economy and the labor market but part of those concerns should be alleviated by recent reports. So if the central bank were to change its views it would include a tinge of optimism. But with no real pressure to raise rates, it could also leave much of its monetary policy statement unchanged. If the RBA is less dovish, AUD/USD will most likely make a run for 76 cents. However if RBA stays cautious, the currency pair could slip back down toward 0.7450. Although there were no New Zealand economic reports released Monday, NZD traded higher alongside AUD and thanks in part to stronger Chinese manufacturing activity.

USD/CAD, on the other hand, held onto its recent gains as the Canadian dollar was pressured by falling oil prices. Data was better with leading indicators and Markit Economics’ Canadian PMI report edging higher. President Trump is also talking about a possible gas tax, which could affect demand but it is not clear if and when this would occur. In the meantime, the U.S. government’s plan to renegotiate NAFTA continues to weigh heavily on the currency preventing any meaningful reversal for USD/CAD. Resistance in USD/CAD is 1.37 and if this level holds, the currency pair could slip as far as 1.3550.

Markets in Europe were closed for the May Day holiday so while the euro was virtually unchanged, sterling moved lower ahead of Tuesday’s PMI report. The sharp drop in the Confederation of British Industry’s report signals weaker manufacturing activity so GBP/USD could be falling in anticipation of that report. Euro, on the other hand, remains resilient ahead of this weekend’s final French election.