The US stock market remains on track to be the performance leader in 2023 for the major asset classes – by a wide margin. The key reason: Big-tech shares are running hot. Take out these companies from the mix and US equities’ year-to-date results fade to a mediocre performance in line with the return on money-market funds.

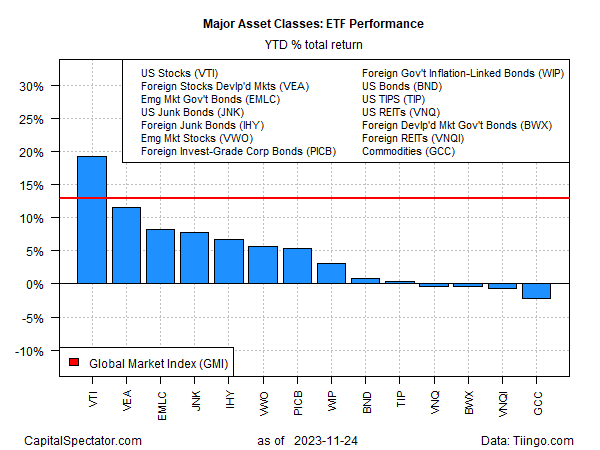

Market-cap-weighted equities in the US space, which are dominated by big-tech, are far and away the year-to-date leader, based on a set of ETFs through Friday’s close (Nov. 24). Vanguard Total US Stock Market Index Fund (NYSE:VTI) is up 19.2% so far in 2023, far ahead of the rest of the primary slices of world markets.

The next-best performer this year: developed-markets stocks ex-US (VEA), which is ahead by a relatively moderate 11.6%. The Global Market Index (GMI) is ahead by nearly 13% this year. (This unmanaged benchmark, maintained by CapitalSpectator.com, holds all the major asset classes — except cash — in market-value weights and represents a competitive benchmark for multi-asset-class portfolios.)

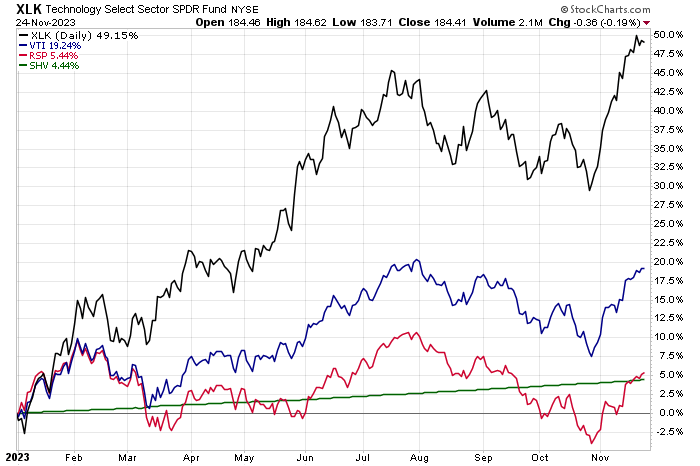

Within the US equities space, big-tech is driving the horse race by a hefty degree. iShares Technology ETF (NYSE:XLK), which is heavily weighted in the likes of Microsoft (NASDAQ:MSFT), Apple (NASDAQ:AAPL) and Nvidia (NASDAQ:NVDA), has surged more than 49% in 2023 – more than double the gain for US shares overall (VTI).

A better comparison tracks how the average stock is faring via an equal-weighted portfolio, which removes the big-tech factor. Notably, the 5.4% year-to-date return for Invesco S&P 500 Equal Weight ETF (NYSE:RSP) is only modestly above the performance for a cash proxy (SHV).

All of which sets out a key question for asset allocation and investment strategy in 2024: Will US stocks (a.k.a. big tech) continue to outperform? No one knows, of course, but after such a stellar run there’s a case for caution in expecting a repeat performance. Yet David Kostin, chief US equity strategist at Goldman Sachs (NYSE:GS), remains optimistic.

“Our baseline forecast suggests that in 2024 the mega-cap tech stocks will continue to outperform the remainder of the S&P 500,” he predicts. Rising sales are the reason, he explains.

“Analyst estimates show the mega-cap tech companies growing sales at a CAGR of 11% through 2025 compared with just 3% for the rest of the S&P 500. The net margins of the Magnificent 7 are twice the margins of the rest of the index, and consensus expects this gap will persist through 2025.”

Add in rising expectations that the Federal Reserve will soon cut interest rates and it’s easy to see the framework that could keep big-tech shares bubbling.

“Wall Street is gearing up for rate cuts,” reports The Wall Street Journal. “Twenty months after the Federal Reserve began a historic campaign against inflation, investors now believe there is a much greater chance that the central bank will cut rates in just four months than raise them again in the foreseeable future.”

The danger is that the future’s still uncertain and no forecast is assured. The tailwinds in favor of big tech certainly look bullish at the moment, but the world remains filled with hazards and the crowd has priced in virtually no margin for error re: the biggest, most successful corporate titans.