Investors in asset management group BlackRock (NYSE:BLK) have seen robust gains so far in 2021. BLK stock, which recently traded around $926.80, is up almost 30% year-to-date.

Shares hit a record high of $973.16 on Nov. 12. The 52-week range for BLK stock has been between $670.28 - $973.16. The current price supports a dividend yield of 1.78%, and the company’s market capitalization exceeds $141.05 billion.

BlackRock is the world's largest asset manager, according to Fund Brand 50 (FB50), the annual research by Broadridge Financial Solutions (NYSE:BR). The investment management giant issued robust fiscal Q3 results in mid-October.

Investors were pleased to see significant growth in assets under management thanks to total net inflows of $75 billion. At the end of the quarter, the fund’s assets stood at $9.46 trillion.

Revenue of $5.05 billion went up by 16% year-over-year. Adjusted earnings of $10.95 per share reflected an increase of 18.8% from a year ago.

On the results, CEO Laurence D. Fink said:

“Organic growth was broad-based, spanning our active platform as well as in each of our ETF product categories. We delivered our 10th consecutive quarter of active equity inflows."

Prior to the release of quarterly metrics, BLK stock was around $860. Then, within a month, on Nov. 12, it reached an all-time high of $973.16, Since then, profit-taking has kicked in, and BlackRock shares have lost about 5%.

Next Move In BLK Stock?

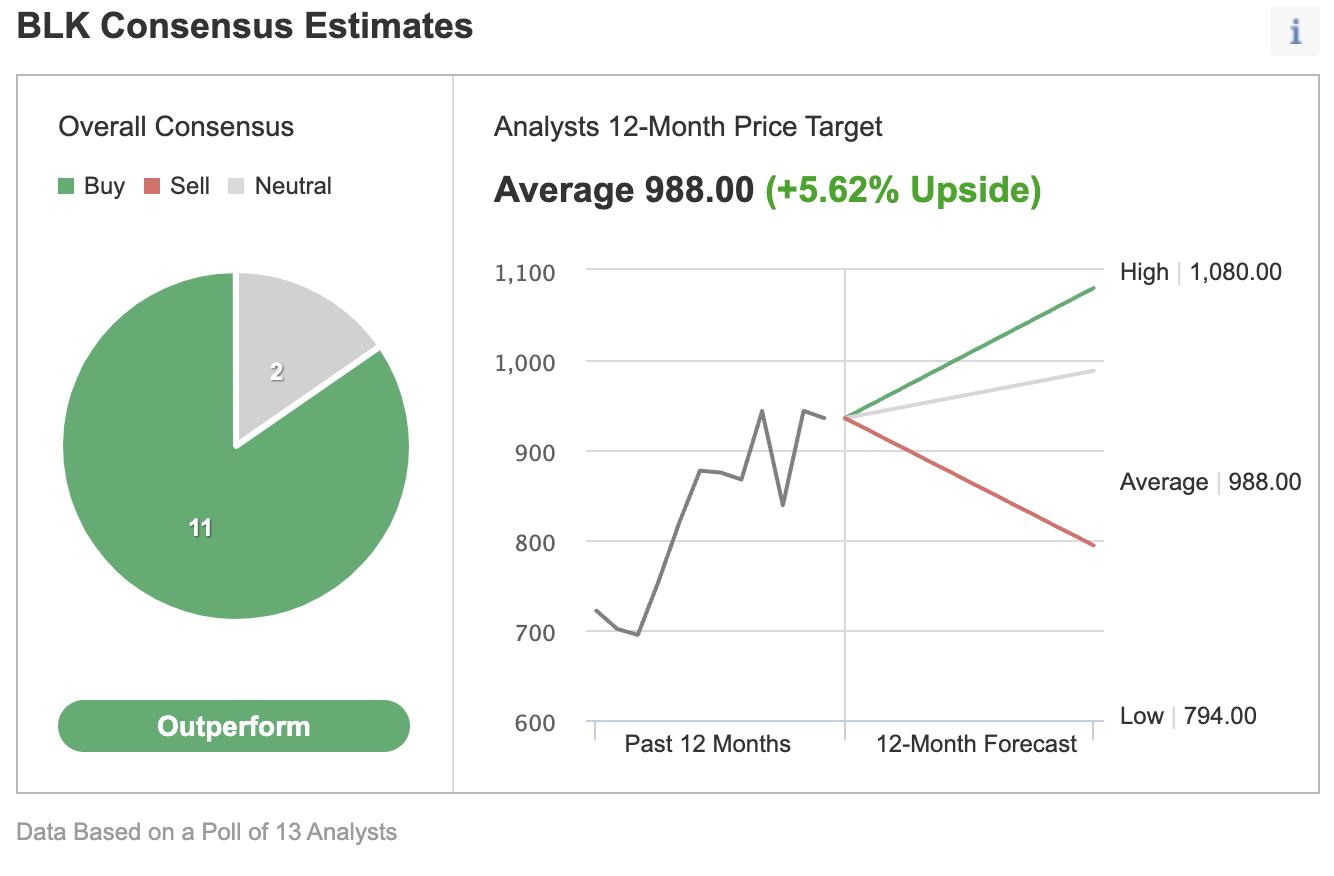

Among 13 analysts polled via Investing.com, BlackRock shares have an “outperform” rating, with an average 12-month price target of $988. Such a move would imply an increase of about 7.5% from the current level. The target range is between $794 and $1,080.

Put another way, despite the recent run-up in price, Wall Street is bullish on the shares of the asset manager in the long run. However, as part of the short-term sentiment analysis, it would also be important to look at the implied volatility level for BLK stock options, which typically shows traders the market's opinion of potential moves in a security. However, it does not forecast the direction of the move.

BLK’s current implied volatility is 23.7, which is about 24% higher than the 20-day moving average of 19.1. In other words, implied volatility (IV) is trending higher, which might mean that the option market is expecting increased choppiness.

We expect BLK stock to potentially drop toward $900 or even slightly below. In that case, the $880 level should act as support. Following such a potential decline, BlackRock shares are likely to trade sideways for several weeks, until they establish a base, possibly between $890-$910, and then start a new leg up.

Therefore, BlackRock bulls with a two- to three-year horizon who are not concerned about short-term volatility could consider buying the stock around these levels for long-term portfolios.

Others, who are experienced with options strategies and who believe there could be further declines in BLK shares, might prefer to have a bear put spread.

Most option strategies are not suitable for most retail investors. Therefore, the following discussion should ideally be seen as simply educational, as opposed to an actual strategy to be followed by the average retail investor.

Bear Put Spread On BLK Stock

Price: $926.80

In a bear put spread, a trader has a long put with a higher strike price as well as a short put with a lower strike price. Both legs of the trade have the same underlying stock and the same expiration date.

The trader wants BLK stock to decline in price. However, in a bear put spread, both the potential profit and potential loss levels are limited. Such a bear put spread is established for a net cost (or net debit), which represents the maximum loss.

Here’s an example.

For the first leg of this strategy, the trader might buy an at-the-money (ATM) or slightly out-of-the-money (OTM) put option, like the BLK Jan. 21, 2022, 920-strike put option. This option is currently offered at $37.40. It would cost the trader $3,740 to own this call option that expires in slightly less than two months.

For the second leg of this strategy, the trader sells an OTM put, like the BLK Jan. 21, 2022, 900-strike call option. This option’s current premium is $29.50. The option seller would receive $2,950, excluding trading commissions.

Maximum Risk

In our example, the maximum risk will be equal to the cost of the spread plus commissions. Here, the net cost of the spread is $7.90 ($37.40 – $29.50 = $7.90).

As each option contract represents 100 shares of BLK stock, we’d need to multiply $7.90 by 100, which gives us $790 as the maximum risk.

The trader could easily lose this amount if the position is held to expiry and both legs expire worthless, i.e., if BLK price at expiration is above the strike price of the long put (or $920 in our example).

Maximum Profit Potential

In a bear put spread, potential profit is limited to the difference between the two strike prices minus the net cost of the spread plus commissions.

So in our example, the difference between the strike prices is $20.00 ($920 – $900 = $20). And as we’ve seen above, the net cost of the spread is $7.90

The maximum profit, therefore, is $12.10 ($20 – $7.90 = $12.10) per share less commissions. When we multiply $12.10 by 100 shares, the maximum profit for this option strategy comes to $1,210.

The trader will realize this maximum profit if BLK price is at or below the strike price of the short put (lower strike) at expiration (or $900 in our example).

Those readers who have traded options before are likely to know that short put positions are typically assigned at expiration if the stock price is below the strike price (i.e., $900 here). However, there is also the possibility of early assignment. Therefore, the position would need monitoring up until expiration.

Breakeven BLK Price at Expiration

Finally, we should also calculate the break-even point for this trade. At the break-even price, the trade will not gain or lose any money.

At expiration, the strike price of the long put (i.e., $920 in our example) minus the net premium paid (i.e., $7.90 here) would give us the break-even BLK price.

In our example: $920 – $7.90 = $912.10 (minus commissions)

Bottom Line On BlackRock Shares

We regard BlackRock stock to be a solid long-term choice for most retail portfolios.

However, there could be further profit-taking in the shares, especially if broader markets come under pressure in the short-term. Therefore, a trading strategy as outlined above might be appropriate for some traders with a bearish outlook.