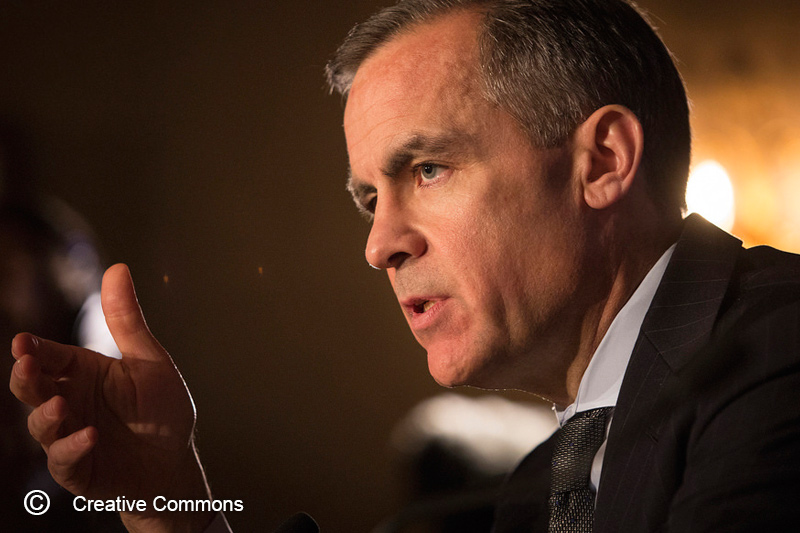

(Bloomberg) -- Bank of England Governor Mark Carney said the institution may need to use non-standard measures to stimulate the economy in a future downturn if it cannot tighten policy quick enough.

Speaking on a panel in Stockholm, Carney said that interest rates are the most powerful instrument the BOE has, and that’s what he would feel most comfortable doing. Still, other measures may be needed if the U.K. economy requires stimulus before the BOE can get rates high enough to cut them substantially.

The average interest rate cycle in the U.K. is about 150 basis points, Carney said, and “until bank rate is up around that area, the BOE will potentially need to use non-standard tools.”

“We’re aware of that -- we have done things recently post referendum to get the effective lower bound down to effectively zero, which has given us more room. We have learned a lot about the effectiveness of asset purchases and we do think guidance has a role as well, but it would be more comfortable if we were in a position where we could use the conventional, the most powerful, the most efficient instrument, which is bank rate.”

The BOE raised interest rates for the first time in more than a decade in November, and officials have said they need to hike in a limited and gradual fashion. The market is currently pricing in about three hikes over three years, which would take the rate to about 1.25 percent.

In a speech in London yesterday, Carney said the Monetary Policy Committee is reviewing the medium-term equilibrium rate, or the interest rate at which policy neither bolsters nor constricts growth. The bank will publish the research in its next Inflation Report in August.