(Bloomberg) -- China will cut the import duty on passenger cars to 15 percent, further opening up a market that’s been a chief target of the U.S. in its trade fight with the world’s second-largest economy.

The Finance Ministry said Tuesday the levy will be lowered effective July 1 from the current 25 percent that has been in place for more than a decade, boosting shares of automakers from India to Europe. Bloomberg News reported last month that China was weighing proposals to reduce the car import levy to 10 percent or 15 percent.

A reduction in the import duty follows a truce between President Donald Trump’s administration and Chinese officials as they seek to defuse tensions and avert an all-out trade war. While the levy reduction could be claimed in some quarters as a concession to Trump and will be a boon to U.S. carmakers such as Tesla (NASDAQ:TSLA) Inc. and Ford Motor (NYSE:F) Co., the move will also end up benefiting European and Asian manufacturers from Daimler AG (DE:DAIGn) to Toyota Motor Corp.

“This is, without a doubt, positive news,” said Juergen Pieper, Frankfurt-based head of automobiles research at Bankhaus Metzler. “You can’t completely disregard the fact that there are certain imbalances in China’s favor. This could be a signal that if one side is making concessions, it could lead to the Americans easing some of their pressure as well.”

Shares of Jaguar Land Rover owner Tata Motors Ltd. and BMW AG posted their biggest intraday gains in more than a month on the news.

The import duty on car parts will be reduced to 6 percent, China’s Finance Ministry said. The shift is significant more for its optics than its potential impact given imported cars made up only about 4.2 percent of the country’s 28.9 million in automobile sales last year.

The latest round of tariff easing is part of a flurry of policy announcements in recent months aimed at demonstrating China’s commitment to opening the economy -- partly in response to the accusations of protectionism leveled by the Trump administration. Beijing has also pledged to cut ownership limits in the auto sector as well as in banking, and last November reduced import tariffs on almost 200 categories of consumer products.

China announced May 18 that it would end its anti-dumping and anti-subsidy investigation into imports of U.S. sorghum, citing the “public interest.” That move, coupled with recent steps including restarting a review of Qualcomm (NASDAQ:QCOM) Inc.’s application to acquire NXP Semiconductors NV (NASDAQ:NXPI), signal a conciliatory stance from the Chinese side.

Trump Retreats

For his part, President Trump has retreated from imposing tariffs on billions of dollars worth of Chinese goods because of White House discord over trade strategy and concern about harming negotiations with North Korea, according to people briefed on the administration’s deliberations. In further evidence of an easing in tensions, China and the U.S. agreed on the “broad outline” of a settlement to the ban on China’s ZTE Corp (HK:0763). buying American technology after alleged sanctions infringements, the Wall Street Journal reported.

Ford and Porsche, maker of the Cayenne and Panamera car models, welcomed the announcement.

“Chinese customers will have a chance to enjoy an even optimized price and pursue more personalized options when buying a car,” Porsche said in a statement in China.

At the Boao Forum in April, President Xi Jinping reiterated China’s commitment to reduce import tariffs on vehicles.

Luxury Carmakers

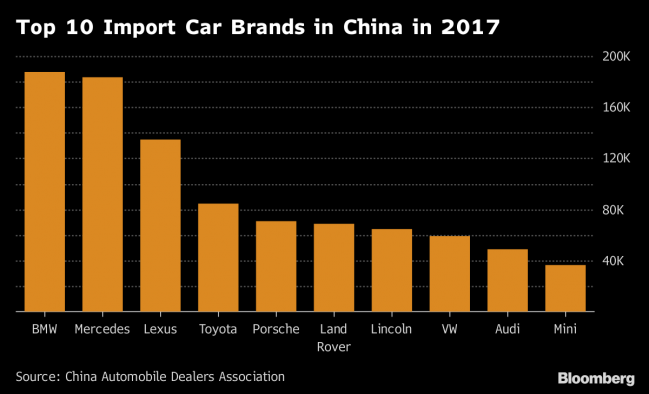

Of the $51 billion of vehicle imports in 2017, about $13.5 billion came from North America including sales of models made there by non-U.S. manufacturers like BMW. China imported 280,208 vehicles, or 10 percent of total imported automobiles, from the U.S. last year, according to China’s Passenger Car Association, an industry trade body.

A duty cut would typically benefit luxury carmakers or manufacturers, like Tesla, that don’t have a local production site. Most automakers produce mass-market models in China.

For Tesla, a tariff cut will provide a boon until the company manages to set up local production. The Palo Alto, California-based company has been working with Shanghai’s government since last year to explore assembling cars in China. China saying that it will allow foreign new-energy vehicle makers to fully own auto factories as early as this year removed a primary hurdle for founder and billionaire Elon Musk.

Luxury sales leader Audi, part of Volkswagen (DE:VOWG_p), has been making cars in China since 1990s. General Motors Co (NYSE:GM).’s Cadillac, which has relegated Lexus to fifth in the luxury-car rankings, opened a factory in Shanghai in 2016.

Foreign carmakers have long pleaded for freer access to China’s auto market, while its own manufacturers are expanding abroad. In April, China announced a timetable to permit foreign automakers to own more than 50 percent of local ventures.

(Updates with analyst comment in fourth paragraph.)