(Bloomberg) -- European Central Bank officials have four weeks left to make up their minds whether to freeze euro-area stimulus at current levels or pump yet more cash into the economy.

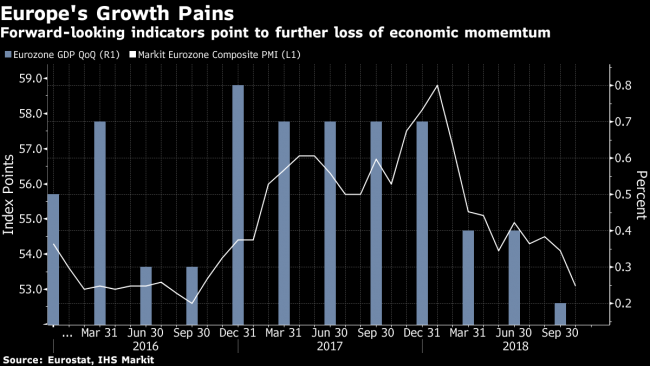

The Governing Council will hold its final policy meeting of the year on Dec. 13, when it will review the plan to cap its 2.6 trillion-euro ($2.9 trillion) bond-buying program. While that decision was initially taken in June, it’s always been dependent on incoming economic data -- which has recently been weaker than expected

Here’s the run-up to the meeting that could mark the end of an era:

WEEK 1 (Nov. 15 - Nov. 21)

ECB President Mario Draghi and Bundesbank head Jens Weidmann, who have mostly been on opposite sides of the quantitative-easing debate, will address an annual gathering of financiers in Frankfurt on Nov. 16. Draghi has previously used the event to hint at his plans. The title of Weidmann’s speech? “From extraordinary to normal: reflections on the future monetary policy toolkit.”

The tail-end of this period will also be the cutoff for data for new forecasts that will underpin the December decision. The Governing Council will hold the first of two meetings in the run up to that date.

The ECB’s Advent Calendar

WEEK 2 (Nov. 22- Nov. 28)

The euro area’s biggest economy, Germany, will release a second reading of third-quarter GDP on Nov. 23. Optimists will be hoping for an upward revision after the initial estimate showed the economy contracted for the first time since 2015.

Shortly afterward, purchasing managers indexes for the euro zone will give a more up-to-date view, and Germany’s Ifo index on Nov. 26 will give a insight into how trade and geopolitical tensions are affecting business confidence.

That should set the scene for a speech by ECB chief economist Peter Praet that day. His most recent message: the underlying strength of the economy remains intact and policy makers should look through noise such as the temporary disruptions at German auto makers.

WEEK 3 (Nov. 29 - Dec. 5)

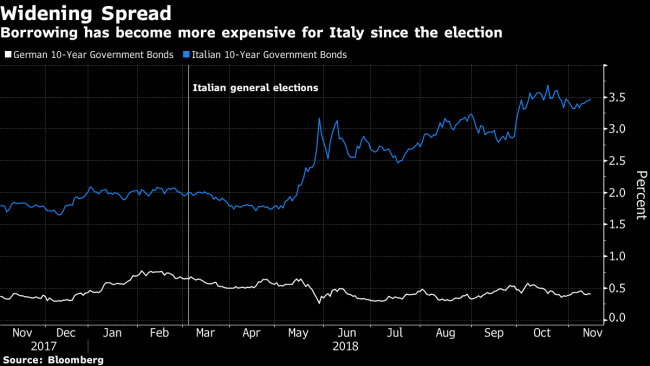

An Italian bond auction on Nov. 29 could mark a week of political drama that includes a budget debate in the Italian parliament, which may show how far the country is willing to test markets and the EU with its spending plans. The EU executive is due to deliver another assessment of the budget by Dec. 4.

Nov. 30 is a key date -- the last reading of euro-zone inflation before the ECB meets. The Governing Council holds a non-monetary policy meeting on Dec. 5 -- though it would surprise no one if monetary matters arose.

WEEK 4 (Dec. 6- Dec. 12)

The Governing Council goes into radio silence a week before its policy decisions, but important data will keep coming in.

Germany will report factory orders and industrial output, and the euro zone will get a detailed breakdown of third-quarter GDP. German investor sentiment and euro-area industrial output will be the last important data before the Governing Council publishes its decision at 1:45 p.m. Frankfurt time on Dec. 13.