By Polina Ivanova

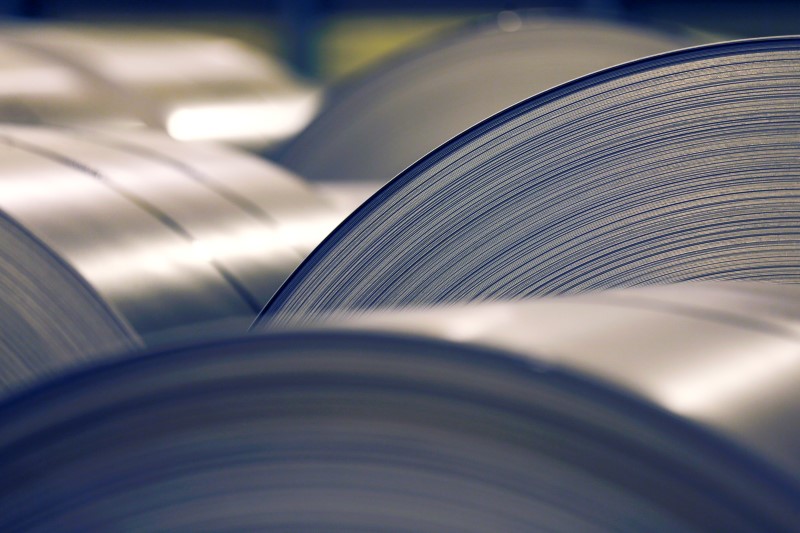

MOSCOW, Oct 19 (Reuters) - Russian steelmaker Evraz EVRE.L is considering spending almost half a billion dollars on a new rail mill in the United States, as U.S. tariffs on steel imports boost the company's U.S. rail business while piling on costs elsewhere.

New protectionist measures, including a 25 percent duty on imports of steel from some countries to the United States, have sent domestic prices soaring, a boon for local producers.

While Evraz's facilities in Portland, Oregon, use imported steel slabs from Russia, to which duties apply, its rail division in Pueblo, Colorado, supplies its own steel, and has become an unlikely winner.

"Pueblo has benefited from the tariff imposition as it produces its own electric arc furnace steel on site, rather than paying tariffs on imports," Andrew Jones, analyst at Wood & Company, said.

The company said on Friday it is considering building a plant producing 100 metre rails, at a cost of $480 million with an annual capacity of 600,000 tonnes, at its Pueblo location.

"Global protectionism did not play well for us," Chief Executive Alexander Frolov said on Friday. "We believe that this is one of the cases when new tariffs are actually helping the business," Frolov said.

Company representatives said on Friday the new rail mill project was inspired primarily by growing demand for longer rails and the need to renovate technology at the mill.

BIG SPENDING

The Pueblo rail mill project is one of four major investment ideas currently under consideration.

If confirmed, they will raise estimated annual capital expenditure to $863-$990 million in 2019-2022. That's compared to around $640-$660 million expected this year.

One of the projects would see Evraz launch a flat steel rolling facility in Siberia, with the capacity to produce 2.5 million tonnes per year.

The chief financial officer of Russian steelmaker Severstal CHMF.MM , a major Evraz competitor, said the project would weigh on domestic prices.

"Obviously any addition to the market, which has excess of capacities, will put more pressure on the balance of the market," Alexey Kulichenko said.

"It will aim to replace other players. That will give more pressure to the pricing level on the domestic market," he said.

Analysts questioned whether the time was right for the proposed package.

"We believe that the projects would have a negative impact on Evraz's investment case as we see no economical reason for expansion in the over-supplied steel sector," BCS Global Markets analyst Oleg Petropavlovsky said.