(Reuters) - Shares of Walt Disney Co (N:DIS) dropped 2.4% on Thursday after the media company delayed the reopening of theme parks and resort hotels in California, following a surge in fresh COVID-19 cases in the state.

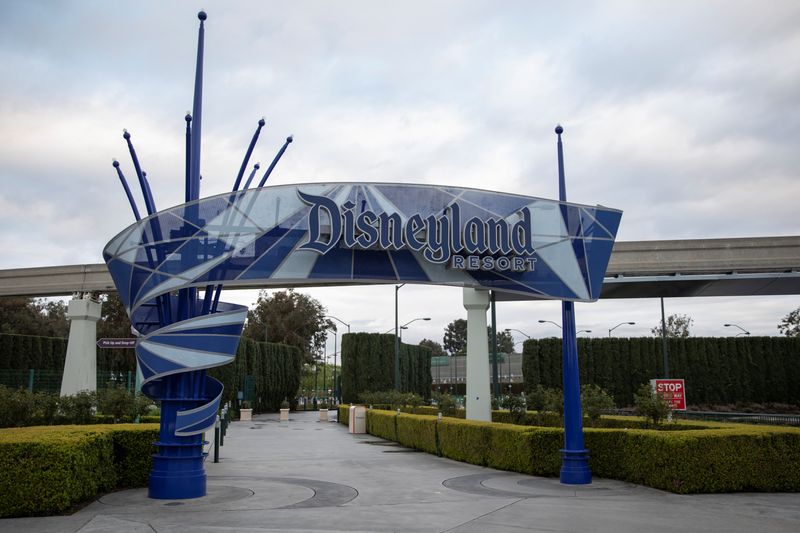

The reopening of Disneyland Park and Disney California Adventure Park that was earlier scheduled for July 17 will be delayed until Disneyland receives an approval from state officials, the company said.

In late January, the pandemic started battering businesses across Disney's global portfolio when the company shuttered Shanghai Disney Resort and Hong Kong Disneyland.

Last month, the company estimated that global lockdown measures aimed at tamping down the spread of the contagion slashed its profit by $1.4 billion, mostly from its shuttered theme parks.

The coronavirus-ravaged U.S. economy has begun to reopen but there is little clarity either on the pace and durability of the recovery, with new cases in the country continuing to rise.

Last week, Apple Inc (O:AAPL) said it is temporarily shutting some stores again in Florida, Arizona, South Carolina, and North Carolina.

Disney had also come under fire earlier as unions representing 17,000 workers at its Disneyland Resort in California expressed concerns to the state's governor about not being convinced that the theme park will be safe enough to reopen by the company's target date.

California witnessed its largest ever spike in confirmed new cases on Tuesday, with an additional 7,149 infections taking the state total to 190,222.

The company's shares, which have slumped more than 22% this year, were down at $109.39 in premarket trading on Thursday.