By Geoffrey Smith

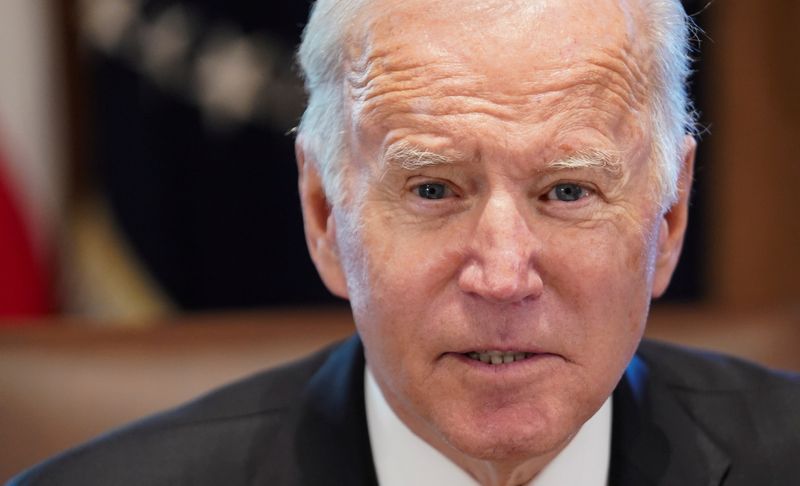

Investing.com -- U.S. President Joe Biden is set to announce a massive release from the Strategic Petroleum Reserve in a fresh effort to bring gasoline prices down in time for the midterms. OPEC meets with Russia and other allies and is expected to open the taps only a little. U.S. personal spending and income data are due, as is the February update for the Fed's preferred measure of inflation. Walgreens reports earnings. And China's manufacturing sector slips into contraction as COVID-19 lockdowns hurt activity. Here's what you need to know in financial markets on Thursday, 31st March.

1. Biden to announce SPR release

U.S. President Joe Biden will announce plans to release up to 1 million barrels of oil a day for six months from the Strategic Petroleum Reserve in a new effort to drive down oil prices, according to various reports.

Biden is under pressure to bring gasoline prices down far enough to have a material impact on inflation to neutralize it as an issue in the midterm elections due in November.

The planned releases are much larger than the last effort to bring prices down earlier this year and come at a time when the momentum in oil prices has weakened. However, it doesn’t alter the fact that the SPR is conceived as a reserve against physical shortages of oil rather than a mechanism for pushing the market one way or the other.

By 6:15 AM ET, U.S. crude futures were down another 6.2% at $101.19 a barrel, while Brent crude was down 5.3% at $105.48 a barrel.

2. OPEC+ to meet as Lavrov seeks alternative buyers for oil in India

Biden’s initiative is timed to coincide with the latest monthly meeting of the so-called OPEC+ group, which is expected to sign off on another routine increase of 400,000 barrels a day. OPEC’s ministerial meeting starts at 8 AM ET (1200 GMT), and Russia and others will join half an hour later.

While Deputy Prime Minister Alexander Novak is meeting with OPEC, Foreign Minister Sergey Lavrov is in Delhi, trying to nail down the terms of a mechanism that would allow India to pay for increased shipments of Russian oil bypassing the dollar-based financial system.

Russia’s oil system still faces constraints due to a buyers’ strike in Europe. Reuters reported that many refineries have either reduced or ceased operations due to their inability to find buyers abroad, while pipeline operator Transneft has reduced the amount of oil it accepts from major producers.

3. U.S. data to show pressure on consumer spending

The U.S. will release personal income and spending data for February, which are likely to be examined for any further evidence of a slowdown in activity as pandemic-era savings are whittled down.

January’s spending figures had shown a surprisingly strong 2.1% gain, but February’s are more likely to be influenced by the continuing surge in consumer prices, more data on which will be available in the price index for personal consumption expenditures in February, which is also due at 8:30 AM ET.

In addition, there are the weekly jobless claims, which are expected to stay below 200,000 for a second week.

Overnight, data in Europe pointed to an increasing battle with stagflation, with U.K. house prices rising at an 18-year high, German retail sales falling in February (even before Russia’s war with Ukraine) and French inflation running way ahead of expectations. The market is now pricing in some 60 basis points of tightening by the European Central Bank by the end of 2022.

4. Stocks set to open mixed; Walgreens in focus

U.S. stock markets are set to open mixed later, with the sharp drop in oil prices over the last two days offering some support to equities despite ongoing fears about inflation and monetary policy tightening.

By 6:20 AM ET, Dow Jones futures were down 11 points – effectively flat – while S&P 500 futures were up 0.1% and Nasdaq 100 futures were up 0.3%. All three indices had finished in the red on Wednesday as hopes for a quick end to the war in Ukraine were damped by the Kremlin. President Vladimir Putin told Italian Prime Minister Mario Draghi earlier that the conditions for a ceasefire are not in place.

Stocks likely to be in focus later in Walgreens (NASDAQ:WBA), which reports quarterly earnings, along with CVS (NYSE:CVS), which reached a $484 million opioid-related settlement on Wednesday. Intel (NASDAQ:INTC) may also come in for some scrutiny after awarding a bumper options package to CEO Pat Gelsinger. Proxy shareholder service ISS has already come out against the package.

5. China's factories struggle with COVID; Shanghai set to extend lockdown

China’s manufacturing sector slipped back into contraction in March, under the impact of COVID-19 lockdowns and waning demand from the U.S. and Europe as pandemic-era stimulus programs fade.

The official manufacturing Purchasing Managers Index fell to 49.5 from 50.2, against a backdrop of continued problems with port and factory closures. The South China Morning Post reported overnight that Shanghai is likely to extend the lockdown of its Pudong district beyond the scheduled end date of Friday.

Elsewhere, the impact of a Chinese boycott was again evident in figures released by Swedish fashion retailer H&M (ST:HMb), whose quarterly profit fell well short of expectations. In addition to problems in China, the chain has also had to close its stores in Russia, its sixth-largest market, and has accelerated its plan for net store closures this year.