By Tommy Wilkes

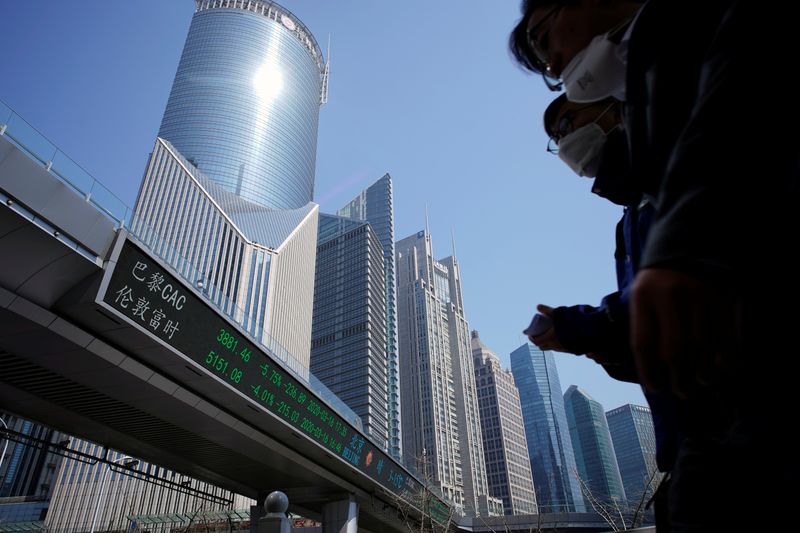

LONDON (Reuters) - Stock markets gave up their early gains on Monday after reports of a pick-up in new coronavirus cases that threatens to slow or reverse the loosening of lockdown measures.

Shares had initially gained, led by Asia, where markets cheered further loosening of coronavirus restrictions in the region - New Zealand will ease some curbs from Thursday, and Japan plans to end a state of emergency for areas where infections have stabilised.

In Europe, millions in France are set to cautiously emerge from one of the region's strictest lockdowns, while Britain laid out its own gradual path out of lockdown.

But South Korea warned of a second wave of the new coronavirus as infections rebounded to a one-month high, while new infections accelerated in Germany, which has been easing its own lockdown.

Investors have tried to stay optimistic in recent weeks, opening up a gap between dire economic conditions on the ground and a stock market rebounding because of huge stimulus programmes as well as on the timing and speed of any recovery.

A spike in new cases in countries that have already begun to relax restrictions on commerce, however, jolted market confidence badly.

"If we do have a second wave and lockdowns, that's almost the worst outcome from an economic perspective," said Guy Miller, chief market strategist at Zurich Insurance Company.

Miller said that would "postpone business investment indefinitely" and see consumers retrench as hopes for a quick economic recovery were dashed.

"The next two or three weeks are going to be pivotal," he said, as evidence of how businesses and consumers were responding to the loosening of lockdown measures.

By 1005 GMT, the Euro STOXX 600 was down 0.47%. Germany's DAX was 0.34% lower and Britain's FTSE 100 0.33% in the red. Energy and travel stock were among the hardest hit.

E-Mini futures for the S&P 500 dropped 0.38%.

World shares, measured by the MSCI world equity index which tracks shares in 49 countries, reversed earlier gains and were flat on the day. The index has risen 16% from its March lows.

For a graphic on The MSCI world equity index, click https://fingfx.thomsonreuters.com/gfx/mkt/xlbpgnzaavq/stocks.PNG

As investors look to the reopening of economies, most have ignored dismal economic data. The most recent was Friday's U.S. jobs report, which showed the biggest jump in unemployment since the Great Depression.

But the numbers were not as bad as economists had expected, and analysts say that markets have already priced in the huge hit to growth and employment. Record monetary and fiscal stimulus has fired up the rebound in asset prices.

"Risk bears are being sent into hibernation," said Kit Juckes, a markets strategist at Societe Generale (PA:SOGN). "Markets focus on re-opening economies and policy activism, bears struggle to understand how they can ignore re-infection and economic destruction."

The bond market seems to think any economic recovery will be slow. Two-year U.S. government bond yields hit record lows at 0.105% and Fed fund futures turned negative for the first time ever. [US/]

The rally in U.S. bond prices has come even as the U.S. Treasury plans to borrow trillions of dollars in the next few months to plug a gaping budget deficit.

The decline in U.S. yields might have been a burden for the dollar, but with rates everywhere near to or less than zero, major currencies have been stuck in tight ranges.

On Monday, the dollar was up 0.2% against a basket of currencies but made more headway against the safe-haven Japanese yen, rising 0.5% to 107.23.

The euro dropped 0.2% to $1.0827 while sterling lost 0.4% to $1.2367.

In commodity markets, oil prices fell as a glut weighed on prices and the pandemic eroded global demand. [O/R]

Brent crude fell $1.11, or 3.6%, at $29.86 a barrel. U.S. West Texas Intermediate crude fell 92 cents, or 3.7%, to $23.82.

The spot gold price climbed back to $1,700 an ounce. Buoyed by its safe-haven appeal, gold has rallied more than 12% so far in 2020, hitting seven-and-a-half year highs.