* Euro falls vs safe-have yen after Paris attacks

* Asian shares hit six-week low, Europe losses modest

* Oil gains after French air-strikes on Islamic State

By Nigel Stephenson

LONDON, Nov 16 (Reuters) - The euro hit its weakest in more

than six months against the yen on Monday as investors sought

safety in gold and low-risk government debt after Friday's

attacks in Paris.

Oil prices edged up after France launched large-scale air

strikes against Islamic State targets in Syria.

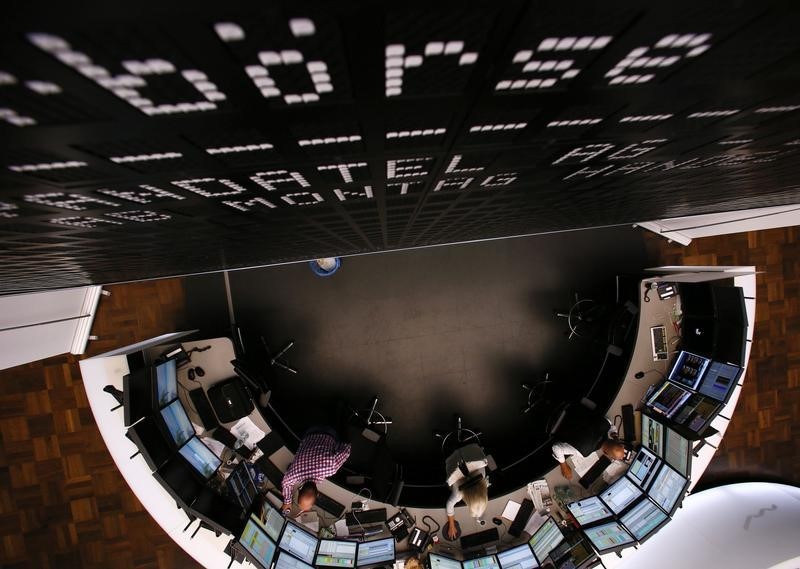

Asian shares fell to their lowest in six weeks but European

shares' losses were modest as markets reopened after the attacks

that killed more than 130 people.

U.S. stock index futures ESc1 turned positive, indicating

Wall Street was likely to open slightly higher.

"It seems likely that -- at least temporarily -- risky

assets, that were under pressure anyway, continue to trade with

a weaker tone," RBC's chief European macro strategist Peter

Schaffrik said.

The pan-European FTSEurofirst 300 index .FTEU3 opened

lower, dragged down by travel and leisure stocks .SXTP , though

miners and energy stocks gained. The index was last down 0.04

percent.

MSCI's broadest index of Asia-Pacific shares outside Japan

.MIAPJ0000PUS fell nearly 1.5 percent at one stage, its

biggest daily fall since Sept. 29, and was last down 1.3

percent.

Leading the losers was Japan's Nikkei stock index .N225

which tumbled nearly 1.1 percent, nearly wiping out last week's

gains as data showed the economy slipped back into recession in

the July to September quarter.

It contracted at a 0.8 percent annualised rate. Economists

polled by Reuters had forecast a 0.2 percent contraction.

Emerging market stocks .MSCIEF lost 0.9 percent.

The widely-tracked CBOE volatility index or "fear gauge"

.VIX hit its highest level since Oct. 2.

Chinese stocks bucked the trend, however, reversing early

losses to end higher. The CSI300 index .CSI300 of the largest

listed companies in Shanghai and Shenzhen rose 0.5 percent while

the Shanghai Composite Index .SSEC gained 0.7 percent.

Yields on safe-haven two-year German bonds hit

a new record low of -0.382 percent before edging up to -0.37

percent. Ten-year German yields DE10YT=TWEB , the benchmark for

euro zone borrowing costs, fell 1.2 basis points to 0.55

percent.

U.S. Treasury yields also fell. Ten-year yields US10YT=RR

were last down 2.1 bps at 2.59 percent, having hit 2.41 percent

in Asian trade.

In currency markets, the euro EUR= hit a 6 1/2-month low

against the safe-haven yen, and close to that mark versus the

dollar, before recovering somewhat. The Swiss franc, also sought

in times of turmoil, strengthened against the euro.

The single currency was last down 0.4 percent at $1.0740,

having hit $1.0674 last week on expectations the European

Central Bank will step up monetary easing.

"There is some caution ruling markets as we have seen with

the reaction to stock markets. Ultimately, the Fed/ECB

divergence will be the focus, with markets already pricing in a

10 basis point deposit rate cut by the ECB and extension of the

QE programme," said Manuel Oliveri, FX strategist at Credit

Agricole.

The dollar was flat against a basket of major currencies

.DXY

MIDDLE EAST

Markets in the Middle East, which trade on Sunday, were hit

hard, though part of that decline was due to last week's drop in

oil prices. Saudi Arabia's .TASI stock index hit a 35-month

low on Sunday while stocks in Dubai and Egypt hit their lowest

of the year. ID:nL8N13A0MU

Crude oil rose. Benchmark Brent LCOc1 rose 20 cents, or

half a percent, at $44.68 a barrel, having dropped 1 percent on

Friday. Traders said the rise was largely a matter of sentiment,

with a premium being factored in after French strikes in Syria

in response.

Spot gold XAU= rose 1 percent. It last traded at $1,092.70

an ounce, having hit its lowest since February 2010 on Thursday.