GuruFocus - On July 2, 2024, Jason Dubinsky, the Chief Financial Officer of Morningstar Inc (NASDAQ:MORN), executed a sale of 3,400 shares of the company. According to the SEC Filing, the transaction occurred at an average price of $300.11 per share, totaling approximately $1,020,374. The insider now owns 20,181 shares of Morningstar Inc.

Morningstar Inc is a global financial services firm that provides an array of investment-research and investment-management services. Known for its wide range of products including software, research, and investment management, the company is a trusted source for insights into asset allocation, portfolio construction, and retirement planning.

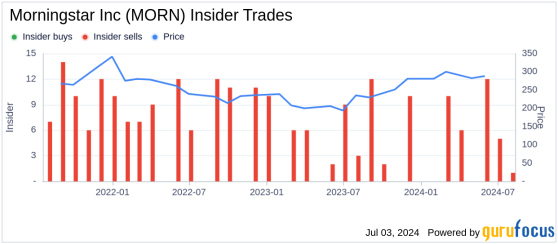

Over the past year, the insider has sold a total of 3,400 shares and has not made any purchases. The broader trend within the company also reflects a similar pattern, with 61 insider sells and no insider buys over the same period.

As of the latest transaction, Morningstar Inc's shares were trading at $300.11, giving the company a market cap of $12.8 billion. The price-earnings ratio stands at 60.50, which is significantly higher than the industry median of 18.325. This high ratio suggests a premium valuation compared to the industry.

The GF Value, an intrinsic value estimate from GuruFocus, is set at $299.85, indicating that the stock is Fairly Valued. The GF Value is derived from historical trading multiples, an adjustment factor based on the companys past performance, and expected future business outcomes.

This sale by the insider could be interpreted in various ways, but it is essential for investors to consider the broader market conditions, the company's valuation metrics such as price-sales ratio, price-book ratio, and price-to-free cash flow, along with the insider's remaining stake in the company, to make informed investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This content was originally published on Gurufocus.com