Investing.com -- Equity funds recorded inflows of $4.7 billion in the week ending October 2, 2024, while bond funds attracted $15.7 billion, Citi said in a Friday note.

China funds attracted a massive $13.9 billion in inflows as the market rebounded by more than 20% since late September after the government unveiled a slew of stimulus measures to support the slowing economy.

“This is the second largest inflow we have ever seen, second only to the $20.6 billion inflows in February this year,” Citi strategists highlighted.

The Hang Seng China Enterprise (CEI) has surged 35% since hitting a low last month, with most of the rally following Beijing’s jumbo stimulus package unveiled on September 24. Some individual stocks have seen colossal gains, with their prices more than doubling in just a few days.

Looking ahead, the future of Chinese equities largely hinges on whether Beijing introduces additional measures to bolster the economy.

Investors are also watching closely for signs of improved consumer spending during one of the country’s key holiday periods. Mainland markets are set to reopen after the Golden Week holidays on Tuesday.

Meanwhile, U.S. funds experienced net redemptions of $9.7 billion as exchange-traded fund (ETF) inflows slowed, and European funds saw substantial outflows of $6.1 billion, marking the largest single-week outflow from European markets since 2022.

Both EU excluding-UK and UK funds contributed to these outflows, Citi notes. On the other hand, global and Japanese funds each managed to secure inflows of over $2 billion.

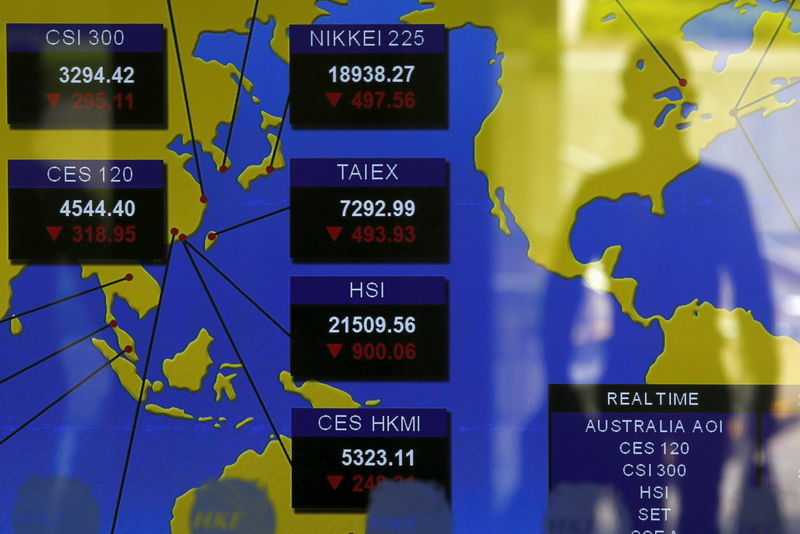

Elsewhere in Asia, India and the Philippines were the only markets to see foreign inflows last week. Korea and Taiwan, however, experienced small outflows.

In Japan, the TOPIX index has endured six consecutive weeks of foreign selling, erasing most of the year-to-date inflows.