HighlightsEntering 2022 brought hopes for the industrial sector as the pandemic started to fade away. The Canadian economy was en route to recovery from the pandemic. However, disruptions like rising interest rates and high inflation, set in this year and weighed on the industrial sector. It caused a pullback, and the stock market too suffered the impact.

- In Q2 2022, the total reported revenues of Canadian National were C$ 4,344 million.

- The EPS of Canadian Pacific Railway Limited to the shareholders is at C$ 2.88.

- The stock price of Waste Connections grew by 11.34 per cent within a span of 12 months.

In Canada, the industrial sector has historically had a major market capitalization. Despite market volatility, presently, the industrial sector jumped by 3.5 per cent on a quarter-to-date (QTD) basis.

As an investor one should strategize stock selection and consider the sector performance in the previous years as well.

Amid the present market situation, let us explore five industrial stocks and visit their performances in recent quarters:

In Q2 2022, the total reported revenues of Canadian National Railway Company were C$ 4,344 million, which was an increase of C$ 746 million (21 per cent) from Q2 2021. For the same period, the net income also increased and was reported at C$ 1,325 million from C$ 1,036 million.

The adjusted EBITDA also witnessed an increase to C$ 7,834 from C$ 7,087 million. Canadian National Railway Company offers a quarterly dividend of C$ 0.733 and had a five-year dividend growth of 10.23 per cent. The earnings per share (EPS) is C$ 7.30.

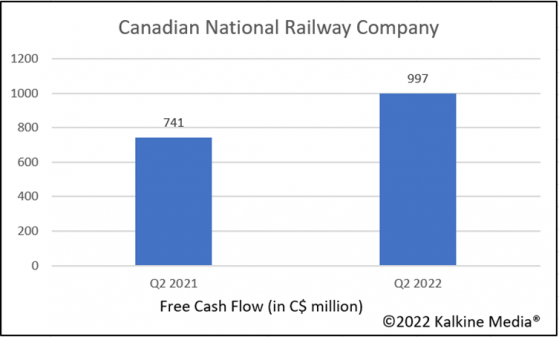

The below graph illustrates the free cash flow (FCF) for Canadian National Railway Company in one year:

Canadian Pacific Railway reported Q2 2022 revenue of C$ 2.20 billion, an increase of seven per cent from C$ 2.05 billion in Q2 2021.

On the contrary, the net income witnessed a decrease which was reported at C$ 765 million from C$ 1,246 million in Q2 2021. The EPS of the company is C$ 2.88 with a price to earnings (P/E) ratio of 33.80.

For Q2 2022, the total revenue of Thomson Reuters Corporation was up by five per cent. The organic revenue grew by seven per cent that includes the Big 3 segments of the company-Legal Professionals, Corporates and Tax & Accounting Professionals.

For the quarter that ended June 30, 2022, the company’s adjusted EBITDA also increased to US$ 561 million from US$ 502 million from the same period previous year. The dividend offered by the company is US$ 0.445 per share and the EPS is US$ 1.3.

In Q2 2022, the revenue of Waste Connections was US$ 1.816 billion, with an increase by 18.4 per cent. The adjusted EBITDA in Q2 2022 was US$ 566.8 million compared to US$ 484.9 million in Q2 2021.

Further, the operating income too grew to US$ 329.6 million from US$ 266.8 million for the same comparative period. The quarterly dividend distributed by the company was US$ 0.23 per share. The five-year dividend growth for Waste Connections was posted at 13.81 per cent.

In Q2 2022, the revenues for WSP Global Inc. were noted at C$ 2.8 billion and grew by 5 per cent compared to Q2 2021.

For the same comparative period, the adjusted EBITDA rose to C$ 352.2 million which was an increase by 2.8 per cent from C$ 342.6 million in Q2 2021.

As on July 2, 2022, there was a decrease in the total liabilities which were noted at C$ 6,417.8 million from C$ 6,585.2 million on December 31, 2021.

The quarterly dividend to shareholders paid by the company is C$ 0.375 with a dividend yield of 0.974 per cent.

On September 23, 2022, WSP Global Inc. declared its acquisition of two business owned by Capita plc-Capita Real Estate and Infrastructure Ltd.

Further, on September 21, 2022, WSP Global Inc. acquired John Wood Group plc’s Infrastructure and Environment Business.

Bottom Line: While selecting your industrial stocks, gauge all the parameters and the potential. Look at the capabilities of the industrial sector and analyze its past performances. Look for more than one aspect to have a holistic growth in your portfolio. There are several industrial stocks that may shown significant growth.

You might consider them as a part of your long-term strategy. Along with this, look for the factors that create an impact on the industries in Canada.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.