(Bloomberg) -- For the past decade, developed-market stocks have mostly outshone emerging markets. But for Carrhae Capital, the Blackstone Group (NYSE:BX) Inc.-backed hedge fund that’s handed its investors the best emerging-market equity returns among peers this year, the tide is turning.

Ali Akay, the London-based chief investment officer of Carrhae, expects returns on developing-nation equities to surpass those of the U.S. and Europe. Emerging markets didn’t fully benefit from low interest rates in the past decade and the potential for more stimulus, especially from China, should provide some support.

“We are optimistic on the trajectory of emerging markets,” Akay said in an interview. “Asset prices haven’t been juiced up as much. We just got through almost a decade of underperformance versus U.S. assets.”

While the pace of recovery in emerging economies outside of China has been weak, growth will accelerate from the second quarter of next year as central banks feel little pressure to remove accomodative policy, with persistently easy Fed policy and a weak dollar, according to Morgan Stanley (NYSE:MS).

Since many of their central banks are at record-low interest rates already and therefore have less room to act if their economies continue to crater, China is the country that really matters, Akay said.

The People’s Bank of China “has been a lot more conservative than any developed market central bank this year in their response to the pandemic,” he said. “China does not want to see the economy adding more leverage at this point and they still have room on the fiscal side so that is where the incremental stimulus is coming from. That does not mean that they don’t have firepower to use in exigent circumstances.”

Read: China’s Massive Stimulus Pile Will Fuel Economic Recovery: Chart

Carrhae Capital’s long-short strategy has returned 9.5%, after fees, this year through August, according to the firm. That makes it the best-performing fund focused on emerging-markets, among those with assets of more than $250 million, according to Singapore-based data provider Eurekahedge Pte. Long-short managers buy stocks they expect to rise and hedge those bets with sales of borrowed shares they hope to buy back at a cheaper price.

‘Ears to the Ground’

The firm, which oversees about $540 million, also manages a long-only strategy which has returned 12.7% in the first eight months of the year. In comparison, MSCI Inc’s gauge of developing-nation stocks lost 1.2% in the same period. The funds, founded in 2011, are named for the battle of Carrhae -- site of a Roman defeat to the Parthians in present-day Turkey -- as a reminder of the risks of investing without thorough knowledge of the market, Akay said.

The Romans’ “ignominious defeat at Carrhae largely stemmed from arrogance, underestimation of the enemy and failure to heed local advice when waging war in a new and alien geography,” Akay said. “When investing in distant emerging markets, we aim to heed his example and proceed with humility and caution, always keeping ears to the ground for sage local advice.”

The hedge fund still has “meaningful exposure” to Chinese technology equities, even after paring back some of its holdings, Akay said. Carrhae had snapped up Chinese and other emerging-market e-commerce and online companies when prices crashed in March in the midst of a coronavirus-induced selloff.

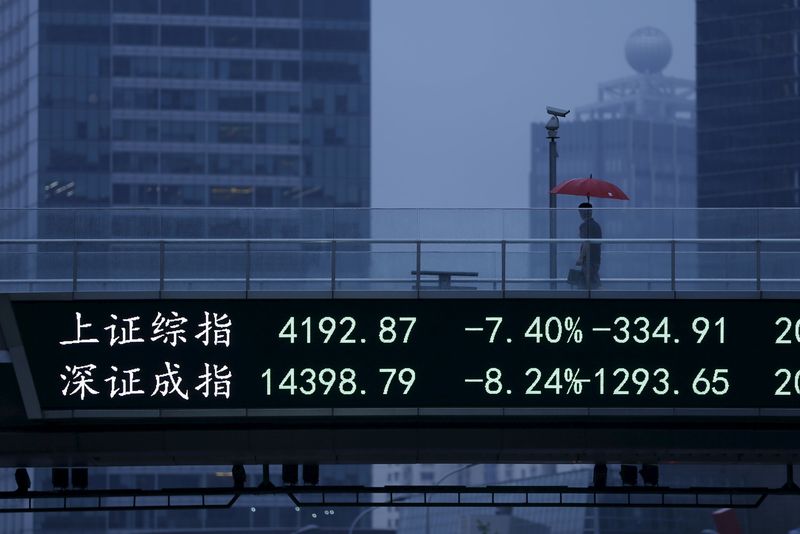

The tidal wave of central-bank stimulus had fueled a 45% rally in emerging-market stocks through August, from a four-year low in March. The market is headed for its first monthly loss since then amid simmering U.S.-China tensions and uncertainty surrounding the U.S. November presidential elections.

The year has “been like London weather -- variable,” Akay said. “A lot of torrents to navigate and requires a lot of mental agility and mental calm.”

Here’s where Carrhae is putting its money:

- Carrhae owns shares of Alibaba (NYSE:BABA) Group Holding Ltd. and JD (NASDAQ:JD).com Inc., and has exposure to Tencent Holdings (OTC:TCEHY) Ltd. through its investments in Naspers Ltd. and Prosus (OTC:PROSF) NV

- “The pandemic and the tech rivalry with the U.S. only increased the determination of the Chinese government to support an even faster digitization of the economy,” Akay said

-

Carrhae holds long positions in Polymetal International Plc and AngloGold Ashanti Ltd.

- “We’ve been bullish on the precious metals complex to implement our view of financial repression”

-

Natural gas companies, including Moscow-based Gazprom (MCX:GAZP) PJSC (OTC:OGZPY), appear attractive on the prospect of a recovery in energy prices within the next two years

- “You starve a cyclical industry of capital and supply eventually you’ll end up with a more favorable supply-demand balance that affects prices,” Akay said. “Currently these stocks are not pricing anything close to that”

- The fund has been a buyer of copper and nickel miners including Vale SA (NYSE:VALE) and MMC Norilsk Nickel PJSC (OTC:NILSY)

- Recently initiated short positions in some emerging-market e-commerce players “that have run ahead of their fundamentals,” Akay said

- The hedge fund has covered its short positions in travel and leisure industry and increased its short exposure to the petrochemical industry, which will continue to be hurt by years of oversupply

(Adds hedge fund’s short positions at the end of story)

©2020 Bloomberg L.P.