- Fed FOMC minutes, Nvidia (NASDAQ:NVDA) Q4 results, and retailer earnings will be in focus this week.

- Home Depot (NYSE:HD) is a buy with strong earnings, guidance expected.

- Walmart (NYSE:WMT) is a sell with conservative outlook on deck.

- Looking for more actionable trade ideas? Join InvestingPro for under $9 a month for a limited time only and never miss another bull market by not knowing which stocks to buy!

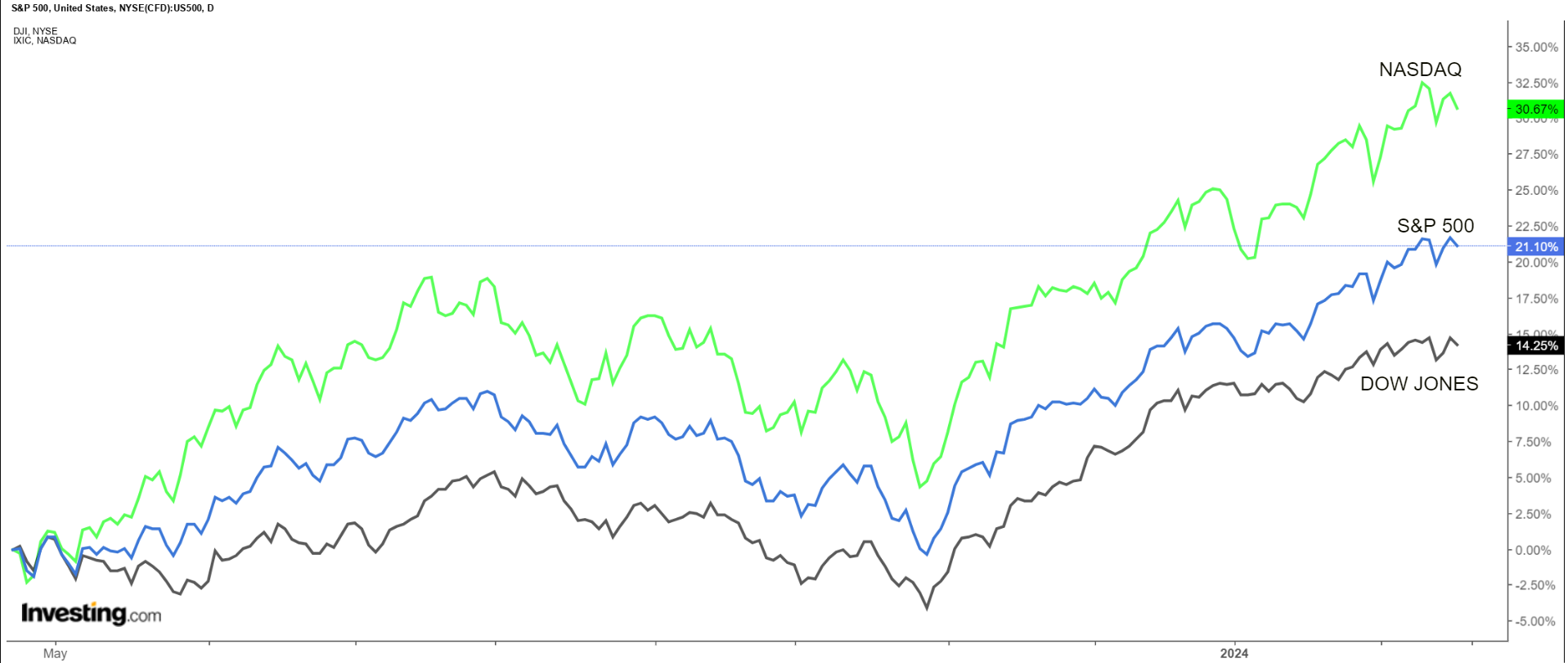

Stocks on Wall Street closed lower on Friday to break their five-week winning streak as investors digested a hotter-than-expected producer price inflation report that added to fears the Federal Reserve is unlikely to cut interest rates anytime soon.

After five consecutive weeks of gains, all three major U.S. averages posted a weekly decline. The benchmark S&P 500 fell 0.4%, the tech-heavy Nasdaq Composite shed 1.4%, and the blue-chip Dow Jones Industrial Average slipped 0.1%.

Source: Investing.com

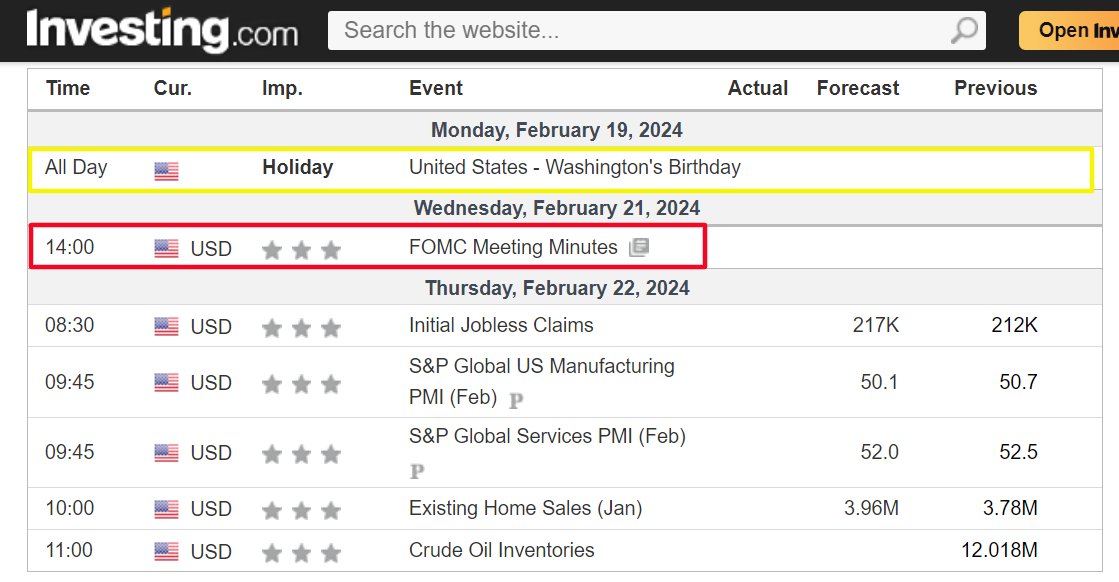

The holiday-shortened week ahead - which will see U.S. stock markets closed on Monday for the Presidents’ Day holiday - is expected to be another busy one as investors continue to assess when the Fed may decide to lower rates.

Most important on the economic calendar will be the minutes of the U.S. central bank’s January FOMC meeting, due on Wednesday.

Source: Investing.com

As of Sunday morning, financial markets see just a 10% chance of the Fed cutting rates in March, according to the Investing.com Fed Monitor Tool, while the odds for May stand at about 30%. Looking out to June, traders believe there is a roughly 75% chance rates will be lower by the end of that meeting.

Meanwhile, the reporting season’s last big week sees earnings roll in from market heavyweight Nvidia, as well as notable retailers Walmart, and Home Depot. Other noteworthy companies on the agenda include Block (NYSE:SQ), Etsy (NASDAQ:ETSY), Palo Alto Networks (NASDAQ:PANW), Moderna (NASDAQ:MRNA), and Rivian (NASDAQ:RIVN).

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see fresh downside. Remember though, my timeframe is just for the week ahead, Monday, February 19 - Friday, February 23.

Stock to Buy: Home Depot

I expect Home Depot to outperform this week, with a potential breakout to a new 52-week high on the horizon, as the home improvement chain’s latest earnings and guidance will surprise to the upside in my opinion thanks to improving consumer demand trends.

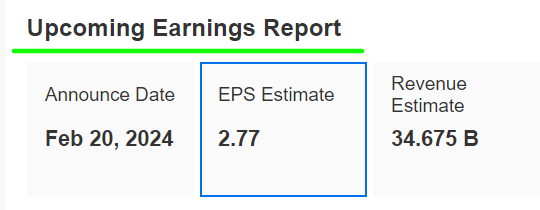

Home Depot’s fourth quarter update is due ahead of the opening bell on Tuesday at 6:00AM EST and results are likely to get a lift from strong demand for its assortment of building materials and construction products from both professional and do-it-yourself customers.

Market participants expect a possible implied move of around 4% in either direction in HD shares after the numbers drop. The stock jumped 7% after its last earnings report in mid-November.

Wall Street sees the Atlanta, Georgia-based retail heavyweight earning $2.77 a share, falling 16% from EPS of $3.30 in the year-ago period. Meanwhile, revenue is forecast to decline 3% year-over-year to $34.67 billion, as tighter budgets and a shift in spending to services triggered a pause in home improvement projects.

Source: InvestingPro

But as is usually the case, it is more about forward-looking guidance than results.

As such, I’m convinced that Home Depot CEO Ted Decker will provide an upbeat outlook for annual profit and sales growth to reflect an expected improvement in discretionary spending and a more normalized home improvement environment.

Americans have cut back spending on home improvements and renovations in recent months amid high interest rates, elevated inflation, and lingering recession fears.

However, that is expected to change this year, especially in the back half of 2024, as mortgage rates stabilize, and the U.S. housing market shows signs of recovery.

Source: Investing.com

HD stock ended Friday’s session at $362.35, not far from a recent 52-week peak of $368.72 reached on February 12. Shares - which are one of the 30 components of the Dow Jones Industrial Average - are up 4.6% since the start of the year.

At current valuations, Home Depot has a market cap of $360.6 billion, making it the largest U.S. home improvement retailer.

As ProTips points out, Home Depot is in ’Good’ financial health condition, thanks to solid earnings prospects, and a robust profitability outlook. Additionally, it should be noted that the company has maintained its dividend payout for 37 years running.

Stock to Sell: Walmart

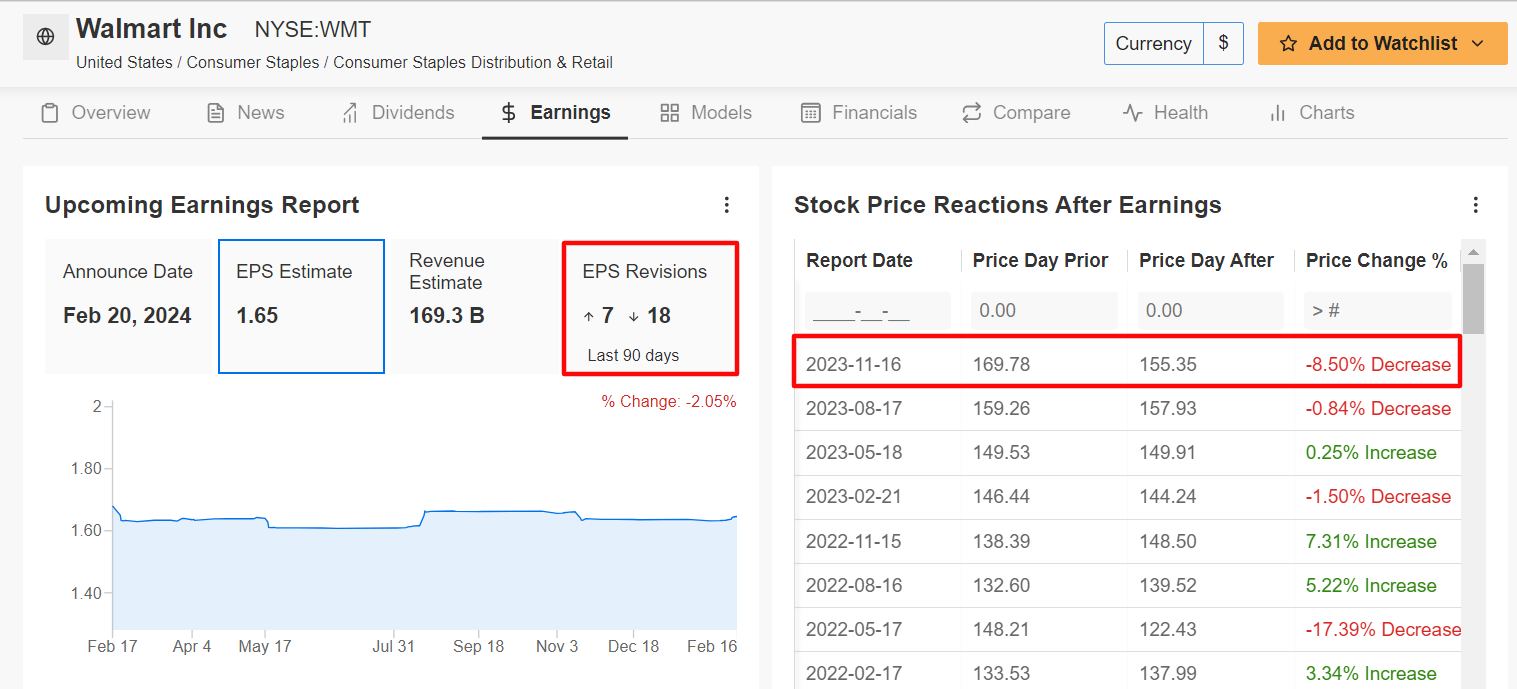

Staying in the retail sector, I believe Walmart will suffer a disappointing week ahead as the big-box retailer will likely deliver another quarter of weak bottom-line and top-line growth and provide a cautious outlook.

The Bentonville, Arkansas-based discount retailer is scheduled to report its results for the fourth quarter, which covers the holiday shopping period, before the U.S. market opens on Tuesday at 7:00AM ET.

According to the options market, traders are pricing in a swing of around 5% in either direction for WMT stock following the report. Notably, shares tumbled 8.5% after its Q3 report came out in November.

Underscoring several near-term headwinds Walmart faces amid the current backdrop, 18 out of the 25 analysts surveyed by InvestingPro have cut their EPS estimates in the 90 days leading up to the print, as Wall Street turned cautious on the retail giant.

Source: InvestingPro

Walmart - which operates more than 5,000 stores across the U.S. - is expected to post Q4 earnings per share of $1.65, falling 3.5% from EPS of $1.71 in the year-ago period. If that is confirmed, it would mark Walmart's first earnings decline in six quarters amid rising operating costs.

Meanwhile, revenue is seen rising 3.2% annually to $169.3 billion, reflecting strong food and grocery sales and as more shoppers sign up for its Walmart+ membership program.

Perhaps of greater importance, it is my belief that Walmart CEO Doug McMillion will disappoint investors in his forward guidance for the year ahead and strike a conservative tone given the topsy-turvy outlook for consumer spending.

The retail giant is seen vulnerable to numerous challenges, including growing concerns over potential food deflation and fluctuating demand for general merchandise.

Source: Investing.com

WMT stock ended Friday’s session at $170.37, its highest ever closing price. With a market cap of $458.6 billion, Walmart is the world’s most valuable brick-and-mortar retailer and the 15th largest company trading on the U.S. stock exchange.

Walmart has stood apart from other retailers amid the challenging macro environment, with shares rising 8% year-to-date. That compares to a 1.7% gain recorded by the Consumer Staples Select Sector SPDR Fund (XLP), and a 0.1% increase for the Consumer Discretionary Select Sector SPDR Fund (XLY).

It should be noted that WMT stock appears to be a tad overvalued, according to the quantitative models in InvestingPro. Its ‘Fair Value’ price estimate stands at $152.68, which points to a potential downside of 10.4% from the current market value.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Readers of this article enjoy an extra 10% discount on the yearly and bi-yearly plans with the coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

Subscribe here and never miss a bull market again!

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY (NYSE:SPY)), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.