So far in October, broader U.S. indices have recovered some of their September losses. Nonetheless, volatility, which measures the change in price and the related risk of a financial instrument over time, has been on the rise. An increase in volatility may mean a rise in risk or the fear factor.

Today we, re-visit the CBOE Volatility index. According to the CBOE:

“The VIX Index is a calculation designed to produce a measure of constant, 30-day expected volatility of the U.S. stock market.”

On Sept. 29, VIX was around 26. Now, it is over 29. VIX typically spikes up when there is fear in the markets and especially when U.S. equity markets plunge. VIX Futures do not show much easing off in the coming weeks, either.

Therefore today, we will continue our discussion of exchange-traded funds (ETFs) that may be appropriate, especially for long-term investors, in choppy markets. One way to navigate volatility would be to ignore such short-term price swings in the markets. Those who have long-run investment horizons and goals that extend to decades should not necessarily be worried about what the markets do daily, weekly or even monthly.

1. iShares Core Conservative Allocation ETF

Current Price: $37.35

52-Week Range: $29.00 - $38.00

Dividend Yield: 2.27%

Expense Ratio: 0.25%

The iShares Core Conservative Allocation ETF (NYSE:AOK) gives access to a basket of ETFs with exposure to range of bonds and global equities. The fund started trading in 2008. Assets under management stand at $761 million.

AOK currently invests in seven ETFs. Put another way, it is a fund of funds. The top four ETFs in it are

- iShares Core Total USD Bond Market ETF (NASDAQ:IUSB) - 55.73% allocation;

- iShares Core S&P 500 ETF (NYSE:IVV) - 17.19% allocation;

- iShares Core MSCI International Developed Market (NYSE:IDEV) - 11.52% allocation;

- iShares Core International Aggregate Bond ETF (NYSE:IAGG) - 9.85% allocation.

Through IUSB, investors have access to a range of bonds across different maturities. AOK also allocates funds among stocks via other iShares funds, including stocks with different capitalizations, and U.S. as well as international shares. As a result, AOK provides diversification in a single fund.

So far in the year, the fund is up more than 3% and hit an all-time high in early September. We believe a large number of investors may find AOK appealing.

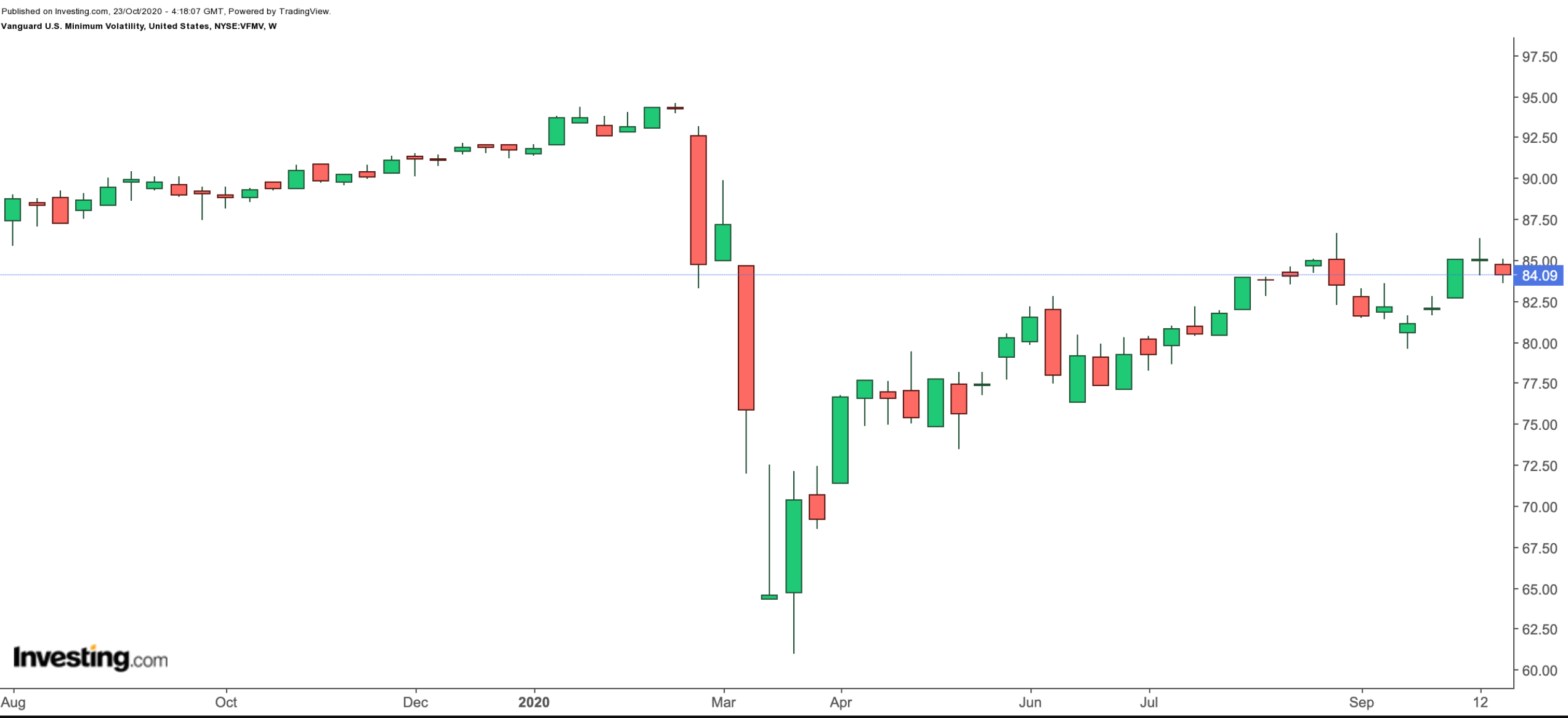

2. Vanguard U.S. Minimum Volatility ETF

Current Price: $84.09

52-Week Range: $60.98-$94.61

Dividend Yield: 1.67%

Expense Ratio: 0.13%

The Vanguard U.S. Multifactor Fund (NYSE:VFMF) provides exposure to a range of U.S.-based firms, representing different market sectors and industry groups. The fund adviser uses a quantitative model to determine a basket of securities that minimizes volatility relative to the broad market.

VFMV, which has 124 holdings, uses the Russell 3000 index as a benchmark. The top 10 holdings constitute over 17% of VFMV's net assets, which stand around $74.1 million. Put another way, no single company is large enough to affect the fund's returns in the short-run.

Virginia-based provider of enterprise software platforms MicroStrategy (NASDAQ:MSTR), New Jersey-based diversified energy group Clearway Energy (NYSE:CWEN), California-headquartered software giant Adobe (NASDAQ:ADBE), Georgia-based manufacturer of packaged bakery products Flowers Foods (NYSE:FLO) and Arkansas-based Walmart (NYSE:WMT), which is the biggest retailer in the world, are among the businesses that head the list.

In terms of sector allocation, technology (22.10%) and health care (18.20) have the highest weightings, followed by consumer discretionaries (14.80%), utilities (10.10%), telecommunications (8.0%) and consumer staples (7.80%).

Since the start of the year, the fund is down around 9%. Long-term investors may want to keep the fund on their radar.

Bottom Line

Each market participant has a unique set of circumstances and investment objectives. Therefore, the portfolio should be based on that investor's situation and reviewed regularly.

However, most retail investors should not be nervous about short-term volatility in the markets. Diversification among asset classes and different sectors would help them navigate choppy waters that may be ahead of us in the coming weeks.

Other ETFs that may be appropriate for a range of volatile markets could include:

- IQ Hedge Multi-Strategy Tracker ETF (NYSE:QAI)

- iShares S&P 500 Value ETF (NYSE:IVE)

- Innovator S&P 500 Power Buffer - January (NYSE:PJAN)

- ProShares S&P 500 Dividend Aristocrats ETF (NYSE:NOBL)

Finally, experienced traders with short-term views who are ready to take on the risk of daily bets, may consider researching the following products:

- iPath® Series B S&P 500® VIX Mid-Term Futures™ ETN (NYSE:VXZ)

- iPath® Series B S&P 500® VIX Short-Term Futures™ ETN (NYSE:VXX)

- VelocityShares Daily 2x VIX Short Term ETN linked to SP 500 VIX Short Fut Index Exp 4 Dec 2030 (OTC:TVIXF)

We plan to cover these funds in future weeks.