TSX slides after Trump announces new tariff increase

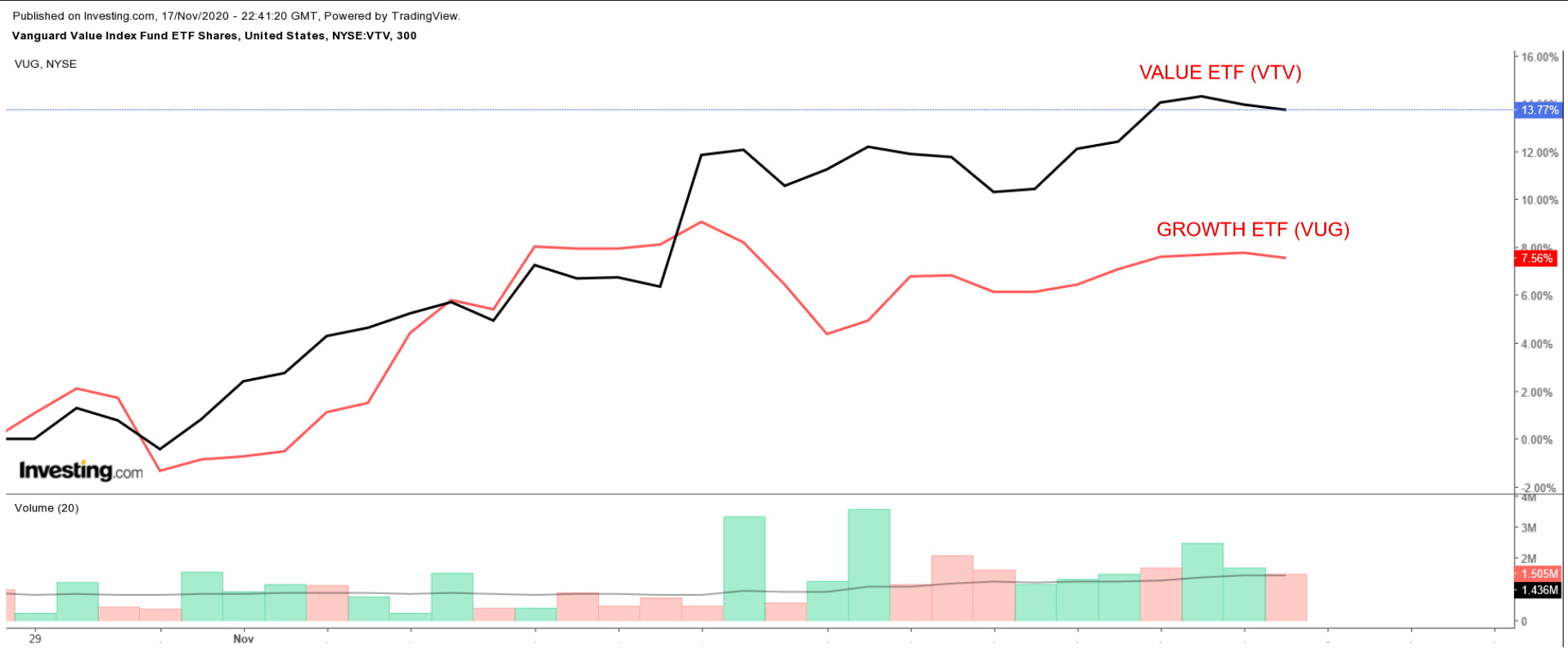

Technology stocks have fallen out of favor in recent sessions, with investors piling into value names, which are typically companies that are more sensitive to economic cycles, in the wake of positive COVID-19 vaccine announcements from Pfizer (NYSE:PFE) and Moderna (NASDAQ:MRNA).

Although Tuesday's session showed stocks falling across the board, as economic jitters about disappointing retail spending and a ramp-up in virus cases weighed, we still expect to see the rotation from technology stocks into value names continue.

Even with a rotation out of the high-flying tech sector, there are some stocks in the space worth holding onto considering their recent blockbuster quarterly earnings and strong potential for long-term growth. Here are 3 that should be on your radar:

1. Pinterest

Pinterest (NYSE:PINS) has been on a tear this year, with shares of the San Francisco, California-based social media company surging by around 240% in 2020, as both users and advertisers flocked to its platform during the COVID-19 pandemic.

The stock ended at $63.35 on Tuesday, rallying back toward its all-time high of $68.90 touched on Oct. 29, giving the image-sharing social media platform a market cap of around $31.5 billion.

Pinterest reported a massive beat on earnings and revenue when it released third quarter financial results Oct. 28, benefitting from expanding budget allocations from advertisers that sought to avoid the toxic and controversial content seen on other social media platforms, such as Facebook (NASDAQ:FB) and Twitter (NYSE:TWTR).

CEO Ben Silbermann said on the company’s earnings call, advertisers “want to be around positivity as they build their brands, and that’s contributing to our growth as well.”

The tech company posted earnings per share of $0.13, improving from EPS of $0.01 in the same quarter a year earlier. Revenue jumped 58% year-over-year to $442.62 million, which was much higher than the estimated $383.47 million.

Pinterest reported its global monthly active users (MAUs) climbed 37% year-over-year to 442 million in the last quarter, with strong gains in both the U.S. (+13%) and globally (+46%). Average revenue per user (ARPU) also rose by 31% domestically to $3.85 and 66% internationally to $0.21.

In the company’s earnings statement, Chief Financial Officer Todd Morgenfeld said:

"We're extremely pleased with the broad-based strength of our business, driven by recovering advertiser demand as well as positive returns from our investments in advertiser products and international expansion."

Looking ahead, Pinterest's guidance for the fourth quarter—which includes the key holiday shopping season—made clear that the company does not expect any slowdown in the coming months, with revenue forecast to jump by 60% in the next quarter.

2. Snap

Snap (NYSE:SNAP) has thrived throughout 2020 as investors have become increasingly bullish on the parent company of social media messaging app Snapchat amid the coronavirus outbreak.

Shares of the Santa Monica, California-based company have run up 140% year-to-date, well outpacing the benchmark S&P 500’s gain of roughly 12% over the same period. The stock closed at $39.27 yesterday, within sight of its record high of $45.60 reached on Nov. 6. At current levels, it has a market cap of $57.7 billion.

The social media tech company, once thought to be dead in the water, managed to blow past consensus estimates when it posted third quarter earnings on Oct. 20, thanks to accelerated ad spending made on its platform.

Snap said that Q3 results were boosted by advertisers looking for “platforms who share their corporate values,” an implicit reference to Facebook’s handling of hateful content and misinformation, which prompted several advertisers to boycott the company over the summer.

The multimedia messaging app unexpectedly reported adjusted earnings of $0.01 per share, compared to expectations for a loss of $0.05 per share. Revenue, meanwhile, jumped 52% from the same period a year earlier to $678.67 million, easily surpassing forecasts for sales of $557.02 million.

It reported daily active users (DAUs) rose nearly 19% from the year-ago period to an all-time high of 249 million. The company had initially projected users in the range of 242 million to 244 million.

Snap's overall average revenue per user rose 28% year-over-year to a record $2.73 in Q3, indicating that the social media company has improved its ability to further monetize its user base.

In a promising sign, Snap said it expects year-over-year revenue to increase 47% to 50% for the fourth quarter, with DAUs forecast to rise to 257 million.

“While there is continued uncertainty about the macro operating environment, we are pleased with the strength of the underlying momentum we have established with our advertising partners, and we remain highly optimistic about the long term prospects for our business,” Snap's Chief Financial Officer Derek Andersen said in the earnings report.

3. Roku

Roku (NASDAQ:ROKU) has been soaring this year thanks to its rapid user growth, which has translated into higher advertising revenue for the streaming media platform provider.

Roku shares have rallied 77% this year. The stock settled at $237.13 last night—not far from its all-time high of $255.66 reached on Nov. 6—giving it a market cap of $29.4 billion.

Roku reported a surprise profit when it released third quarter results on Nov. 5, along with better-than-expected revenue, due to strong growth in its ad-supported, video-on-demand services.

The company said in its earnings statement:

"In Q3, Roku delivered outstanding financial and operational results led by robust demand for TV streaming products, strong growth in advertising and the expansion of content distribution partnerships."

The streaming video platform said it earned $0.09 per share, compared to estimates for a loss of $0.42 per share. Revenue rose to $451.66 million, up an impressive 73% from the same quarter a year earlier.

Roku's active accounts as of the third quarter jumped 43% from the same period a year earlier to 46 million. Those accounts spent 14.8 billion hours streaming through Roku's hub, up from 14.6 billion hours in the preceding quarter.

Further underpinning optimism surrounding the company, average revenue per user clocked in with a double-digit percentage gain in Q3, rising 20% year-over-year to $27.

Roku said that it expects revenue to rise around 40% during Q4, although it did not offer formal guidance given questions around the economic impact of COVD-19.

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI