A second 25bp cut is on its way

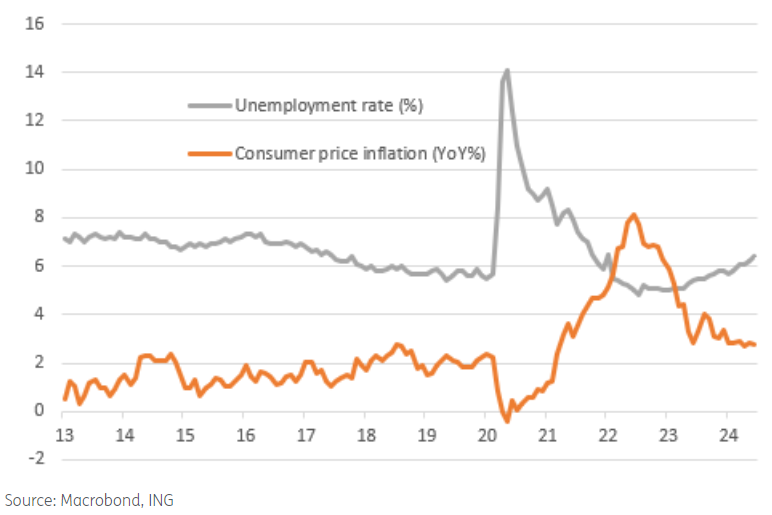

The Bank of Canada kicked off its easing cycle at the 5 June meeting and our sense in the wake of that decision was it would follow up with a further 75bp of rate cuts in the second half of the year, but it may not immediately cut again in July. That has changed following another sizeable increase in the unemployment rate to 6.4% from 6.2% and the June inflation report undershooting expectations. With financial markets now pricing 22bp of a 25bp cut on 24 July, it would be a surprise for the BoC not to cut.

A further 50bp to go despite concerns of rate differentials with the US

At its June meeting, the BoC concluded that diminishing inflation worries and excess supply in the economy meant its monetary policy doesn’t need to be quite so restrictive. The statement acknowledged that "indicators of the breadth of price increases across components of the CPI have moved down further and are near their historical average” while "recent data has increased our confidence that inflation will continue to move towards the 2% target."

In the accompanying press conference, Governor Tiff Macklem went further to say that there is “sustained evidence” inflation is easing and it is “reasonable to expect” further interest rate cuts.

With inflation now comfortably within its 1-3% target range and rising labour supply and weaker hiring pushing the unemployment rate up by 1.6 percentage points from its July 2022 lows, there is growing evidence that excess supply is forming in the economy. High interest costs continue to hurt the household sector with debt service costs as a proportion of income at 30+ year highs, contributing to the Canadian economy likely growing just 1% this year. As such, we expect a further 50bp of rate cuts before year-end.

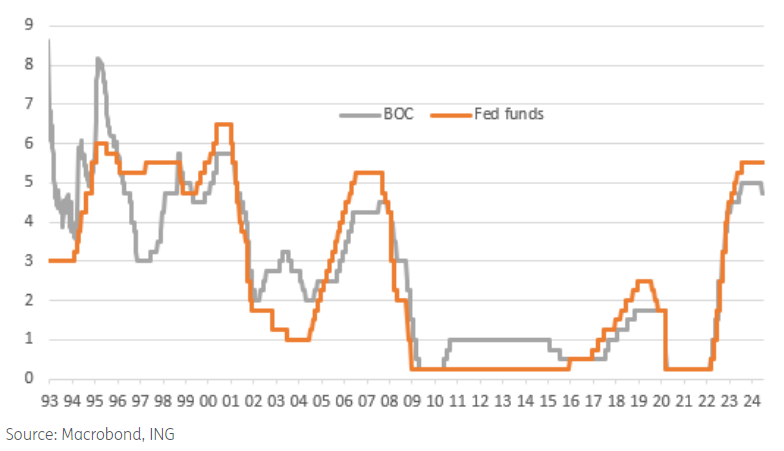

The one note of caution is that the BoC policy rate is already 75bp below the Fed funds ceiling, and another cut next week would take that to 100bp – the widest it has been since 2006. This may make the central bank wary that it could make the CAD look a little vulnerable, but with the market fully convinced that the Federal Reserve will start easing in September, we don’t see this as a major constraint on BoC policy easing next week.

CAD still looks trapped

USD/CAD appears to have limited room on both the upside and downside at this stage. The dovish repricing in Fed rate expectations is negative for USD/CAD, but the loonie normally underperforms most G10 peers when USD rates decline. On the other hand, we observed a few waves of pre-emptive positioning for a potential re-election of Donald Trump. Protectionist measures are all but positive for USD, but the Canadian economy is perceived as least likely to be hit by those policies, both directly and indirectly. Accordingly, CAD is in a less vulnerable position than other high-beta currencies should Trump get re-elected and go ahead with his protectionist agenda.

How does the BoC feed into all this? We have long argued that Canada’s “exceptionalism” on disinflation meant large BoC cuts and ultimately CAD would have lost attractiveness from a carry perspective and lagged other commodity currencies. Given our call for another cut this month, we remain of the view that CAD will have limited gains in the near term. However, we are no longer as negative on the loonie against other commodity currencies after the recent market shift to play the “Trump trade”, which may linger into the election.

In USD/CAD, opposing forces mean that 1.36-1.3750 could remain the trading range for longer. Ultimately, we still favour a descent to 1.35 as the first Fed cut approaches.

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI