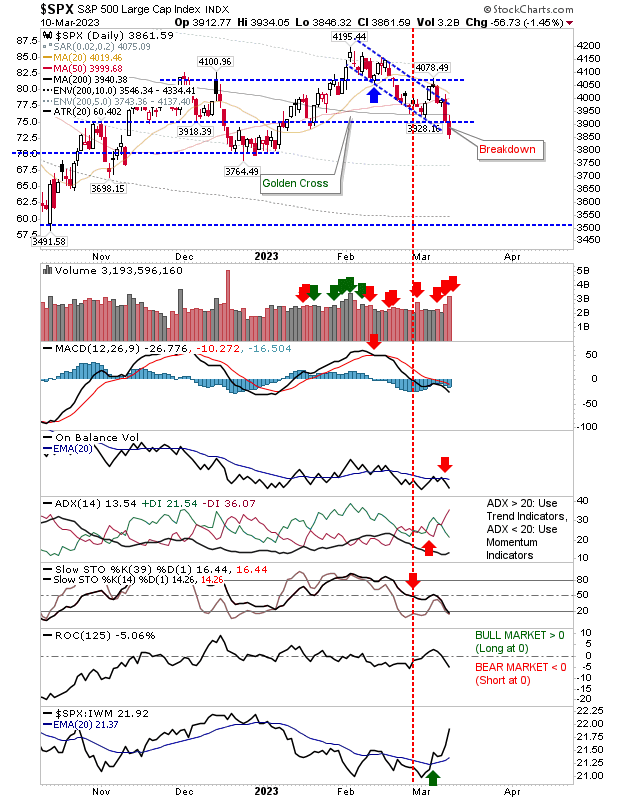

A potential area for support and buyers was quickly undone by the panic generated by the collapse of the Silicon Valley Bank (NASDAQ:SIVB). While I tend to go with technicals over fundamentals, this looks to be a case where the fundamentals did override the technicals.

Unfortunately, the tentative situation we're in is now a different space.

There was a fresh break of support for the S&P 500, with an undercut of the 200-day MA on confirmed distribution. Technicals are net bearish, although relative performance has moved sharply in the index's favor.

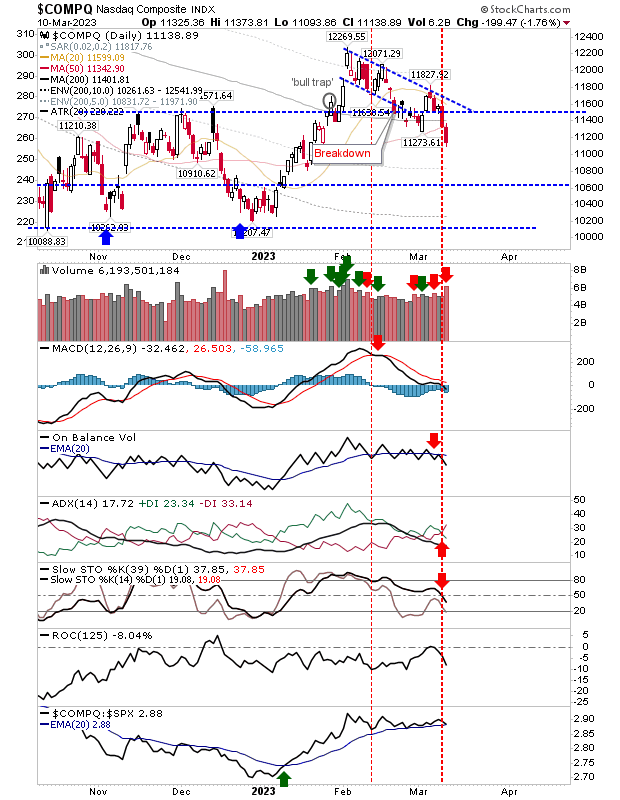

The Nasdaq has slipped below support defined by the November/December highs, but it has lots of room before it reaches the next level of support.

The flip side of this is given the loss of breakout support - and the undercut of the 'bull trap' - the likelihood here is that this will slip all the way back to 10,700 support, which in itself, may not be enough.

There was confirmed distribution to go with net bearish technicals. The index is also outperforming the S&P 500.

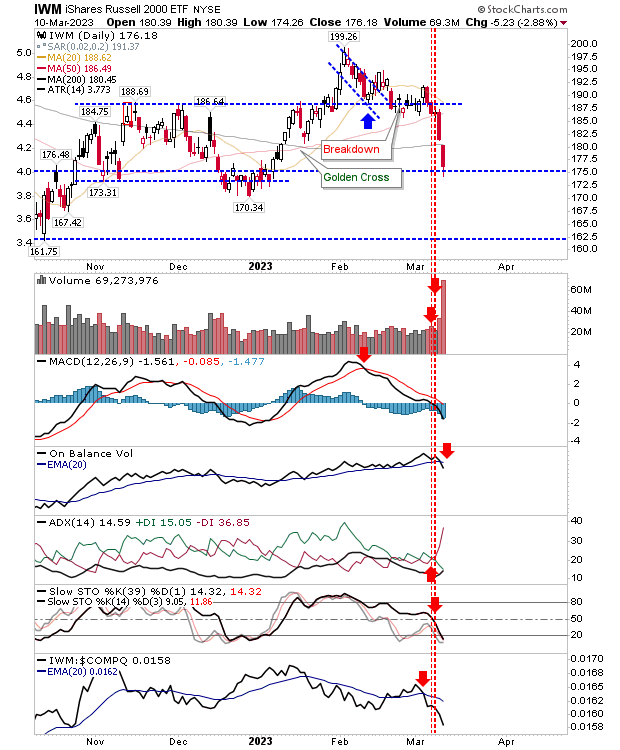

The index which suffered the most is the Russell 2000. Last week saw a wave of selling on a big uptick in volume (confirmed distribution).

The relative performance of the index was kicked to the curb as 50-day, and 200-day MAs were quickly breached.

The index has finished on a support level, but given the speed of descent, it's hard to see this holding, but watch for doji or 'hammer'; anything with a long spike low would suggest buyers are willing to defend.

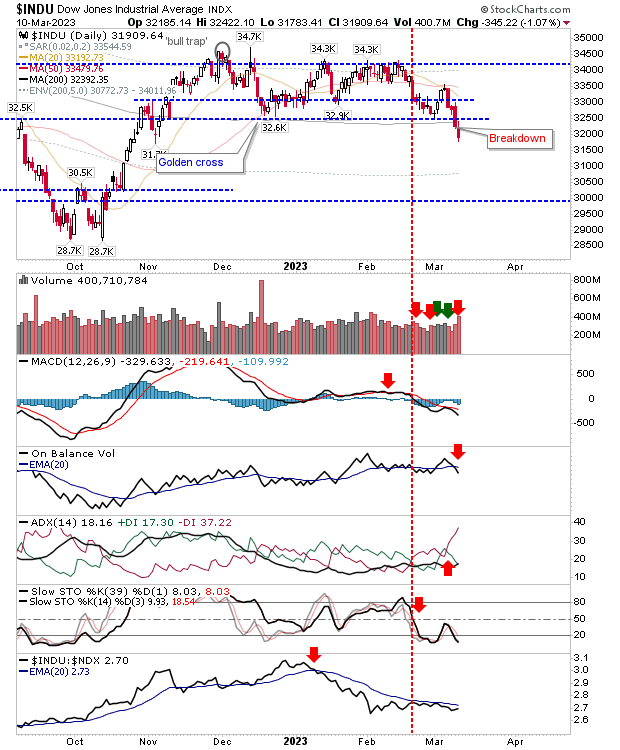

The Dow Industrials was looking good to break to new highs, but since the middle of February, it has drifted lower until last week's acceleration.

Technicals are net negative, including a long-standing relative underperformance to the Nasdaq 100. The next support is down at 30,000; there is a long way to go before we get there.

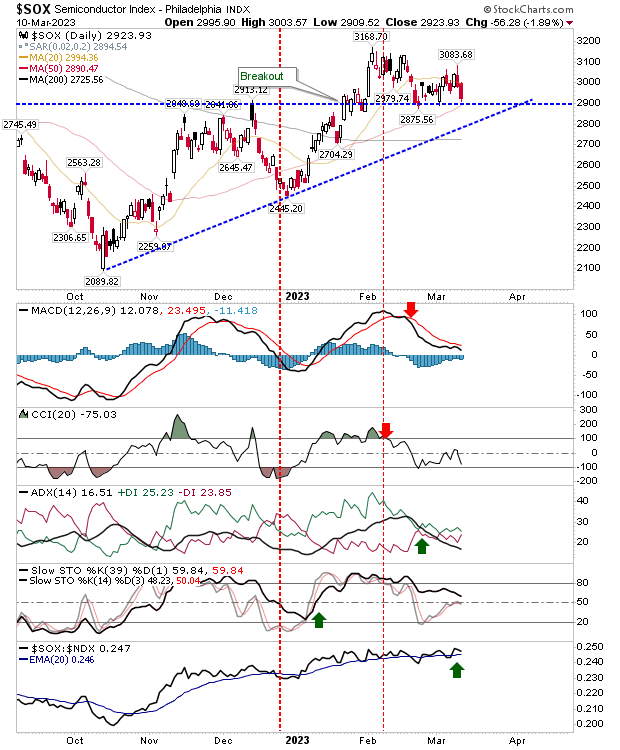

If there is a point of optimism, it's the Semiconductor Index. Where others were quick to give up on their breakouts and, in many cases, drift down to the low end of previous trading ranges, the semiconductor index still holds on to breakout support.

Technicals are mixed, but stochastics are still above the bullish mid-line.

For next week, we will want to see some stall in the selling, but there is likely more to come from the banking crisis. Watch for reversal candlesticks.

This will give a spike low and a place to measure risk (marked by a loss of reversal candlestick lows). Traders can focus on the Semiconductor Index. Investors can hang on to existing positions and maybe look to add.