1: Introduction

Exxon Mobil Corporation (NYSE: NYSE:XOM) announced its earnings for the fourth quarter and full year of 2024 on January 31, 2025. This article updates my previous article published on Gurufocus on February 21, 2024.

Exxon Mobil is a leading oil supermajor, ranked 15th in the S&P 500. It is known for consistently increasing its dividends annually, making it a dividend aristocrat. For the fourth quarter of 2024, the quarterly dividend was raised by 4.2% from the previous quarter, reaching $0.99 per share. This increase, which is above the average market rate, translates to a yield of 3.7%, a significant return for investors.

ExxonMobil operates in three main segments: upstream (oil and gas production), downstream, and chemicals, including specialty products. The company is also developing low-carbon solutions and emerging energy sources.

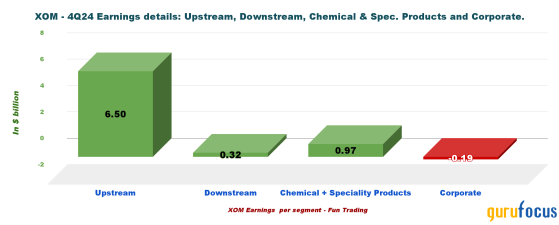

However, the upstream operations are the primary focus, generating approximately 83% of the company's total earnings in 4Q24, as shown in the graph below:

Analyzing Exxon Mobil without mentioning Chevron Corporation (NYSE:CVX) would be a significant error. ExxonMobil and Chevron have similar valuations, are in the same oil and gas industry, and pay attractive dividends (4.6% for Chevron, while ExxonMobil's is 3.7%). Chevron is ranked 28th in the S&P 500 and is a dividend aristocrat as well.

From the perspective of a savvy investor, both companies stand out as top choices in the oil and gas industry. However, there are some differences between them. Chevron is regarded as more stable, known for its consistent returns and lower volatility. In contrast, ExxonMobil adopts a more aggressive strategy that is more sensitive to fluctuations in oil prices. For those who cannot afford to invest in both, my analysis will help you choose the one that suits you best. I will provide a detailed analysis of Chevron following this article about ExxonMobil.

CEO Darrel W. Woods said in the conference call:

Financially, we demonstrated our steadily improving earnings power across a range of metrics. We delivered earnings of $34 billion in 2024, our third highest result in a decade despite softer market conditions. Over five years, we've grown earnings, excluding identified items, a compounded annual growth rate of nearly 30%. We generated cash flow from operations at $55 billion, also our third highest in a decade to fund profitable growth, maintain our financial strength and reward shareholders.XOM's total revenue for 2024 was $339.25 billion, reflecting a 1.5% decrease from the previous year, while Chevron's total revenue for the same year stood at $202.79 billion, excluding the HESS merger.

Upon analyzing the one-year chart below, we can see that XOM has been performing slightly better over time. Despite some recent weaknesses, both stocks have managed to increase by single digits over the past year. This situation may change in 2025.

2: XOM and CVX have a long history of successful mergers and acquisitions, a testament to their strategic prowess.

A brief history of ExxonMobil and Chevron mergers:

On November 30, 1999, Exxon and Mobil merged to form ExxonMobil. In 2001, Chevron acquired Texaco, followed by Unocal in 2005. ExxonMobil has recently completed its merger with Pioneer Natural Resources (NYSE:PXD), while Chevron is currently merging with Hess Corporation (NYSE:HES).

The proposed merger between Chevron and Hess, valued at $53 billion, is experiencing delays because of concerns raised by ExxonMobil and CNOOC regarding alleged preemptive rights associated with the joint operating agreement for the Stabroek Block in Guyana. ExxonMobil's block operator holds a 45% interest, while CNOOC has 25%. Hess holds a 30% interest in this block. The merger is currently paused until the ongoing arbitration proceedings before the International Chamber of Commerce (ICC) are satisfactorily resolved.

In the fourth quarter of 2024, ExxonMobil's oil production in Guyana reached approximately 650,000 barrels per day, driven by its three major projects: Liza Phase 1, Liza Phase 2, and Payara. The Yellowtail project, which is the fourth in the series, is set to commence production by the end of 2025, with an expected output of 250,000 barrels per day. Additionally, three more projectsUaru, Hammerhead, and Longtailare projected to start production by 2030.

The merger of ExxonMobil and Pioneer has resulted in approximately a 16% increase in oil equivalent production year over year, or 4,602,000 barrels of oil equivalent per day (Boepd). However, comparing last year's production to this quarter's production may not be advisable, as it could lead to inaccuracies.

Currently, ExxonMobil is producing a record of 2,011,000 barrels of oil equivalent per day (Boepd) in the U.S. alone, which represents a significant increase compared to last year's production of 1,228,000 Boepd.

US oil production was 1,468,000 barrels of oil per day and 543,000 oil equivalent barrels per day (natural gas production) or 8,331 million cubic feet per day (Mmcf/d). Below is the detailed production of crude oil and liquids versus natural gas per region.

Pioneer Natural Resources focused exclusively on the Permian Basin, specifically in the Midland sub-basin. ExxonMobil acquired Pioneer Natural Resources in an all-share deal valued at $64.5 billion on May 3, 2024.

One emerging issue is that ExxonMobil is producing a substantial amount of oil and gas in Canada and other Americas (Guyana for one), as shown in the chart above. The recent tariff on Canadian oil imports may lead to higher costs for ExxonMobil's Canadian operations, particularly if the company exports a significant portion of its oil production to the United States. The U.S. depends on Canadian oil, shipping approximately 60% of its oil imports from Canada. This situation means that ExxonMobil will encounter additional costs, which could impact profit margins and, ultimately, contribute to inflationary pressure in the U.S.

3: A critical analysis of the fourth quarter results: Concerns about the future outlook caused the stock to decline.

The results for the Upstream segment were relatively strong, showing an increase of 56.6% year over year, primarily due to the merger with Pioneer. However, the market responded negatively to ExxonMobil's earnings from gasoline and diesel production, which saw a significant decline. Earnings in this segment dropped from $3.207 billion the previous year to just $323 million, reflecting weaker refining margins.

Additionally, total revenue fell short of expectations at $83.426 billion in 4Q24, indicating a concerning trend of revenue decline over the last three quarters, particularly in the downstream and chemicals segments, as illustrated below.

The decline in stock prices is primarily due to concerns about global fuel demand for 2025. Additionally, the U.S. policy of imposing tariffs on oil imports from China and other countries, including Canada, Mexico, and potentially Europe, may also be contributing to this decline or will soon. These tariffs are likely to raise domestic fuel prices and disrupt established trade flows.

I believe tariff policy is a poor strategy and will negatively impact the global economy. It is the primary reason why I feel cautious about 2025 and recommend taking profits on any uptick.

ExxonMobil's oil and gas prices have been decreasing, yet they have remained above $61 per barrel in the U.S., which is the average global price received by XOM since 2015. However, the overall trend is concerning, and any further decline in 2025 could negatively impact XOM.

One effective way to evaluate a business is by examining its free cash flow. Despite facing challenges such as weaker refining margins and decreased global fuel demand, particularly in China, ExxonMobil is still generating a robust free cash flow, which I estimate to be approximately $5.39 billion. The company reported a free cash flow of $7.997 billion, which is significantly higher than my estimation. The reason for this discrepancy is easy to explain.

XOM is not using the basic formula for FCF, which is cash from operations ($12.229 billion) minus CapEx ($6.837 billion). The company adds additional investments and advances, other investing activities including the collection of advances, proceeds from asset sales and returns of investments, and inflows from noncontrolling interest for major projects and deducts additional investments and advances, which unnecessarily complicates the free cash flow. However, XOM is generating healthy free cash flow, which should cover dividends, share buybacks, and provide some extra for debt reduction as shown in the chart below:

One concern is that ExxonMobil has committed to a $20 billion share buyback in 2025, which seems excessively high to me. With 4.413 billion shares outstanding diluted and a quarterly dividend of $0.99 per share, the quarterly dividend expense amounts to $4.4 billion. If we add approximately $5 billion per quarter for the share buyback, it's clear that the company does not have enough free cash flow to support such spending and will likely need to increase its debt.

XOM's long-term debt, including current liabilities, is $41.71 billion, while its cash, cash equivalents, and marketable securities total $23.03 billion. Cash is declining rapidly from $31.54 billion in 4Q23.

This calculation clearly demonstrates weaknesses in the business model and how the situation could quickly worsen if oil prices drop below $60 with increased costs due to a tariff war.

4: Technical Analysis. XOM is weakening.

Note that the chart above has been updated to reflect dividends.

Exxon Mobil follows a descending channel pattern, with resistance at $110.50 and support at $103.50. The Relative Strength Index (RSI) is at 47 and declining, indicating strong resistance at $103.50 and a potential downside target of $100 or lower. The stock will continue channeling downward until it breaks through the upper or lower trend line.

For a short-term trading strategy, consider taking profits between $108.50 and $111.40, with a possible higher resistance at $114, corresponding to the 200-day moving average. Conversely, I recommend accumulating shares between $105.50 and $103, with an additional lower support level at $100 or below.

I suggest implementing a short-term Last In, First Out (LIFO) approach for 50% to 60% of your total position while maintaining a core long-term holding for a higher target. XOM offers a good dividend, and despite potential short-term downside risks, which you could use to average down, your investment will likely yield significant long-term gains if you remain patient.

It is also important to note that the chart above should be updated regularly to remain relevant.

This content was originally published on Gurufocus.com