Since I wrote my last piece, gold futures exhibited signs of fatigue and struggled to maintain its position above the critical point of $1815, eventually closing the week at $1817.

The Federal Reserve's indecisiveness became apparent on Friday's economic data, causing an increase in uncertainty.

Personal Consumption Expenditures, or PCE, Index (YoY) grew 5.4% and Personal Spending (MoM) grew 1.8% in January, while Personal Income (MoM) fell 0.6% - below expected levels.

New Home Sales (MoM) rose more than expected on Friday, which furthered concerns over the weak U.S. GDP announced the day prior, signaling a potential weakness in gold prices ahead.

The current state of precious metal markets is characterized by uncertainty regarding the level at which interest rates will peak this year. This is due to the ongoing Russia-Ukraine conflict which has been steadily driving up inflationary pressure since February 24, 2022, with no apparent signs of subsiding.

On the other hand, members of the G-20 summit in February 2023 appeared to be unwilling to coordinate and support further sanctions on Russia despite its invasion of Ukraine, which has led to a significant increase in inflation.

The post-pandemic period has witnessed a sudden surge in inflationary pressure globally, largely due to the steep rise in energy prices since the Russian invasion of Ukraine in 2022. This has resulted in widespread debt around the world, exacerbating economic uncertainty and volatility.

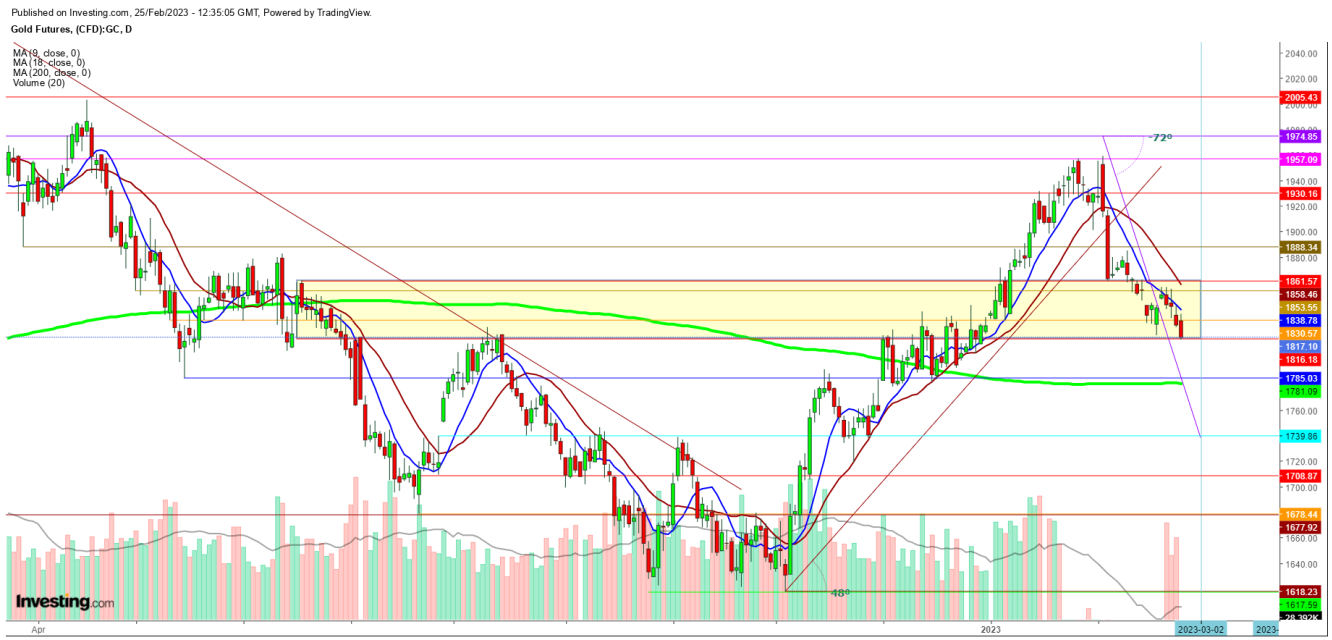

From a technical perspective, the daily chart indicates that if gold futures fail to hold the immediate support level of $1815, they could continue to slide downwards. In such a scenario, the next support level to watch would be the 200 DMA. Furthermore, as gold futures closed below the 9 DMA at $1838 last week, it suggests that there could be further downward pressure in the short term.

There is a possibility of a reversal in gold futures if the U.S. dollar weakens during the upcoming week.

In my view, there is a risk of rallies being sold off above the 9 DMA due to heightened inflationary pressures and growing uncertainty around potential rate hikes, which could lead to increased volatility in the near term.

On the other hand, if gold futures begin the upcoming week with a gap-down opening and maintain sustainable movements below $1813, bears may initiate selling sprees on each subsequent rally.

Disclaimer: The author of this analysis may or may not have any position in the gold futures. Readers can take any long or short trading position at their own risk.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.