The real estate market has had a rough ride since the Federal Reserve began raising interest rates in March 2022. But as expectations strengthen that the central bank will start cutting next month, the outlook is rebounding for property shares.

Yesterday’s news that existing home sales rose in July for the first time since February helped focus attention that the industry’s headwinds are slowing and perhaps approaching a turning point.

From the perspective of homebuilder stocks, the case for expecting a housing rebound is old news.

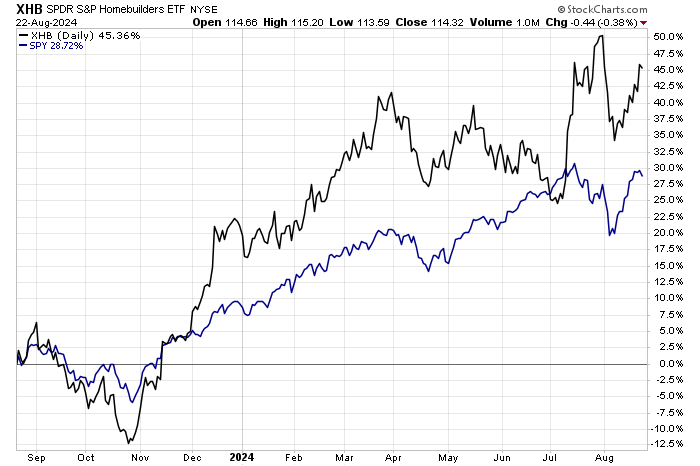

The SPDR S&P Homebuilders ETF (NYSE:XHB) has been outperforming the broad US stock market (SPY) for much of the year.

Bullish sentiment for homebuilder stocks may be conspicuous, but the real estate market, as usual, lags market sentiment. Speaking about the latest pop in existing home sales, the chief economist of the National Association of Realtors, which publishes the data, says:

“Despite the modest gain, home sales are still sluggish. But consumers are definitely seeing more choices, and affordability is improving due to lower interest rates.”

Construction activity for housing, however, has yet to post encouraging numbers. Notably, housing starts fell to a four-year low last month.

The sharp rise in mortgage rates is widely cited as the key headwind, but here, too, there are signs that the tide is turning following yesterday’s news that the average rate on a 30-year mortgage dipped to a 15-month low.

“The fate of the housing market in the coming months will be dictated in part by the direction of mortgage rates, as well as the health of the broader economy,” says Bankrate’s senior economic analyst. “The market could benefit from a combination of tailwinds, if they were to develop and are sustained.”

Cue up today’s upcoming speech (10:00 am Eastern) by Federal Reserve Chairman Jerome Powell at the Jackson Hole Symposium. Although there’s a growing sense that he’ll hint at rising odds for a rate cut, some analysts remain cautious.

“Stop me if you’ve heard this before: They’re still data dependent,” says Lou Crandall, a former Fed official and currently chief economist at Wrightson-ICAP. He predicts Powell will be “directionally unambiguous, but specifics about how fast and exactly when will depend on the data between now and the meeting. Little doubt that they will start cutting in September.”

The only uncertainty vis-à-vis the Fed funds futures market is the size of the cut expected for the Sep. 18 policy meeting. At the moment, the market is pricing in a roughly 74% probability for a 25-basis-point reduction in the current 5.25%-to-5.50% target range for the Fed funds rate.

But as the saying goes, it ain’t over till it’s over. Ahead of the next Fed meeting are two key economic reports for August that could help or hinder the rate-cut narrative: payrolls (Sep. 6) and consumer inflation (Sep. 11).

The consensus view is that the numbers will cooperate, namely, disinflation will continue and the labor market will soften. If the crowd is right, the data will be a set-up for a rate-cut announcement a few days later.