- Despite a turbulent August, the market remains in overall good shape

- As September kicks off, many of the same pressures should remain in place

- Let's take a look at various trends to evaluate the actual risks for the US market

Stocks faced a few hurdles in August, but some would argue that it came at an opportune moment.

As this year's bull run surged into overbought territory, the likelihood of a bigger downturn appeared significant at the start of the month. This trend was further compounded by seasonal vulnerabilities and the convergence of various macroeconomic factors.

However, the reassuring news now is that we shouldn't jump to the conclusion that this marks the start of a bear market. Instead, this seems like a 'normal' correction, where stocks are simply taking a breather.

Let's also not forget the impressive performances of the top three indices since the beginning of the year:

- The Nasdaq 100 is up by 41.7%.

- The S&P 500 has seen a 17.4% increase.

But where does that leave us for September?

Put vs. Call Ratio

Looking at the Put vs. Call equity ratio, we can observe that it reached its highest level in late 2022 to early 2023, indicating the market's readiness for potential declines. However, in recent months, it has exhibited a predominantly sideways-bearish trend, with values rarely exceeding 1. This implies that the volume of put options outweighs that of call options. Interestingly, in the last month, it has come much closer to this "threshold," hinting at the emergence of a bullish trend.

Indeed, this ratio serves as a compelling indicator that divides the put volume by the call volume, offering valuable insights into market sentiment and the potential for market appreciation or depreciation.

In essence, what we're witnessing can be considered a correction, albeit a fairly typical one. A 3-4% decline in several major indices (with the exception of the Hang Seng) shouldn't disrupt our anticipated trajectory or shake investor confidence. Nevertheless, many may be contemplating whether this signals the start of a substantial downward movement in the equity markets.

The truth is, we cannot definitively determine this outcome unless specific psychological thresholds are breached, and we gather different inputs from various financial instruments.

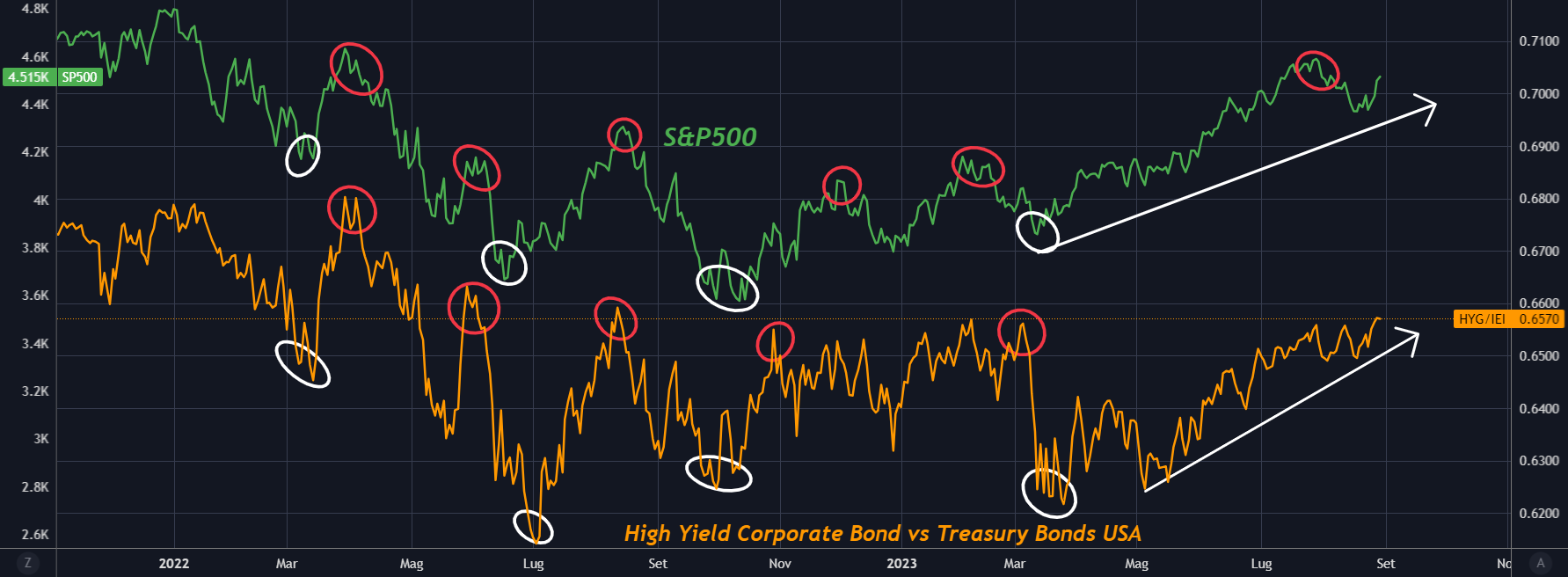

High-Yield Corporate Bonds Vs. Treasury Bonds

Now, let's turn our attention to the comparison of the S&P 500, high-yield bonds, represented by the iShares iBoxx $ High Yield Corporate Bond ETF (NYSE:HYG), and mid-term U.S. Treasuries, represented by the iShares 3-7 Year Treasury Bond ETF (NASDAQ:IEI):

In this chart we are talking about stocks of companies that are not very stable and in trouble, at the time when there is fear and volatility, they are the 'first' to be dumped by investors. currently we are 'still' in a phase of indecision, the ratio, which sees high-yield bonds at the numerator, is close to the highs of a year that corresponds to the period in which the stock then had declines marking the October 2022 bottom. Supporting the indecision thesis is the same spread that still shows a bullish trend, in favor of high yields = high risk, with higher volumes of "sell" on U.S. Treasury bonds.

High Beta Vs. Low Beta Ratio

Consequently, the "defensive" rotation is not there at the moment. Confirming a continuation of trend (and no rotation) is the High Beta, represented by the Invesco S&P 500 High Beta ETF (NYSE:SPHB), vs. Low Beta ratio, represented by the Invesco S&P 500 Low Volatility ETF (NYSE:SPLV).

We can observe a distinct pattern from March 2020 to November 2021, where equities experienced a consistent upward trend driven by the High Beta sectors (in the numerator). During this period, these sectors outperformed the Low Beta sectors (in the denominator).

However, as we moved through 2021 up to the market bottom in June 2022, a noticeable reversal occurred. Low Beta companies started to outperform, capitalizing on the prevailing economic uncertainty. This shift is also reflected in the performance of Low Beta-rated companies.

Following this phase, there was yet another pronounced reversal, with High Beta sectors resurging and even approaching the highs of March 2021. This level now represents a psychological resistance that seems challenging to overcome. A potential breakout at this point could serve as a strong signal indicating the continuation of the bullish trend.

Tech Vs. Consumer Staples

Now, to conclude, let's now analyze the relationship between the technology sector, represented by Technology Select Sector SPDR Fund (NYSE:XLK), and the consumer staples sector, represented by the Consumer Staples Select Sector SPDR Fund (NYSE:XLP):

The chart above provides compelling evidence of investors' risk preferences. Following the market bottom in December 2022, we witnessed a gradual shift away from commodity stocks, followed by cyclical and defensive stocks. Instead, capital flowed toward the perceived 'riskier' High Beta tech stocks. Currently, the ratio faces a crucial psychological threshold, namely, the highs recorded in November 2021.

A notable signal, adding to our analysis, comes from the Beta coefficient. The XLK boasts a coefficient above 1, precisely 1.05, indicating higher volatility, while the XLP has a value below 1, specifically 0.58, suggesting lower volatility. If a significant correction were to occur, it could prompt a shift of capital towards investments with smaller betas. In all likelihood, we would observe a reversal of these ratios.

Bottom Line

What's worth noting is the change in the P/E ratio of the S&P 500 over the past few months. Previously, the ratio, based on reported earnings for the last 12 months, stood at 30x. Presently, the market has undergone a modest correction, but the ratio still remains approximately 55% above its long-term average value of 16x, equivalent to about 25 times.

It's important to acknowledge that multiples can't ascend indefinitely. Therefore, it's reasonable to entertain the idea of a reversion to the mean. However, the timing of such a shift remains exceptionally challenging to predict.

The undeniable fact remains that stocks experienced a decline in August, heightening fear among investors. With the month of September ahead of us, it may bring its own set of challenges and uncertainties to contend with.

We can't predict what will happen; however, we don't seem to be looking at a risk-on environment right now.

***

Disclosure: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.