- US futures move higher after Tuesday's Wall St. slump

- Pound sterling gains ground

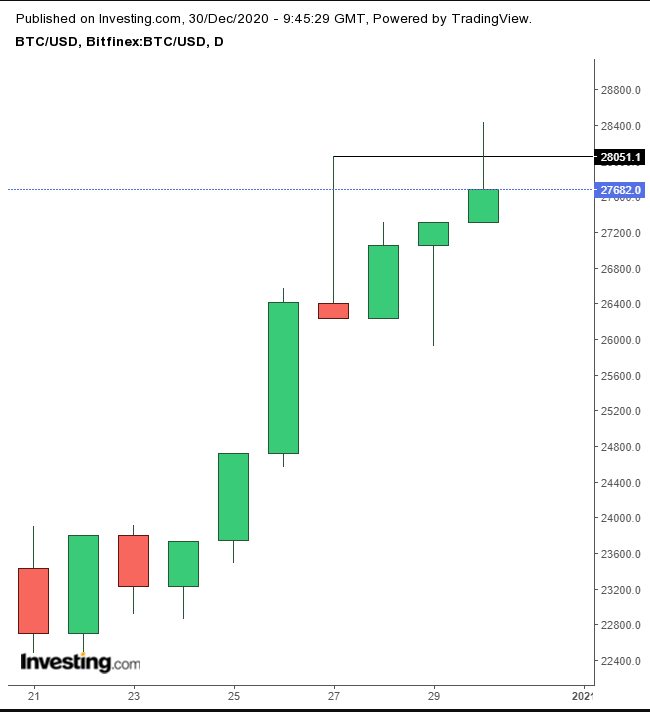

- Bitcoin dips after hitting fresh highs

Key Events

US futures for the S&P, Dow, NASDAQ and Russell 2000 all rebounded on Wednesday. European stocks edged higher}} this morning, continuing their upward trajectory amid thin trading, as drugmaker AstraZeneca (LON:AZN) gained approval in the UK for its coronavirus vaccine.

As this turbulent year winds to a close, with only two more trading days left in 2020, the dollar extended its drop, and yields moved higher. Bitcoin touched yet another, new all-time high.

Global Financial Affairs

US contracts rebounded from the first decline in US stocks since last Wed. Contracts on the Russell 2000 outperformed one day after the underlying index suffered a deep loss. The market narrative attributes the renewed optimism to the start of stimulus checks being sent to Americans.

Notwithstanding the still-rising COVID-19 case count and fatality rate worldwide, as well as the emergence in the US of the faster spreading coronavirus variant, the AstraZeneca-Oxford University vaccine has provided an additional reason for investors to be hopeful. The Stoxx Europe 600 Index climbed for a sixth straight day.

The FTSE 100 also managed to move higher for the fifth day in a row, to its highest level since Mar. 5, even with the added weight of a stronger pound, which jumped for the second day, as it inches toward its highest since May 1.

While Asian indices were mixed earlier Wednesday, the MSCI Asia Pacific ex-Japan index advanced 1.2% to score a record high, as investors bet that 2021 will be better across the region. South Korea’s KOSPI outperformed, (+1.9%), as it also hit a new all-time high, after achieving its biggest annual gain since 2009.

The VIX trimmed some of yesterday’s jump.

The so-called 'fear index' bounced off its uptrend line since Nov. 27. We're wondering if it's forming a H&S continuation pattern.

Yields, including for the 10-year note, demonstrate the same setup for risk-on as Treasurys were sold off.

Rates are bouncing off the bottom of a continuation pattern within a rising channel.

The dollar fell for a second day, as US net short bets rose to $30.15 billion in the week ending Dec 21. That's up from $26.56 billion in the week before, the highest since September, according to calculations by Reuters and Commodity futures Trading Commission data released Monday.

The greenback deepened its penetration from a second consecutive pennant along a tight falling channel. Having broken below the 90.00 psychological level, the next major support is the Feb. 16, 2018 low of 88.25.

Gold was little changed, having dropped from session highs, as the dollar rebounded off its lows.

From a technical perspective, the yellow metal found resistance at the top of its falling channel since the August record, after completing a falling flag, itself a return-move to a small H&S bottom.

Bitcoin is up for a third day. If the digital currency closes at its current price of $27,810 at time of writing, it will post a new record for its closing price. It already achieved a new intraday high of $28,599.99 on Wednesday.

The price has yet to be able to close above Sunday’s shooting-star at $28,051, and is developing a second shooting star, as of the current price.

{{8849|Oil rebounded for the second day.

Crude bounced off the bottom of a pennant; it's attempting to return above its uptrend line since Nov. 2.

Up Ahead

- US Pending Home Sales and Goods Trade Balance data will be released later today.

- Weekly Initial Jobless Claims figures for the US will be published on Thursday.

- Most global stock markets are closed Friday for the New Year holiday.

Market Moves

Stocks

- Futures on the S&P 500 Index gained 0.3%.

- The Stoxx Europe 600 Index increased 0.2%.

- The MSCI Asia Pacific Index rose 0.7%.

- The MSCI Emerging Markets Index added 1.3%.

Currencies

- The Dollar Index declined 0.1% to 89.87.

- The euro increased 0.1% to $1.2257.

- The British pound climbed 0.3% to $1.3541.

- The Japanese yen strengthened 0.2% to 103.34 per dollar.

Bonds

- The yield on 10-year Treasuries climbed one basis point to 0.95%.

- The yield on two-year Treasuries increased less than one basis point to 0.13%.

- Germany’s 10-year yield gained one basis point to -0.56%.

- Britain’s 10-year yield climbed two basis points to 0.234%.

Commodities

- West Texas Intermediate crude gained 0.6% to $48.35 a barrel.

- Gold was little changed at $1,878.56 an ounce.