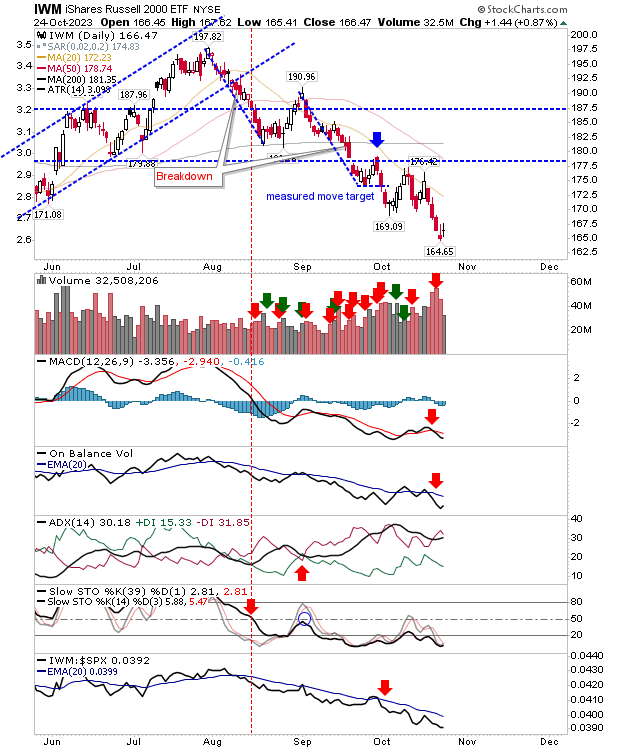

At this stage, only weekly time frames are important as we track "Crash Watch". It's a tricky situation as the S&P 500 and Nasdaq don't look vulnerable, but the Russell 2000 (IWM) is really struggling.

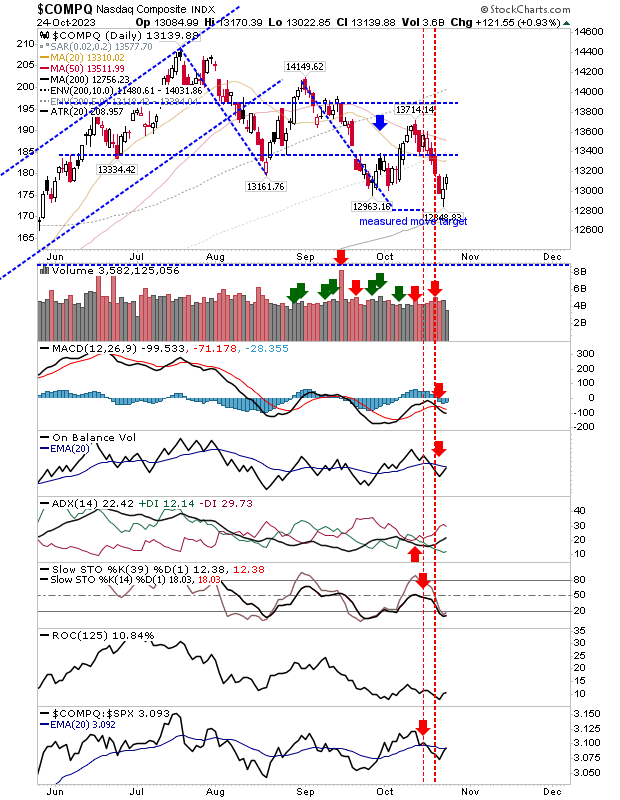

Starting with the Nasdaq, we have a technical negative picture but it remains above 200-day MA support. This looks like an index in the process of forming a (multi-year) trading range, but even if this is the case, it's still early days as no trading range boundaries have been set.

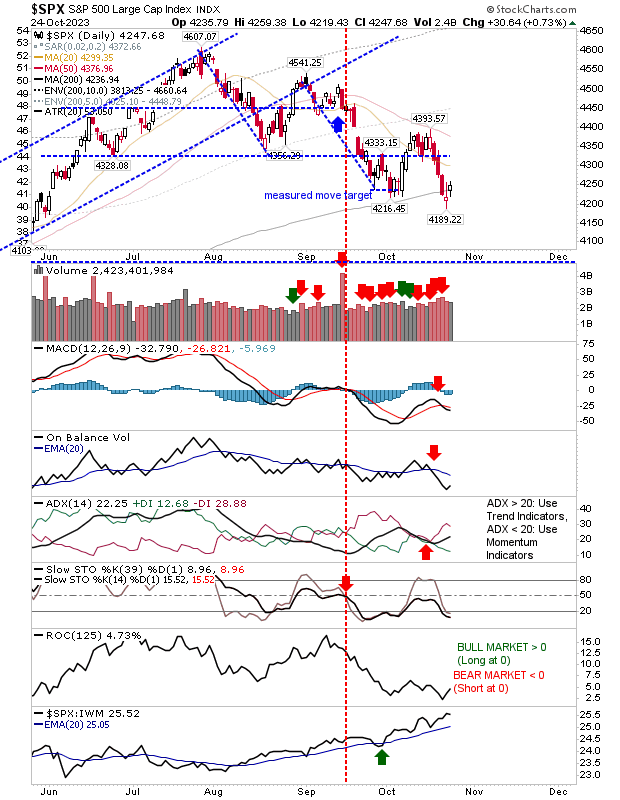

The S&P 500 tagged its 200-day MA, returning above this moving average after yesterday's close. The buying volume was less than the previous day's selling distribution, but there are grounds for buyers to step in at a logical support level.

The Russell 2000 (IWM) did manage to post a gain, but the candlestick was a neutral doji, not one to inspire confidence. Technicals are bearish and oversold and show little sign of a recovery.

Conclusion

It's still early in the week but yesterday's action does not inspire confidence. I would be looking for a down day today as indexes look to challenge lows.

The Russell 2000 (IWM) is now trading 14.9% below its 200-day MA, accounting for 95% of historic price action dating back to 1987; i.e. only 5% of price action since 1987 was weaker than what we are seeing now.

We don't know if the index will crash, but what we do know is that historically it's in strong buying territory. If you are an investor, don't be afraid to be a buyer. Future losses - should they come - will be short and sweet.