When I was thinking about writing this week, the song, “The Long Run” immediately came to mind. The Eagles released it in 1979. According to Henley, the title track was in part a response to press articles that said they were “passé” as disco was then dominant and punk emerging, which inspired lines such as “Who is gonna make it/ We’ll find out in the long run.” (wikipedia)

You can go the distance

We’ll find out in the long run

(In the long run)

We can handle some resistance

If our love is a strong one

(Is a strong one)

People talkin’ about us

They got nothin’ else to do

When it all comes down

We will still come through

In the long run

Ooh, I want to tell you

It’s a long run…

Who is gonna make it?

We’ll find out in the long run…

The similarities to being an investor in Alibaba (NYSE:BABA) are striking. The Eagles turned out to be right. Disco and Punk, not so much…

Furthermore, it takes a “long run” view to look through the short term noise of the debt ceiling – among other headlines I discussed with Phil Yin on CGTN America last night. Thanks to Phil and Ryan Gallagher for having me on:

Alibaba

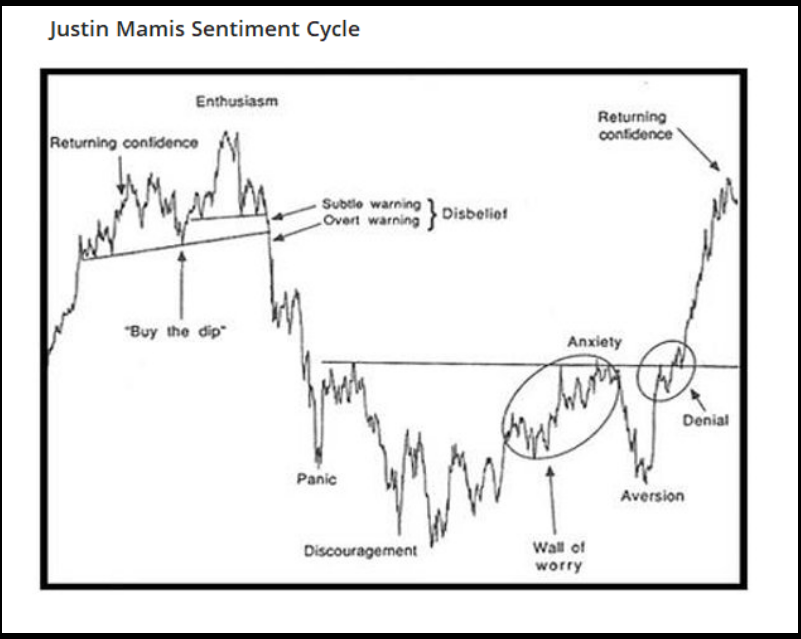

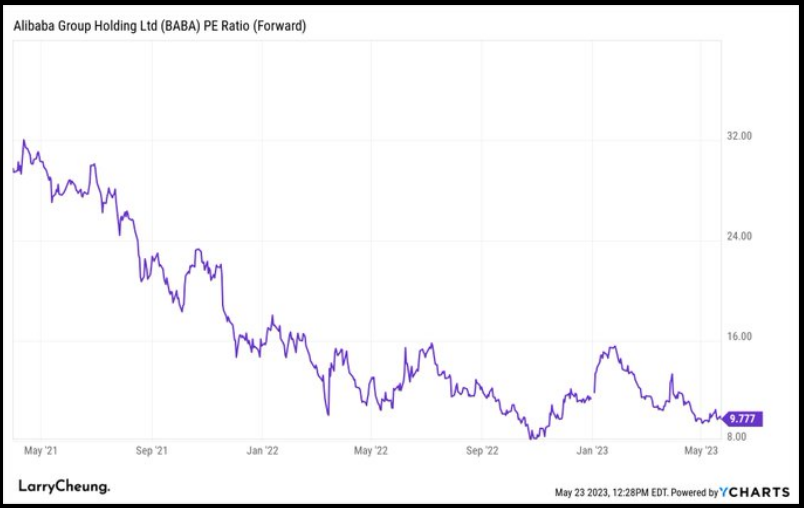

We’re nearing the end of the final shake out cycle we’ve been discussing in Alibaba. We’ve discussed a possible final overthrow into the high seventies in recent podcast|videocast(s) (along the lines of what was seen last March) and we’re now in the neighborhood:

This week there were headlines about a covid resurgence in China. Since the government no longer tracks or publishes case numbers or institutes lockdowns, it’ll probably work out to be the equivalent of a short-term bad Flu season in the rest of the world (if the “academic” who predicted it at a conference is even correct).

Dialogue is resuming between US/China. While there are never any guarantees when it comes to the big egos involved in politics, the mutual interdependence dictates there should be incremental progress.

While the daily headlines on China beat up shareholders on a daily basis in every effort to separate them from their stock before we return to confidence, we prefer to deal with the facts.

So here are the key facts from Thursday evening’s earnings earnings call:

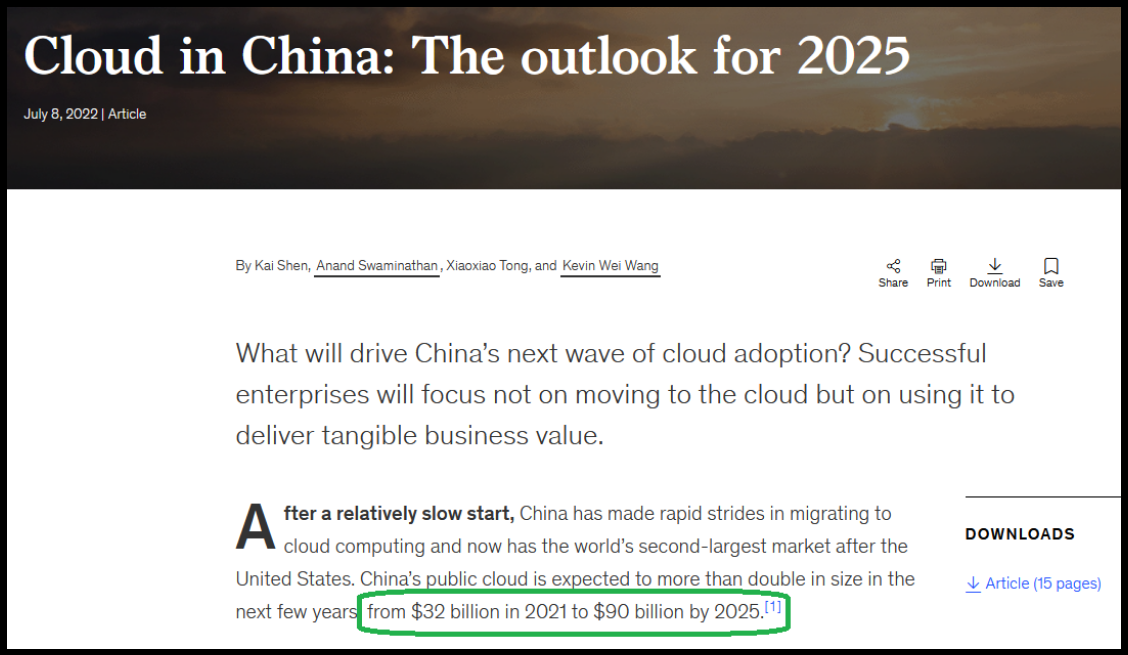

The most important line in the entire call edified EXACTLY what we said two weeks ago when we presented our SOTP “Sum of the Parts” analysis on Alibaba. When we assigned our valuations on each part of the business, we allotted ~$200B for AliCloud over then next couple of years as the industry triples and they retain their number one position (~36% share).

WHAT ZHANG SAID ON THE CALL:

CEO Daniel Zhang, “We would be happy to see and indeed EXPECT to see Alibaba Cloud as an independent company growing to be as big as and PERHAPS EVEN BIGGER than the Alibaba Group is today.”

For context, the marketcap of Alibaba is currently $209B.

Another key point we made was that AliCloud today is where Amazon (NASDAQ:AMZN) Web Services was in 2016. Skeptics scoff at this analysis, but we follow the money. Daniel Zhang is currently the CEO of Alibaba Group. When the business is spun out to shareholders to operate on a standalone basis, Zhang is going to run AliCloud. Why? Here’s EXACTLY WHAT HE SAID ON THURSDAY’S CALL, which confirmed our analysis:

A key point he noted was the profitability gap between leading cloud ventures internationally (AWS) and Alicloud: “I see that gap really as our opportunity as we continue to grow and scale and achieve more economies of scale. And in particular, as we develop our core technologies, we see a definite opportunity and are confident in our ability to increase the profitability.”

Look familiar? AliCloud is where AWS (Amazon Web Services) was in 2016 in the US.

“I think we are still in the early days of development of cloud, especially as it is a proportion of overall IT expenditure here (China).” McKinsey agrees with him:

But, but, but “isn’t AliCloud cutting prices?” The answer is “YES” but not for the reasons you think. The reason they are cutting prices in the short term is to control the market in the long term. Once you transfer all of your data to their servers, the switching costs are higher. Then they sell you the higher margin AI and software services that go on top (and straight to the bottom line). This is the razor/razor blade model. Give away the razor so you can make a fortune refilling the razor blades for years to come. Gain market share and the profits will follow. Jeff Bezos became the richest man in the world doing this.

As Zhang stated above the key is to get everyone (even students) into their cloud, then once you have them in, first, sell them more computing power (which will be unlimited demand with AI), and second, sell them new products (IaaS, PaaS and A.I. applications). The A.I. applications will result in an “exponential increase in demand for computing power.” This is the flywheel that is a “huge opportunity” for AliCloud moving forward.

Other Key Points From the Earnings Call:

All of this happy talk is fine and dandy, but what are the next catalysts to bring it (BABA, EEM, China) out of the funk?

- Debt Deal Completed. This will unwind the recent “safe haven” bid to the U.S. Dollar.

- Fed Pause (in June) confirmation will cement the downtrend in U.S. Dollar that began in October.

Cooper Standard

A key customer for CPS in the US is Ford. In a pivot from its covid-era framework of scarce production and higher prices, Ford stated it intends to reclaim 2018-2019 unit numbers – which implies another 1M additional units above current estimates. This will be a monster boon for CPS (well ahead of schedule) if Ford can hit the targets it laid out this week:

Now onto the shorter term view for the General Market:

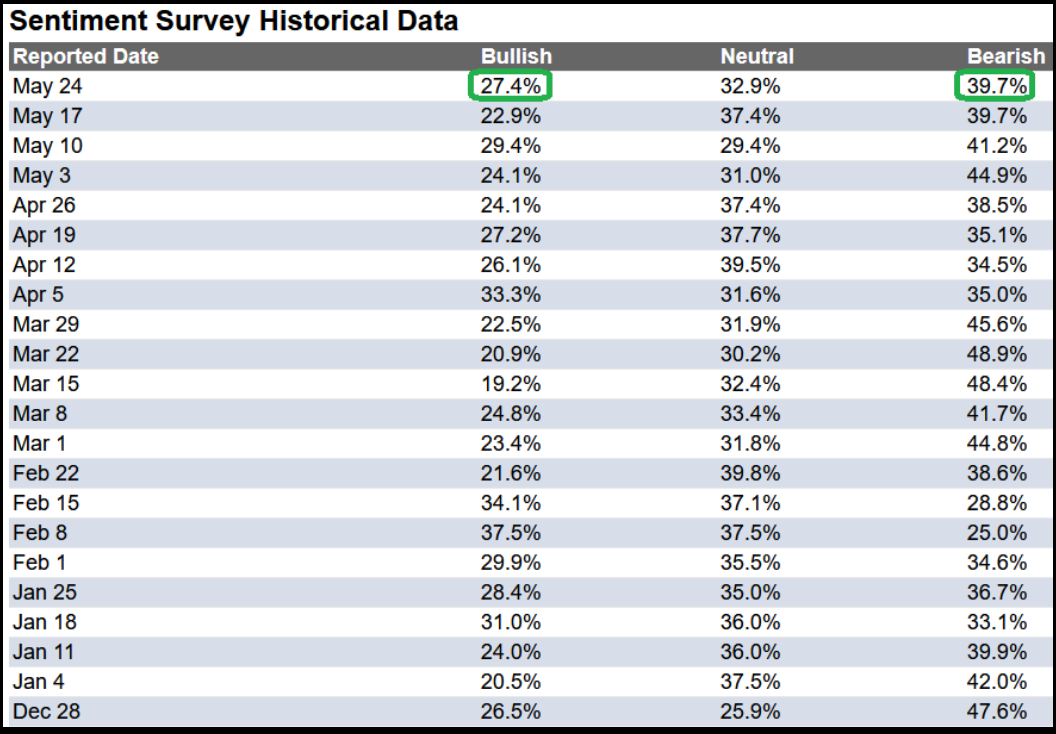

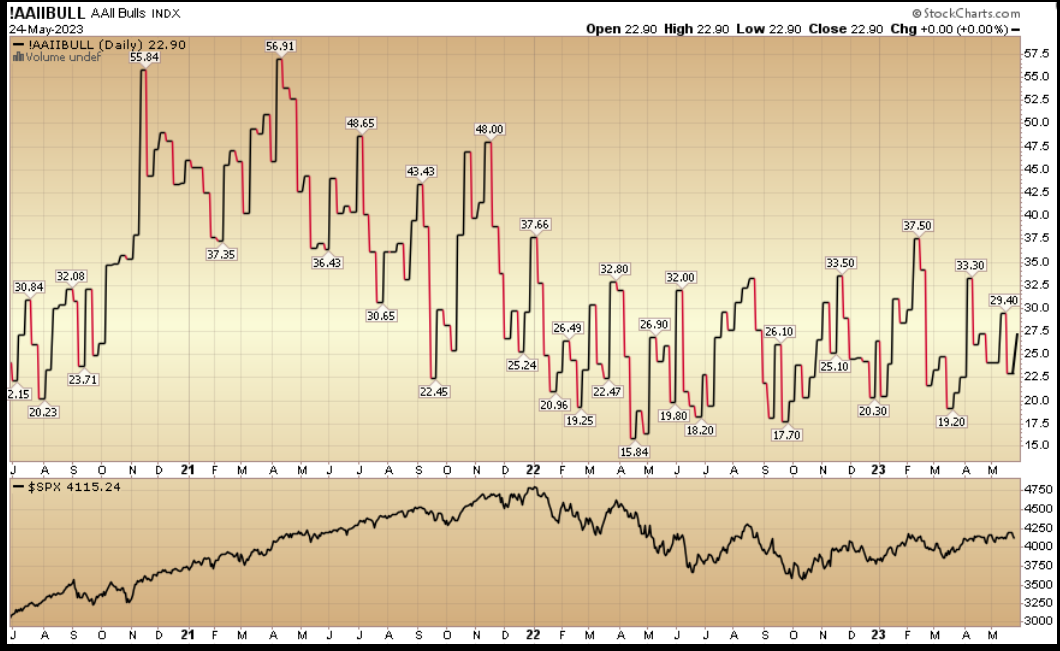

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) rose to 27.4% from 22.9% the previous week. Bearish Percent flat-lined to 39.7% from 39.7%. The retail investor is still fearful.

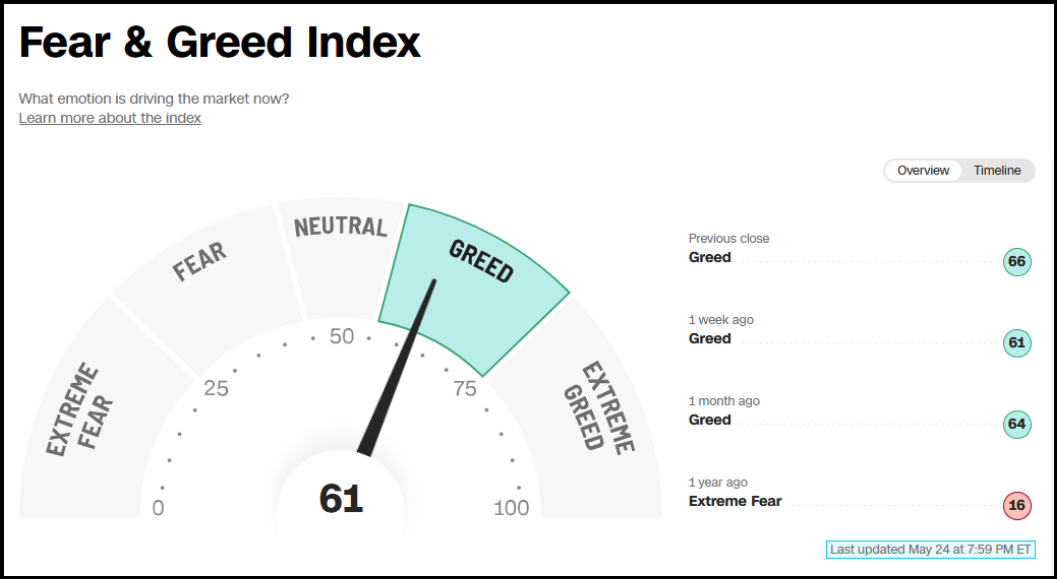

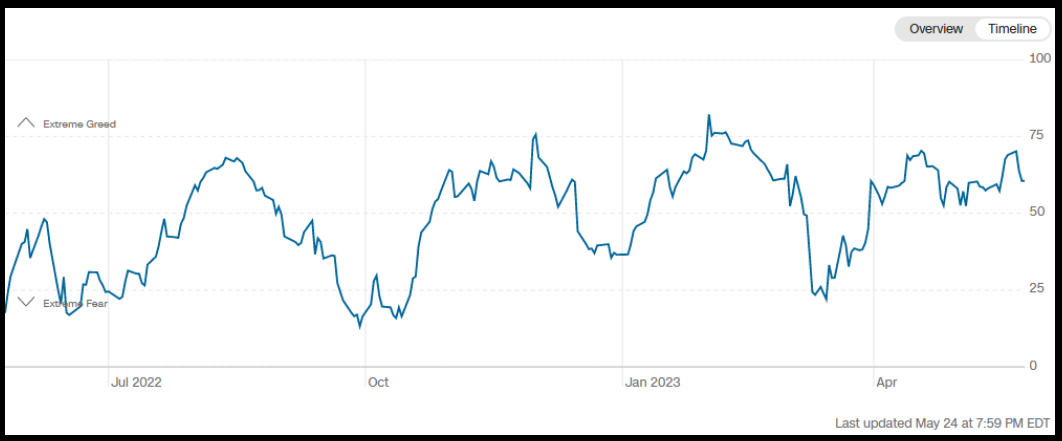

The CNN “Fear and Greed” flat-lined from 61 last week to 61 this week. Sentiment is moving up. You can learn how this indicator is calculated and how it works here: (Video Explanation)

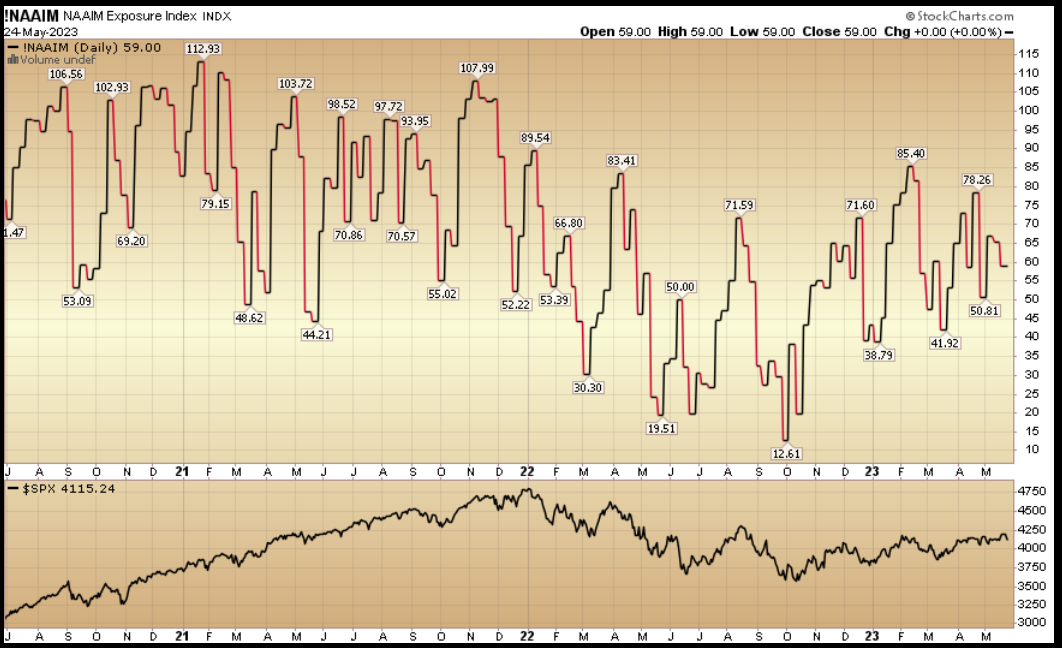

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked down to 59% this week from 65.22% equity exposure last week.

This content was originally published on Hedgefundtips.com.