Are you looking for a reliable tool that helps you make informed investment decisions and maximise your return? InvestingPro is the right choice for you! With a combination of advanced AI technology, extensive financial data and intuitive tools, InvestingPro provides everything investors need to successfully manage their investments.

But that's not all – thanks to the integration of our ProPicks AI, which balances six stock market strategies with over 100 individual stock shares per month, InvestingPro stands out clearly from other platforms. In this article, you will learn what InvestingPro has to offer and why it is the best choice for your investment strategy.

-

Note : The Cyber Monday Deal for InvestingPro is still on, but for less than 24 hours. This means that now is the perfect moment to secure the entire InvestingPro package with up to 60% discount. Access now and harness InvestingPro's full potential – everything you need for smart decisions and a strong investment strategy. Click here to go to the offer

Why InvestingPro?

InvestingPro is a user-friendly and powerful investment tool tailored to the needs of private and institutional investors. With extensive data, intuitive features and a wide range of functions, InvestingPro clearly stands out from the competition.

Here are some of the highlights:

1. AI-powered ProPicks : With our ProPicks, InvestingPro offers over 100 share recommendations per month based on six different AI-based strategies. These algorithms are programmed to identify stocks that can be characterized by strong potential and surpass the market.

2. Ad-free experience : No annoying distractions – you can fully concentrate on your analysis and investments.

3. In-depth business analysis : Over 1200 different company figures are available to you to analyse shares in detail. These range from fundamentals to specific financial forecasts.

4. Fair value calculator : Investors can determine the fair value of a share based on more than 14 different financial models and make informed purchasing or sales decisions.

5. Latest news : With InvestingPro you always stay up to date. Every day you get the latest information and market analyses so that you do not miss any important developments.

InvestingPro vs. InvestingPro+: Which plan is right for you?

InvestingPro offers two different subscription plans – the Pro version and the Pro+ version. Both versions offer a number of functions, but the Pro+ version expands them considerably.

InvestingPro – Ideal for getting started:

-

CYBER MONDAY SPECIAL : CAD $10.99/month for one year or CAD $8.49/month with a two-year contract.

-

AI-powered ProPicks : Benefit from six equity strategies to help you beat the market.

-

Fair Value Calculator: Evaluate shares with an intuitive tool.

-

ProTips : Get valuable and concise information about companies that help you identify opportunities and avoid risks.

-

Quality check : Quickly evaluate the financial health of a company using five key categories.

-

Comprehensive fundamental key figures : Over 100 metrics enable you to delve deep into the analysis of companies.

-

Peer Group comparison : Compare companies with their direct competitors to make the best investment decisions.

-

Pro News : Stay up to date and make informed decisions based on the latest information.

-

Access to the portfolios of top investors : Get insight into the portfolios of legendary investors such as Warren Buffett and George Soros, and see which shares are currently prefering to market sizes.

InvestingPro+ – The ultimate tool for professionals:

-

CYBER MONDAY SPECIAL : CAD $26.99/month for one year or CAD $21.49 euros/month with a two-year contract.

-

All features of the Pro version : Pro+ offers you all the features of the Pro version, including AI-supported ProPicks, ProTips, Fair Value calculator with over 14 model calculations, quality check and peer group comparison.

-

Professional Screener : Find the best stocks with advanced filtering options.

-

Extended financial data : 10 years of financial data as well as detailed forecasts and historical developments are available.

-

More than 1200 metrics : Detailed analysis tools to gain even deeper insights.

-

Customizable views : Customize the presentation of key figures to your individual needs.

-

Data export : Export data for your own analysis to Excel or Google (NASDAQ:GOOGL) sheets.

-

Special widgets : Dividend and earnings widgets enable targeted analysis.

-

Fundamental data in clear charts : Use the user-friendly charts to quickly visualize complex financial data and identify trends and opportunities at a glance.

ProPicks – The AI-based revolution for your investment strategy

With ProPicks, InvestingPro stands out clearly from other investment platforms. ProPicks is a powerful tool powered by our advanced artificial intelligence. This intelligent technology not only analyzes and evaluates equities based on simple key figures, but also takes into account a wealth of financial data and indicators that paint a complete picture of market dynamics and company performance. The combination of data and machine learning makes ProPicks an indispensable tool for all investors – from beginners to experienced professionals.

InvestingPro offers six stock market strategies based on our ProPicks AI. Each of these strategies has been developed to systematically beat the market and identify the best investment opportunities.

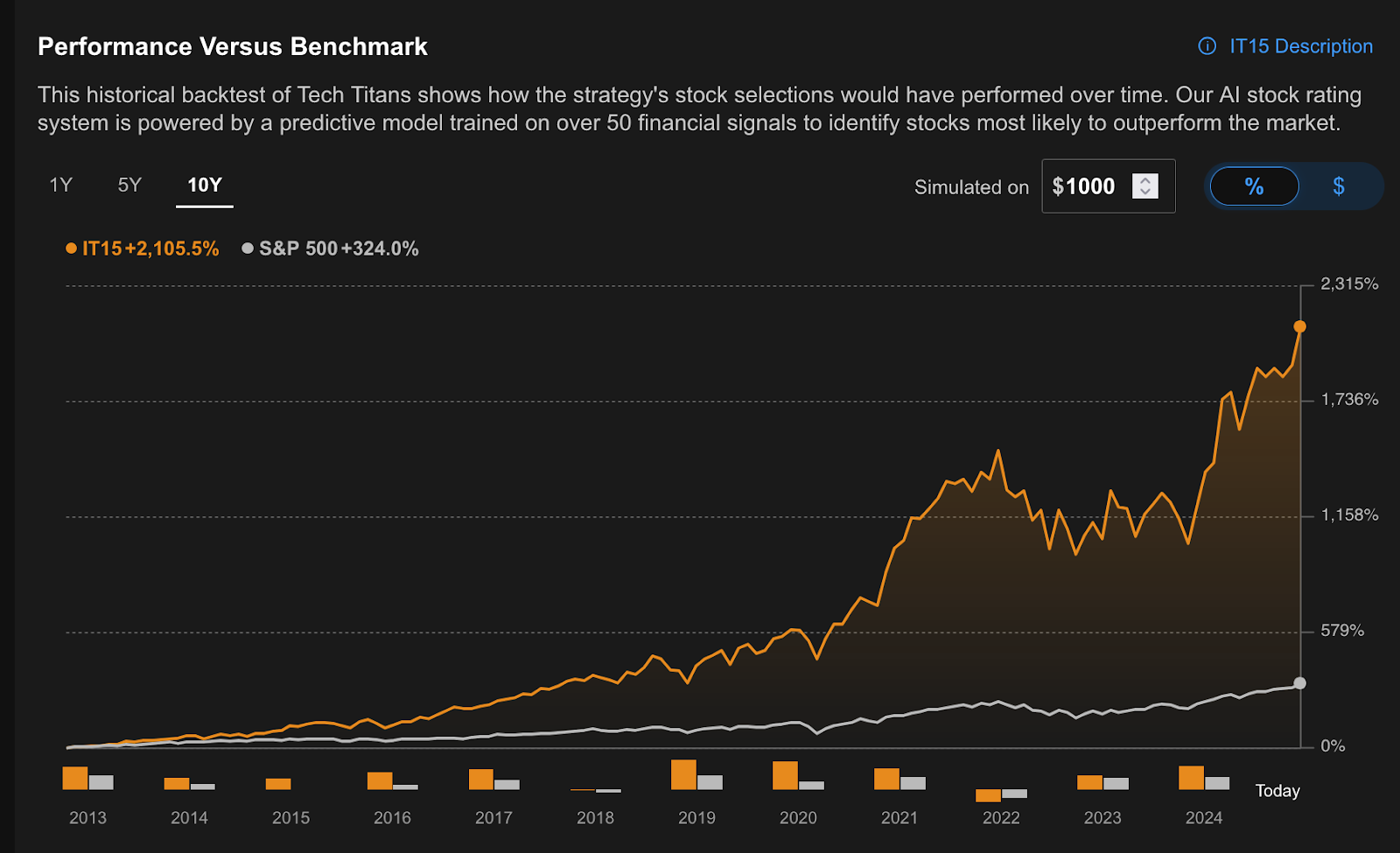

One of the most popular strategies is the "Tech Titants" portfolio, which focuses on promising technology stocks, and has generated an annualized return of 29.96%

In addition to this portfolio, there are five other strategies available, all of which are aimed at different market segments:

-

Beat the S&P 500: This strategy selects shares from the S&P 500 that stand out due to their relative strength and stable growth trend. The strategy delivers an annualized return of 23.4%.

-

Dominate the Dow : This strategy is aimed at investors who prefer companies from the Dow Jones Industrial Average and offers a solid selection of stocks with a positive market development. The annualized return is + 19.2%

-

Top Value Stocks : Value shares are identified here that are undervalued but have enormous upside potential. This strategy delivers an annualized return of 16.4%.

-

Mid Cap Movers : Focused on mid-cap stocks that are in the growth phase and can develop excellently. This strategy has achieved + 30.14 %.

-

Best of Buffett : This strategy is based on Warren Buffett's investment strategies, one of the most successful investors of all time. The annualized return on this portfolio is + 16.4%.

Each of these strategies provides a tailored opportunity to diversify your portfolio and rely on proven growth strategies.

How does ProPicks AI work?

The strength of ProPicks lies in the synergy between advanced technology and human expertise. AI analyses large amounts of historical financial data to identify trends, patterns and hidden opportunities that would be difficult for the human mind to grasp.

The process behind the ProPicks strategies can be summed up in five steps:

-

Data collection : AI is using over 25 years of financial data and more than 50 financial figures from thousands of companies. This raw data comes from trusted sources such as S&P Global and is continuously updated.

-

Data preparation : The collected data is structured and filtered using machine learning methods to avoid errors or distortions. Data preparation ensures that AI can access reliable and clean information.

-

Model Training : AI is trained with these data and learns how to evaluate equities based on performance, financial metrics, industry trends and other factors. This process takes place on the Google Vertex (NASDAQ:VRTX) AI platform, one of the most powerful AI platforms worldwide.

-

Data analysis : ProPicks analyzes the financial figures of each company and assigns a weighted valuation to these key figures. This ensures that the most important indicators are correctly included in the stock valuation.

-

Backtesting : To ensure the quality and reliability of the strategies, all ProPicks strategies are subjected to intensive backtesting. It examines how the strategies would have cut off under different market conditions in the past. This creates transparency and confidence in potential performance.

Rebalancing – Always up to date

Every month, the ProPicks strategies are reviewed and subjected to rebalancing. The individual share positions are adjusted according to the latest data and market conditions. This ensures that the strategies are always optimally positioned to achieve the best possible returns.

At the beginning of each month, a detailed article is published, which details all changes. You will learn exactly which stocks have been removed from the strategies and which have been added. In addition, you will receive an email with all the changes, so you can stay up to date and make informed decisions.

This means that you can rely on continuously updated recommendations that correspond to current market conditions and are based on sound analyses. ProPicks not only offers you precise, data-based recommendations, but also full transparency so that you always have your investment strategy in mind.

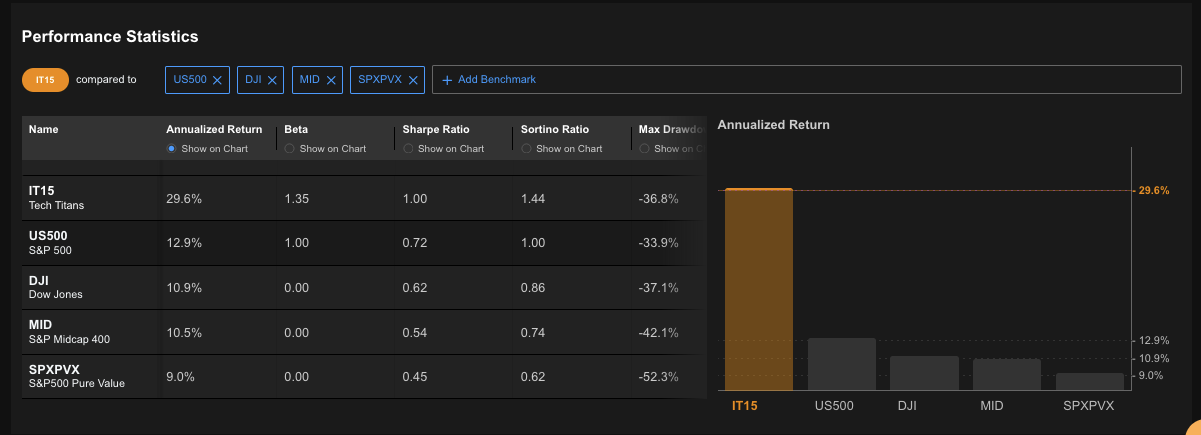

Risk Management: A central component

Each ProPicks strategy is examined not only for return potential, but also for risk. InvestingPro provides important risk indicators for this:

-

Beta : Specifies how much a strategy fluctuates compared to the overall market.

-

Sharpe Ratio : Shows the ratio of risk to return and allows you to evaluate strategies that seek a high return at low risk.

-

Sortino Ratio : A refined version of Sharpe Ratio that takes into account the risk of losses.

-

Maximum drawdown : Specifies how strongly a portfolio has fallen to the maximum in the past – an important indicator of risk management.

These metrics will help you make informed decisions and find the optimal balance between risk and return. ProPicks is not only about finding the best stocks, but also about managing them in a safe and sustainable way.

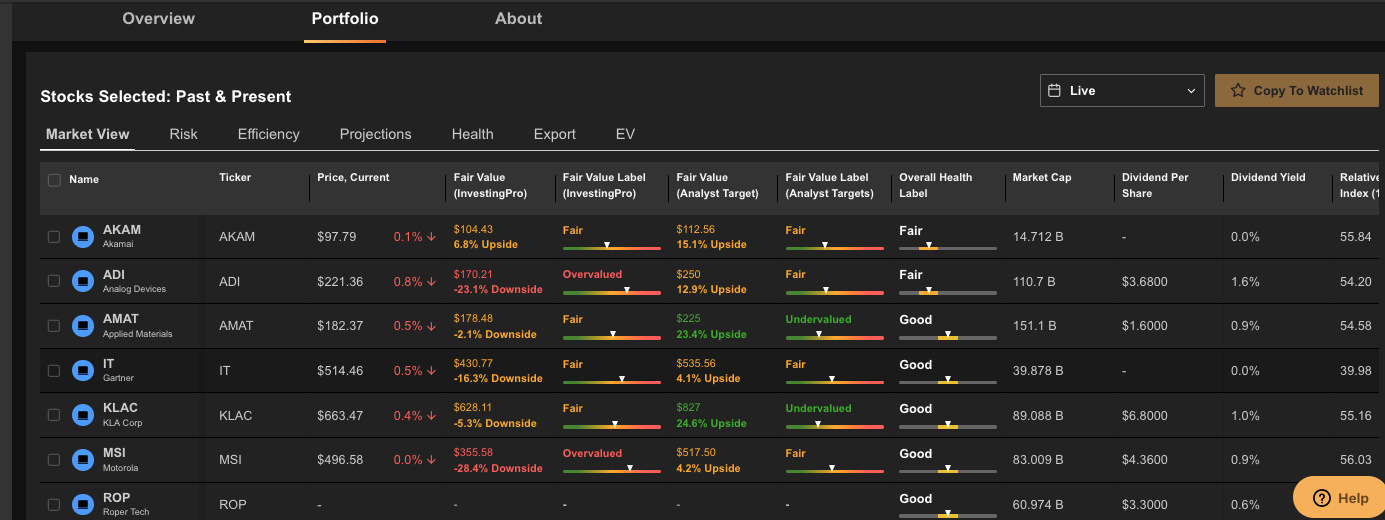

Transparent insights into the strategies

What makes ProPicks special is transparency. All individual investments of the strategies are open to the list, giving you full control and clarity about your investment decisions. You can analyze and track any company and share that is part of a ProPicks strategy in detail. This gives you the confidence to manage your investments in a targeted manner.

Fair value and balance sheet data – your toolbox for the perfect company valuation

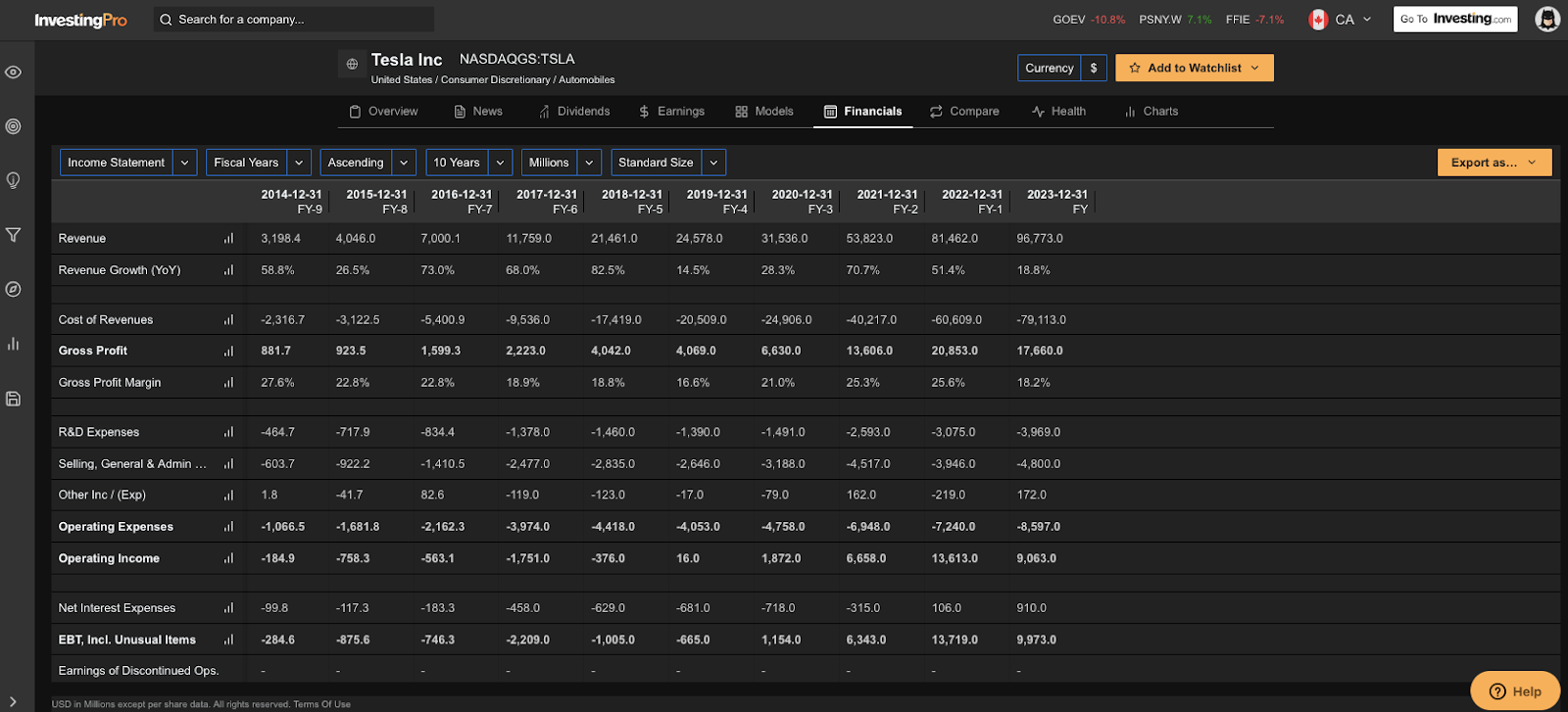

With InvestingPro, you have access to comprehensive and flexibly viewable balance sheet data of up to 10 years – whether quarter, fiscal year, half-year, TTM (Trailing Twelve Months) or since the beginning of the year. These include all important financial documents such as P&L, balance sheets and cash flow invoices.

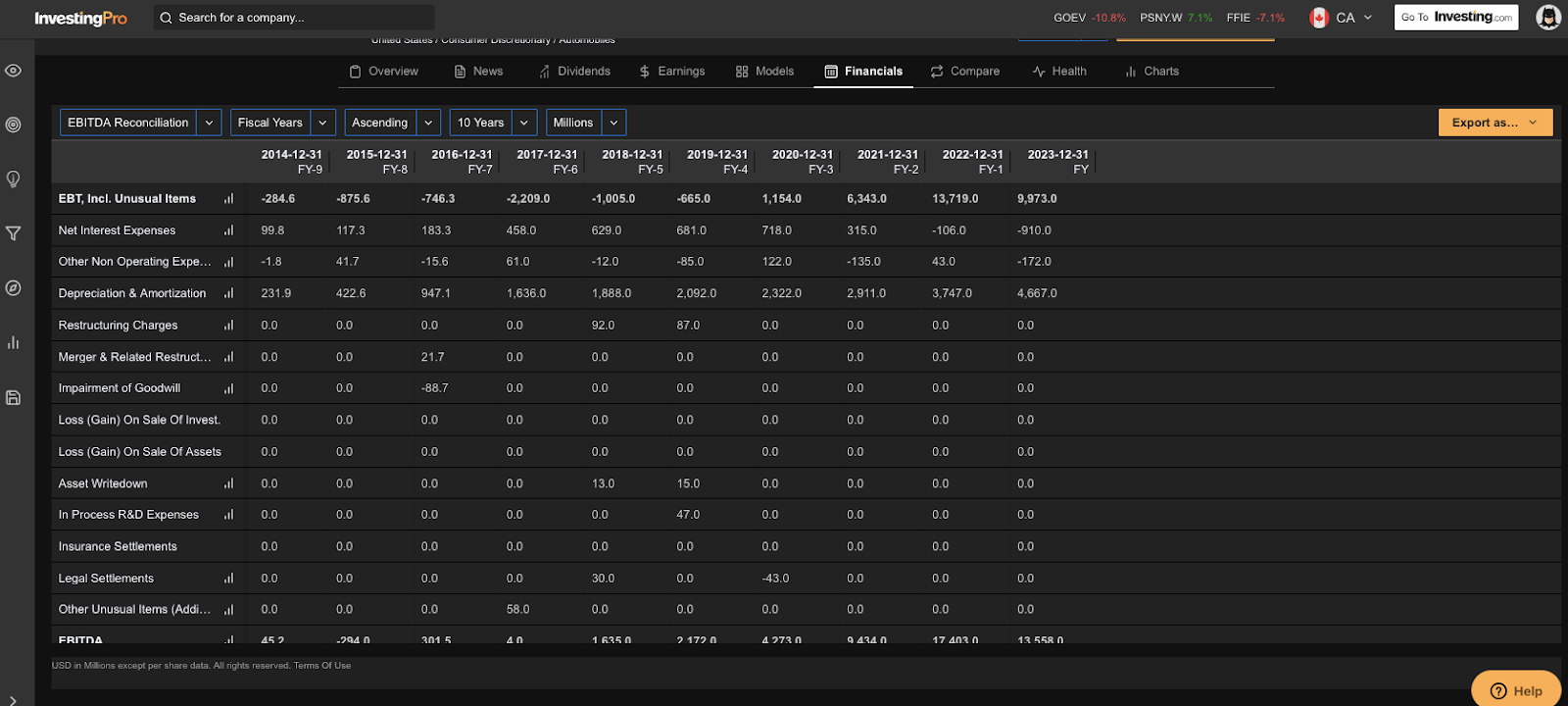

It is also particularly practical that you can see directly how the reconciliation to net earnings or EBITDA is composed. This way, you can immediately recognise which items have a great impact on company profits.

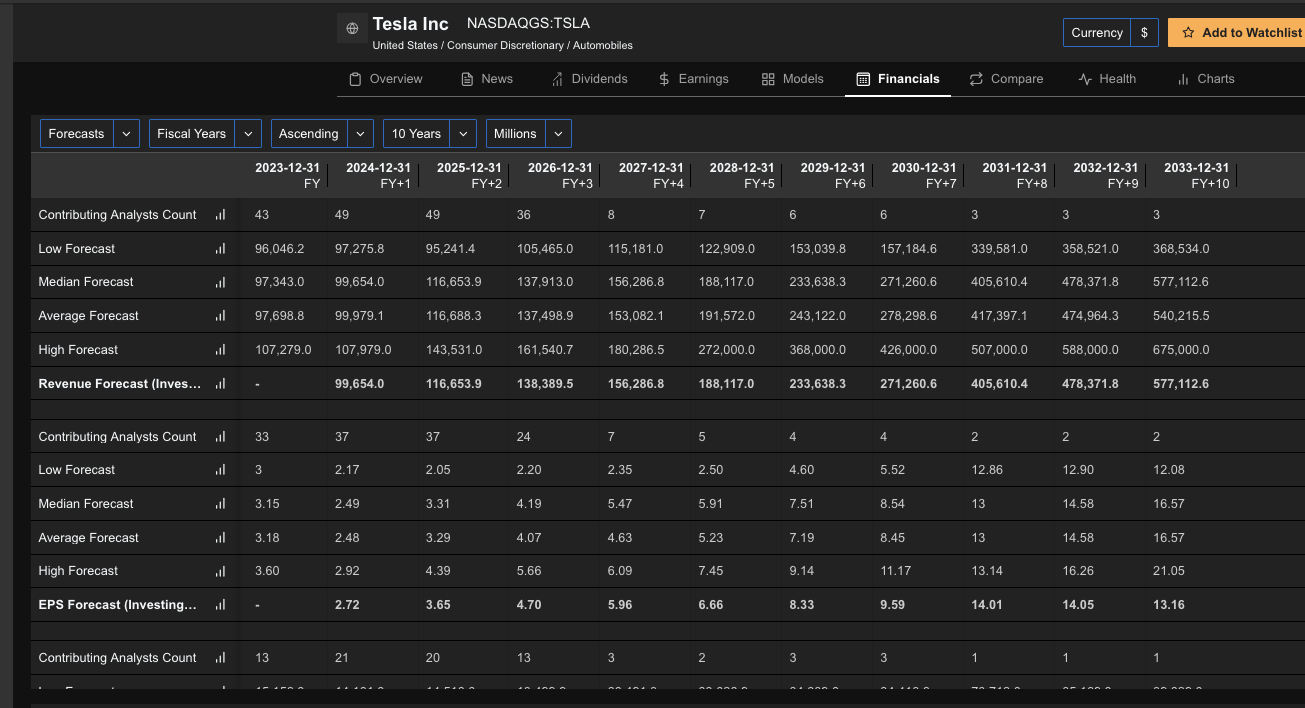

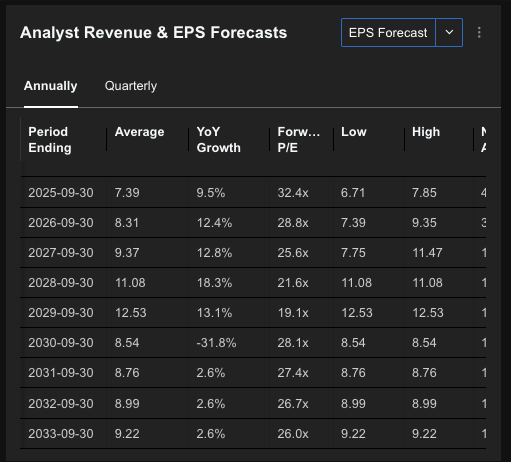

Even better: In the “Forecasts” section, you will find analysts’ assessments of the most important key figures such as revenue, EPS, EBIT, EBIT, investments or dividends. Why is it so relevant? Because you can take a look into the future. These forecasts will help you to understand how the professionals assess the company and where it could be headed in the coming years. Whether analysts expect growth or difficulties is an important decision-making basis.

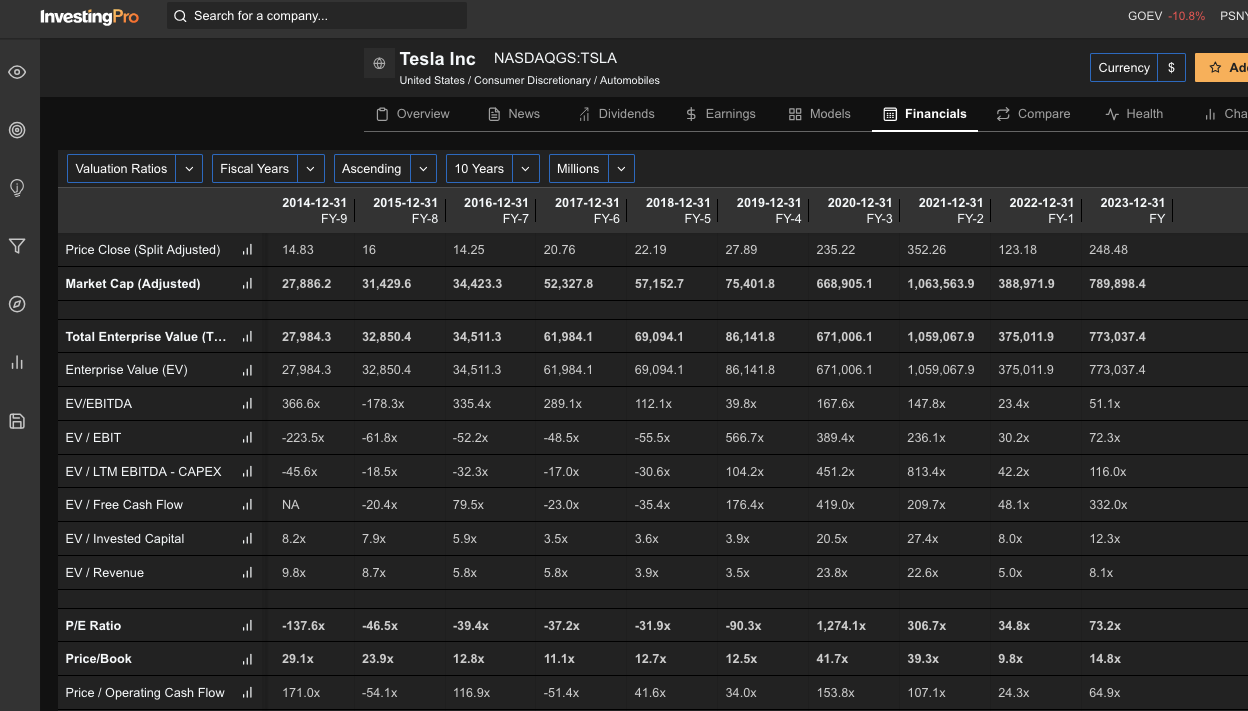

If you want to evaluate a stock, it will be particularly exciting under “Valuation Ratios”. Here you can combine the analyst estimates directly with multiples such as the KGV, EV/EBITDA or the KUV. This gives you a clear picture: Is the stock classified cheaply compared to its history or its competitors, or does it perhaps be too highly traded? These figures are worth if you want to find out if a stock is really worth their money – and whether it has the potential for the next market rocket.

Using the Fair Value Calculator, you can determine the intrinsic value of a company based on more than 14 models. This gives you a clear basis for your decisions and helps you to balance opportunities and risks.

If you have the impression that a particular model does not match the stock, you can simply remove it from the calculation – the fair value will then be adjusted automatically.

And for even more flexibility: All models and data can be exported to Excel or Google Sheets and adapted to your expectations – maximum flexibility for your individual strategy!

The Quality Check – A company's health in view

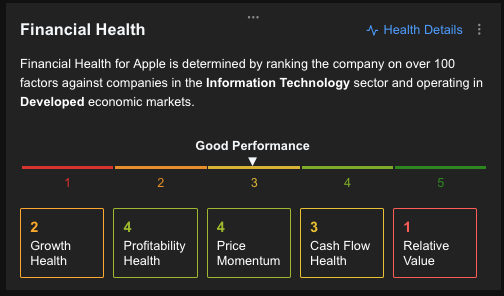

With the quality check, InvestingPro offers a simple but extremely effective method to assess the financial health of a company. The analysis is based on five key categories:

-

Profitability : How well can a company increase profits?

-

Relative value : What is the company's position compared to competitors and the market as a whole?

-

Growth : Does the company continuously record increasing sales and profits?

-

Momentum : What is the current price performance of the company?

-

Cash flow : How well does the company cash equivalent?

Each category is evaluated on a scale of 1 to 5, which allows you to assess quickly and reliably. On this basis, you can optimize your further investments in a targeted manner.

Each category is evaluated on a scale of 1 to 5, which allows you to assess quickly and reliably. On this basis, you can optimize your further investments in a targeted manner.

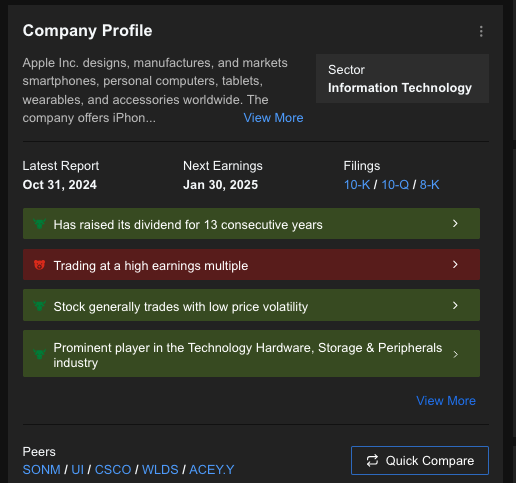

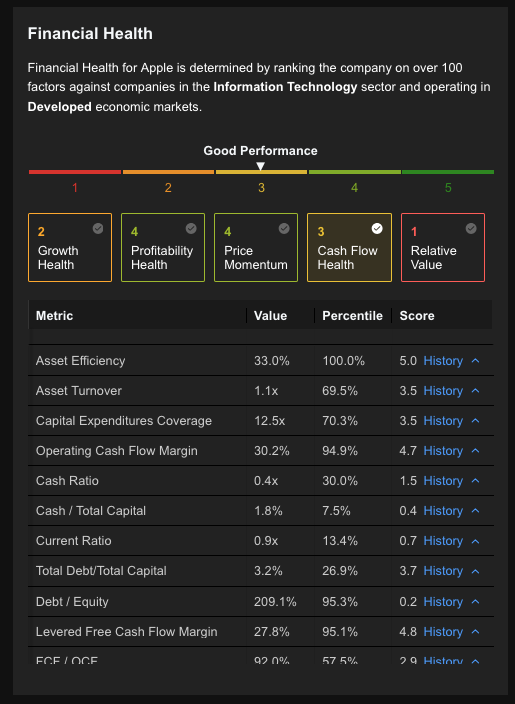

Would you like to delve deeper into the details? No problem! With just one click on the category of your choice - for example "cash flow" - you get a complete overview of the underlying metrics. For example, with Apple (NASDAQ:AAPL) you can see why the cash flow is currently rated 3. Each relevant metric is clearly listed, including its exact weighting within the score. This way you can understand at a glance which factors influence the score - and where potential or risks might lie. Maximum transparency so that you can make your decisions with complete clarity!

ProTips – Short, concise and valuable

With ProTips, InvestingPro offers another handy tool that helps you quickly grasp important company data. The tips not only offer advantages, but also point out potential risks so that you always have a complete picture of a company. This allows you to quickly identify which stocks could strengthen your portfolio.

Peer Group Comparison – Understanding Companies in Context

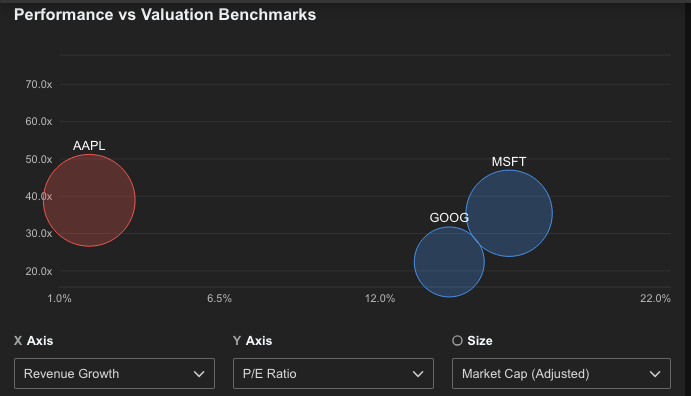

InvestingPro's Peer Group Comparison allows you to directly compare a company's performance with its competitors or other companies in the same industry. This tool allows you to perform in-depth analysis by placing relevant metrics and financial data of companies side by side, allowing you to make informed decisions about which company is performing best in a particular sector.

What you can do with the peer group comparison:

-

Key metrics comparison : Analyze key financial metrics such as revenue, profit, debt and valuation in direct comparison with a company's competitors.

-

Relative Valuation : Determine whether a company is overvalued or undervalued compared to its peer group. You can quickly see which stocks are currently attractively valued.

-

Industry Overview : Understand how a company compares to other players in its industry, whether in terms of growth, profitability or efficiency.

-

Performance Tracking : Compare a company's historical share price performance with that of its competitors to see who is ahead in the long term.

-

Strategic decisions : Use the peer group comparison to find out which companies offer the best long-term prospects and which stocks you should invest in.

Estimates, reactions, trends: understanding quarterly figures

The "Earnings" tab gives you everything you need to take a closer look at a company's performance. What's particularly useful is that you can see at a glance whether analysts have revised their sales and profit expectations upwards or downwards in the last 90 days.

Why is this important? If estimates are rising steadily, it could be a sign that the company is surprising to the upside and that further growth is ahead. Conversely, if there are negative revisions, you should take a closer look - there may be challenges that could also affect the share price.

A real highlight is the "price reaction after the quarterly figures" . Here you can see how the market has reacted to the results in the past - whether the share price really went through the roof after good figures or whether weak results caused price losses. This helps you to better estimate how much the next quarterly figures could affect the price - a valuable advantage if you want to align your strategy with such events.

The analyst estimates for coming periods are also a real added value. At a glance, you can see not only the forecasts for the next quarters or years, but also valuation metrics such as the expected P/E ratio (price-earnings ratio) or the expected P/S ratio (price-sales ratio). This information makes it easy to find out whether a company is attractively valued or perhaps even underestimated. This gives you all the tools you need to make the best decisions in the long term - well-founded and strategic.

Simple subscriptions for flexible investing

InvestingPro offers a clear and simple pricing structure, and now you can save even more thanks to our Cyber Monday special! Choose between an annual or two-year subscription and benefit from up to 60% off - the longer the term, the greater the benefit. Perfect for new customers and existing users who want to extend their subscription.

*Prices only during Cyber Monday and for new customers

Conclusion: InvestingPro – your partner for smarter investing

InvestingPro is much more than just a simple investment tool. With its AI-powered strategies, comprehensive financial data and intuitive tools, it offers everything investors need to invest successfully. Whether you are just starting out or are an experienced investor, with InvestingPro and ProPicks you are well equipped to beat the market. Go Pro now !