Investing.com - Here are the top five things you need to know in financial markets on Friday, May 4:

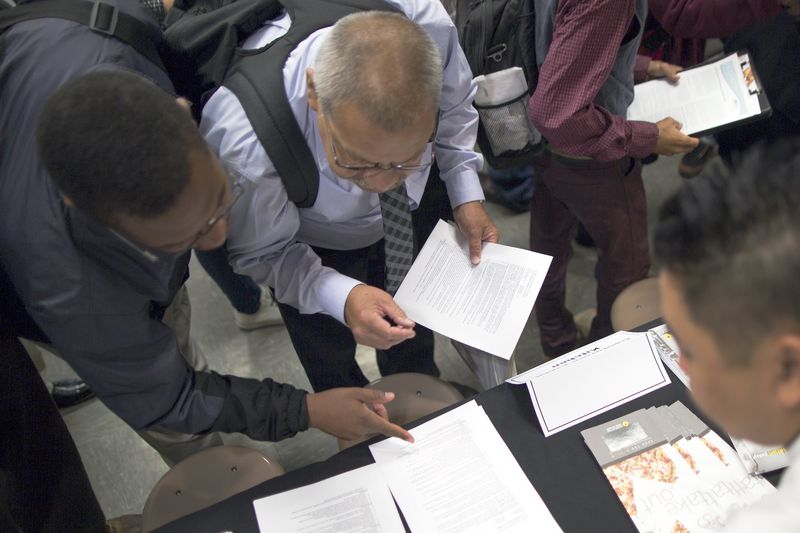

1. Jobs report to reveal wage growth

Market participants are waiting for the publication of the monthly jobs report at 8:30AM ET (12:30GMT).

The consensus forecast is that the data will show jobs growth of 189,000, after adding 103,000 positions in March, while the unemployment rate is forecast to dip to 4.0% from 4.1%.

However, most of the focus will likely be on average hourly earnings figures, which are expected to rise 0.2%, following a gain of 0.3% a month earlier. On an annualized basis, wages are forecast to increase 2.7%, the same as the rise seen in March.

Steady wage growth would add to signs of building inflation pressures and likely keep the Federal Reserve on a gradual path of monetary policy tightening.

Markets are currently pricing in the next hike to come in June with the following increase to arrive in September. Odds for a third hike by the end of the year hover around 43%.

2. U.S.-China trade talks end with no agreement

As widely expected, the two-days of trade talks between China and the U.S. ended on Friday with no breakthrough agreement.

China’s official Xinhua News Agency reported Friday that both sides reached a consensus on some trade issues, without providing details. They also acknowledged major disagreements on some matters and will continue communicating to work toward making more progress.

U.S. Treasury Secretary Steven Mnuchin told reporters in Beijing that “we are having very good conversations” with Chinese counterparts.

Markets have been keeping an eye on discussions in the hopes that a full-scale trade war can be avoided.

Trump has threatened to impose tariffs on as much as $150 billion of Chinese goods to punish China over its intellectual property practices if the talks fail to yield progress, a move that China said would spark retaliation in equal measure on American exports.

3. U.S. stocks point to lower open ahead of NFP

Despite the Dow making a comeback in Thursday’s session, erasing a nearly 400 point loss to close slightly higher, U.S. futures pointed to a lower open on Friday as markets await the publication of nonfarm payrolls. Earnings will also be on the radar with Alibaba (NYSE:BABA) being the focus as it reports ahead of the opening bell.

At 5:44AM ET (9:44GMT), the blue-chip Dow futures fell 44 points, or 0.18%, S&P 500 futures lost 5 points, or 0.18%, while the Nasdaq 100 futures traded down 17 points, or 0.26%.

Elsewhere, European stocks traded mostly higher on the back of positive earnings reports, though weak reports from the banking sector capped gains.

Earlier, Asian stocks closed lower ahead of the latest reading on the U.S. labor market. Trading was lighter than normal as Japan’s stock market was closed for a holiday.

4. Oil prices head lower ahead of data on U.S. output

Oil prices moved lower on Friday amid ongoing concerns over possible Iran sanctions and increasing U.S. crude production.

U.S. crude oil futures fell 0.18% to $68.31 at 5:45AM ET (9:45GMT), while Brent oil traded down 0.19% to $73.48.

Iran’s foreign minister said on Thursday that U.S. demands to change its 2015 nuclear agreement with world powers were unacceptable.

Investors are worried about oil supplies after Iran took a tough stance in its response to the U.S., as a deadline set by President Donald Trump for European powers to “fix” the deal loomed.

Trump will decide by May 12 whether to re-impose sanctions on Tehran, which would likely result in a reduction of its oil exports and tighten global supplies. Iran is OPEC’s third-largest producer.

The weekly installment of drilling activity from Baker Hughes on Friday will provide investors with fresh insight into U.S. oil production and demand after data last week showed the number of U.S. oil rigs rose for the fourth week in a row.

Market participants remain concerned that rising U.S. shale output could offset OPEC-led attempts to curb production in order to reduce the global supply glut.

5. Buffett boosts stake in Apple

Warren Buffett’s Berkshire Hathaway (NYSE:BRKa) bought 75 million shares of Apple (NASDAQ:AAPL) in the first quarter, pushing its holdings in the iPhone maker to 240.3 million shares worth $42.5 billion.

“If you look at Apple, I think it earns almost twice as much as the second most profitable company in the United States,” CNBC quoted Buffett as saying.

Berkshire typically discloses its largest common stock holdings and percentage stakes in its quarterly and annual reports. The report for the first quarter is scheduled for release on Saturday morning, just before Berkshire's annual shareholder meeting in its Omaha, Nebraska, hometown.