By Alwyn Scott and Scott Murdoch

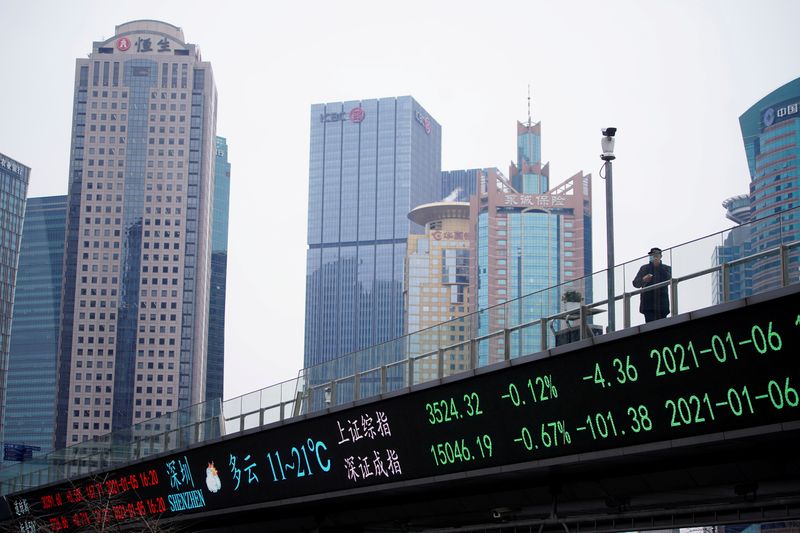

NEW YORK (Reuters) - Asian shares were mixed early Tuesday as global investors shook off worries about a hedge fund default that roiled global banking stocks overnight, while rekindled concerns about inflation pushed bond yields higher.

Wall Street pared earlier losses driven by the banking sector on fears that issues with a defaulting hedge fund could spread throughout the banking sector.

In Asia, the MSCI's broadest index of Asia-Pacific shares outside Japan was marginally higher by 0.08% in early in the session Tuesday.

Hong Kong's Hang Seng Index was up 0.36% to 28,440 but in Australia a weaker tone emerged when the S&P/ASX200 slid 0.4% to its lowest point for a week.

Mainland China's CSI300 index is 0.18% higher in early trade while Japan's Nikkei is off 0.1%.

Nomura and Credit Suisse (SIX:CSGN) are facing billions of dollars in losses and regulatory scrutiny after a U.S. investment firm, named by sources as Archegos Capital, defaulted on equity derivative bets, putting investors on edge about who else might be exposed.

Nomura shares were down a further 2.49% Tuesday after dropping by as much as 16% on Monday when it revealed it could take a $2 billion loss from the hedge fund fallout.

Michael McCarthy, chief markets strategist at CMC Markets said the worries "are very specific to a small number of hedge funds." He said he did not expect any systemic fallout.

Still, the dollar gained on safe-haven buying, while bond prices came under pressure as the outlook for economic growth raised the specter of inflation, he added.

Citigroup (NYSE:C) equity derivative solutions director Elizabeth Tian said investor sentiment was still closely tied to the pace of the global vaccine rollout.

"Investors will also be watching the number of COVID cases as rises in Western Europe and the Philippines sees the return of renewed restrictions while vaccination attempts threaten to stall amidst supply constraints and vaccine nationalism," Tian said.

"While restrictions are increased in Europe, the UK will be relaxing stay at home rules," she added.

During the Asian session, benchmark 10-year yields hit 1.7321%, up 1.4 basis points, after earlier trading marginally higher in the U.S. after the state of New York on Monday announced people aged 30 and older could get coronavirus vaccinations starting March 30.

Crude prices inched up on a report that Russia would back broadly stable oil output when the Organization of the Petroleum Exporting Countries and allies meet this week.

On Wall Street, the Dow Jones Industrial Average rose 0.3%, the S&P 500 lost 0.09% and the Nasdaq Composite dropped 0.6%.