By Matt Scuffham

NEW YORK (Reuters) - U.S. government borrowing costs advanced for a sixth week on Monday, hurting tech stocks as investors bet on rising interest rates, while three-year high oil prices ignited the energy sector.

An easing in Sino-U.S. tensions and Chinese authorities' decision to pump in more cash to offset the fallout from real estate firm Evergrande's woes offered encouragement to investors. There was also relief that Germany's election outcome ruled out a pure left-wing coalition government.

U.S. indices were mixed, with the industrials-heavy Dow Jones index outperforming the Nasdaq index of tech stocks.

"Technology stocks are higher valuation, meaning you're paying for future growth, and higher interest rates are a brake on future growth," said Tim Ghriskey, chief investment strategist at Inverness Counsel in New York. "When yields rise, tech shares tend to underperform."

The Dow Jones Industrial Average rose 71.37 points, or 0.21%, to 34,869.37, the S&P 500 lost 12.37 points, or 0.28%, to 4,443.11 and the Nasdaq Composite dropped 77.73 points, or 0.52%, to 14,969.97.

Europe's STOXX 600 index ended lower as declines in tech stocks offset gains in banks and energy, while German shares hit 10-day highs.

Germany's blue-chip DAX rose 0.3%, leading gains among regional indexes, while the pan-European STOXX 600 index fell 0.2%.

The oil price surge is stoking speculation that global inflation will prove longer-lasting than anticipated, forcing central banks to act and benefiting so-called reflation investments, which rise in tandem with rates.

"All in all, it's a positive story as we have a strong economic macro story underpinning everything," said Fahad Kamal, CIO at Kleinwort Hambros in London.

Kamal noted that optimism was reflected in central banks signaling their intent to remove pandemic-era stimulus gradually, which in turn was lifting bond yields.

Oil futures have climbed around $9 a barrel over September.

U.S. crude futures settled up 2% at $75.45 per barrel. Brent crude futures settled at $79.53 per barrel, up 1.8%.

Coming on top of this year's 300% surge in European gas prices, the price rises risk further inflaming inflation expectations and hastening the end of super-cheap money.

Graphic: European Gas Prices 2021 - https://graphics.reuters.com/EUROPE-GAS/dwpkrdjljvm/chart.png

Goldman Sachs (NYSE:GS) forecast Brent to hit $90 per barrel by year-end, noting "the current global oil supply-demand deficit is larger than we expected, with the recovery in global demand from the Delta impact even faster than our above-consensus forecast."

Investors are, therefore, repositioning portfolios.

On Monday, U.S 10-year Treasury yields continued their recent march, hitting 1.5% for the first time since June on solid economic data and signals the Federal Reserve is shifting toward a more hawkish policy.

The 10-year Treasury yield rose as high as 1.516% in morning trading, its first time above 1.5% since June 29, before falling back as the higher rate drew in buyers.

Benchmark 10-year notes last fell 8/32 in price to yield 1.4889%, from 1.461% late on Friday.

The rise in U.S. yields, especially on an inflation-adjusted basis, is also lifting the dollar. The dollar index rose 0.146%, with the euro down 0.15% to $1.1697.

Gold prices steadied with gains curbed by the stronger dollar and Treasury yields.

U.S. gold futures settled mostly unchanged at $1,752.

Worries persisted about China.

A power supply crunch that is triggering an industrial contraction and pressuring the economic outlook is adding to concerns stemming from property firm Evergrande, which missed a bond coupon payment last week and faces another in coming days.

Hong Kong-listed shares in Evergrande's electric car unit plunged as much as 26% after it warned it urgently needed a swift injection of cash.

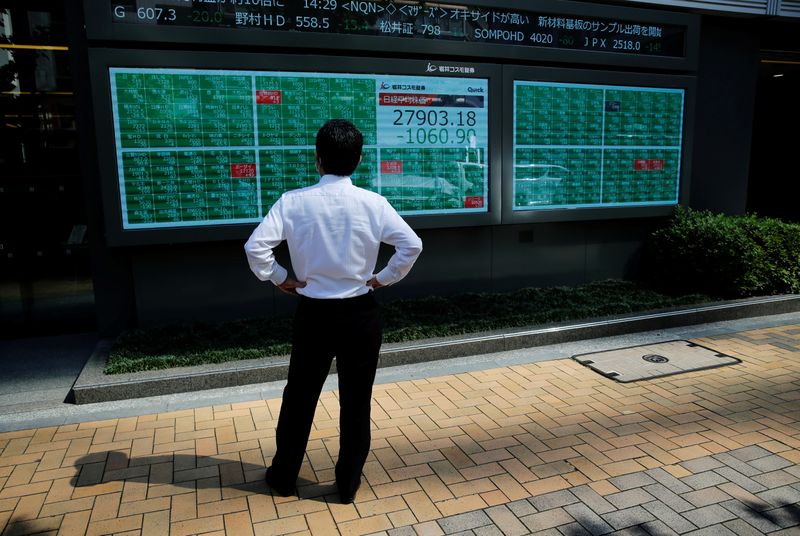

Still, Chinese blue chip shares gained 0.5%, thanks to another cash injection from the central bank and hopes the release of Huawei executive Meng Wanzhou would reset ties with the West.