By Herbert Lash

NEW YORK (Reuters) - Bonds sold off and global equity markets failed to fully shake off New Year blues on Thursday after U.S. unemployment data indicated a resilient labor market, tempering expectations of Federal Reserve interest rate cuts in 2024.

The yield on 10-year Treasuries jumped above 4% in a sharp reversal from last week, when the benchmark note slid to a five-month low of 3.783% on recent data showing inflation by some measures had declined close to the Fed's 2% target.

The focus has turned to the U.S. central bank's efforts to steer the economy to a soft landing.

"The real federal funds rate doesn't need to be as high and as restrictive as it currently is. But the Fed will need more evidence of inflation progress to get those cuts," said Roosevelt Bowman, senior investment strategist at Bernstein Private Wealth Management in New York.

"So that's where we would say, 'You know what? The market is probably a little bit ahead of itself here in terms of the number of cuts and the need to cut.'"

Major equity indexes in Europe closed higher, with the pan-regional STOXX 600 index up 0.69%, helping MSCI's gauge of stocks across the globe to tread higher for most of the session.

Wall Street closed mixed, with the Dow eking out a gain as the Nasdaq and the S&P 500 dived, to pull MSCI's global index close down 0.03%.

The number of Americans filing new claims for unemployment benefits fell more than expected last week, data showed. Separately, the ADP (NASDAQ:ADP) National Employment Report showed U.S. private employers hired more workers than expected in December.

"The combination of better-than-expected ADP and lower-than-expected-jobless claims was enough to inspire a little bit of selling pressure on Treasuries," said Ben Jeffery, a U.S. rates strategist at BMO (TSX:BMO) Capital Markets in New York.

The reports "definitely moderate the odds of a near-term rate cut from the Fed just given the fact that the job market remains in a relatively good place," he said.

The yield on 10-year Treasuries rose 9.2 basis points to 4.00%.

Minutes from the U.S. central bank's December policy meeting offered few clues on when the Fed might start cutting rates. Traders see a 66.4% chance for at least a 25-basis point (bps) rate cut in March and about a 92% probability in May, according to the CME Group's (NASDAQ:CME) FedWatch.

Fed policymakers have indicated they expect three rate cuts this year. Futures traders have trimmed the total estimated reduction by December to just over 137 bps from expectations of more than 160 bps late last year.

On Wall Street, the Dow Jones Industrial Average rose 0.03%, the S&P 500 lost 0.34% and the Nasdaq Composite dropped 0.56%.

Data in Europe was encouraging. Both German and French inflation surveys showed prices moving up again, bolstering forecasts that euro zone-wide inflation rose back to 3% last month.

European bond yields reversed early declines and the euro rose further versus the dollar, putting it up 0.25% to $1.0948. The dollar index edged down 0.01%.

Against the Japanese yen, the greenback rose to a two-week peak of 144.87 yen a day after jumping nearly 1%.

HCOB's Composite Purchasing Managers' Index (PMI), a survey-based gauge of the euro zone's economic health, was revised up for December to match November's 47.6 after an earlier estimate of 47. It was still below the 50 mark separating growth from contraction.

The German 10-year yield, the euro zone benchmark, was last up 2.2 basis points (bps) at 2.127% having hit a one-year low of 1.896% last week. France's yield inched up as well, to 2.677%.

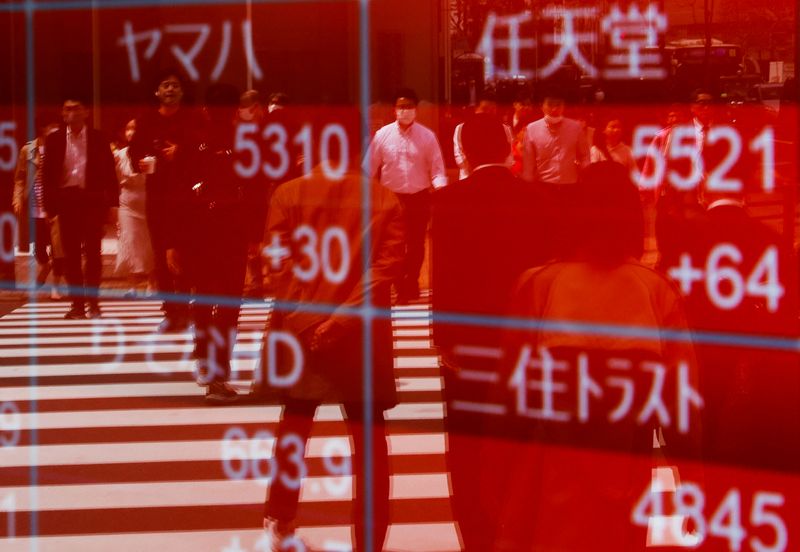

Asian shares closed slightly lower, as did Japan's Nikkei on its first trading day of the year.

Oil settled lower in a choppy see-saw session, as massive weekly gasoline and distillate stock builds overshadowed a larger-than-expected crude stock draw.

Brent crude settled down 66 cents to $77.59. During the session it both rose and fell over $1. U.S. West Texas Intermediate crude futures fell 51 cents to settle at$72.19.

Gold held steady after four sessions of declines as investors braced for the U.S. non-farm payrolls data.

U.S. gold futures settled up 0.4% at $2,050.00 an ounce.