Investing.com - After a tumultuous year for the biotech sector, BofA Securities sees early positive signs for 2023, outlining a number of biotech stocks in new research that could see strong gains in the coming year on the back of positive trial data and a gradual return of investor risk appetite.

"We see 2023 as a year of rebuilding for the sector, with continued positive clinical study readouts and large M&A underscoring sustained innovation still needed to grow share momentum over the next 12-18 months," Alec Stranahan, research analyst at BofA Securities, said in a note Thursday. "On the deal front, we expect this also to pick up (but likely weighted towards 2H23/1H24e)."

A nerve-wracking stock market year for the overall market is slowly coming to an end. It was characterized above all by the central banks, which felt compelled to aggressively raise interest rates due to galloping inflation and thus pushed the valuations of many companies that were not yet profitable down into the basement.

The NASDAQ Biotechnology Index, the most important price barometer for biotech stocks, was already on a downward trend heading into 2022, reaching its low for the year of 3,323 points in June. Thereafter, a significant recovery set in, taking the index back above the 4,000-point mark and most recently up to 4,418 points. Since the beginning of the year, the index is down 9.2%. The biotech index has thus held up better than the broader NASDAQ Composite, which fell by 31% in the same period.

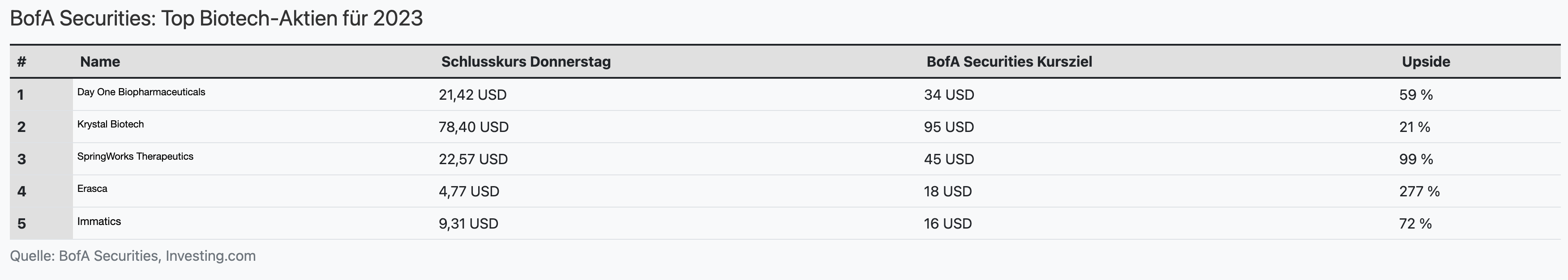

The following table provides a stock list of 5 biotech stocks for 2023, with BofA Securities calling the first three stocks "top picks" for the new year and the last two so-called "dark horses." The latter are stocks that still fly under the radar of many investors, but could provide positive surprises in 2023. Nonetheless, they also carry higher risk.

Stranahan calls Day One Biopharmaceuticals (NASDAQ:DAWN) his top pick for the new year. BofA Securities expects the U.S.-based biotech to continue its positive momentum in 2023, reporting topline results for its novel drug called tovorafenib (DAY101) in the first quarter of 2023. If the results are positive, the company is expected to submit a New Drug Application (NDA) to the U.S. Food and Drug Administration (FDA) in the first half of 2023.

Based on current share price levels, analysts estimate the stock could climb 59% to $34. "We see shares currently undervalued given interim readout adding a stroke of confidence with most expecting a positive topline, and robust clinical evidence supporting approval," the note said.

Also making the list are shares of Krystal Biotech (NASDAQ:KRYS) and SpringWorks Therapeutics (NASDAQ:SWTX), which carry potential returns of 21% and 99%, respectively, according to BofA Securities' price targets. While shares of Krystal Biotech have clearly outperformed the overall market this year, gaining 12%, those of SpringWorks Therapeutics have lost 63% of their value.

In September, Krystal Biotech's gene therapy Vyjuvek for the treatment of dystrophic epidermolysis bullosa (DEB) received ''priority review'' status from the FDA. BofA Securities expects the U.S. Food and Drug Administration to make a decision on the related marketing authorization application no later than Feb. 17. Approval is likely, the analysts said. They were also positive about the wrinkle treatment KB301, which is expected to enter Phase 2 trials in 2023.

BofA Securities considers shares of Erasca (NASDAQ:ERAS) and Immatics (NASDAQ:IMTX) to be "dark horses." The experts gave the former a price target of $18, which would represent a potential upside of 277% based on the current share price. "Erasca has in our view one of the most underappreciated pipelines in precision oncology," the report said.

Immatics, which focuses on the development and manufacture of T-cell immunotherapies for the treatment of cancer, is seen as having a potential return of 72% to $16. The company's product candidate IMA201, which targets solid tumors, accounts for $8 of that return. BofA Securities experts attribute $3 to the product candidate IMA203, which also targets tumors that carry the antigen PRAME on their surface.