* Turkish lira hits new lows, govt promises it has a plan

* Selling spreads to South African rand, Argentine peso

* Euro slips as safe haven yen, Swiss franc, dollar bid

* Asian stocks fall further, emerging markets under pressure

By Wayne Cole

SYDNEY, Aug 13 (Reuters) - Asia share markets skidded and the euro hit one-year lows on Monday as a renewed rout in the Turkish lira infected the South African rand and drove demand for safe harbours, including the U.S. dollar, Swiss franc and yen.

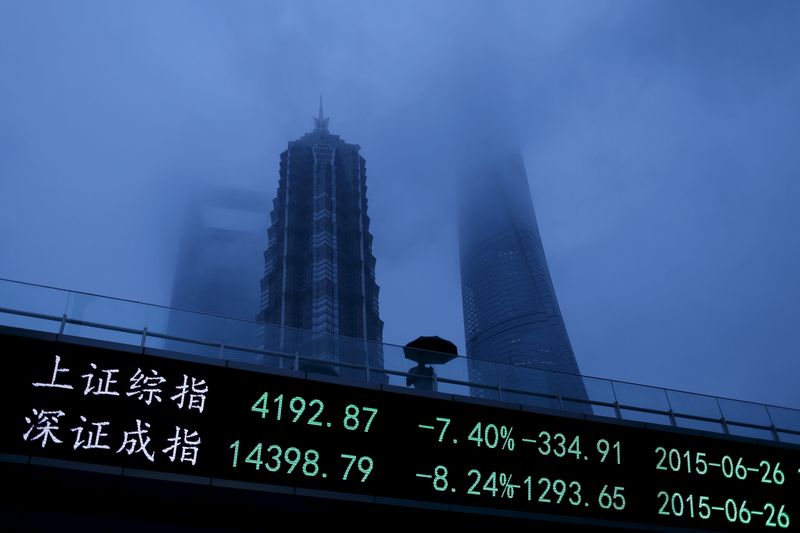

The run from risk dragged MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS down 1.3 percent to a five-week low. Japan's Nikkei .N225 lost 1.6 percent with every bourse in the region in the red.

EMini futures for the S&P 500 ESc1 were off 0.4 percent, while 10-year Treasury yields dipped further to 2.85 percent US10YT=RR .

China's blue chip index .CSI300 shed 1.4 percent, while Hong Kong stocks .HSI lost 1.6 percent as the local dollar fell to the limits of its trading band.

Much of the early action was in currencies with the euro gapping lower as the Turkish lira TRYTOM=D3 took another slide to all-time lows around 7.2400.

The lira found just a sliver of support when Turkish Finance Minister Berat Albayrak said the country had drafted an action plan to ease investor concerns and the banking watchdog said it limited swap transactions. the dollar was still up almost 10 percent on the day at 7.0000 lira. This time last month it was at 4.8450.

The currency tumbled on worries over Turkish President Tayyip Erdogan's increasing control over the economy and deteriorating relations with the United States.

"The plunge in the lira which began in May now looks certain to push the Turkish economy into recession and it may well trigger a banking crisis," said Andrew Kenningham, chief global economist at Capital Economics.

"This would be another blow for EMs as an asset class, but the wider economic spillovers should be fairly modest, even for the euro zone," he added.

Kenningham noted Turkey's annual gross domestic product of around $900 billion was just 1 percent of the global economy and slightly smaller than the Netherlands.

The Turkish equity market was less than 2 percent of the size of the UK market, and only 20 percent was held by non-residents, he added.

"Nonetheless, Turkey's troubles are a further headwind for the euro and are not good news for EM assets either."

BANKS EXPOSED

Indeed, the single currency sank to a one-year trough against the Swiss franc EURCHF= around 1.1300 francs, while hitting a 10-week low on the yen around 125.45 EURJPY= .

Against the U.S. dollar, the euro touched its lowest since July 2017 at $1.13700 EUR=D3 . It was last at $1.1380 and still a long way from last week's top at $1.1628.

The dollar eased against the safe haven yen to 110.21 JPY= , but was a shade firmer against a basket of currencies at 96.431 .DXY .

The Argentine peso and South African rand were also caught in the crossfire, with the dollar adding 5 percent on the rand. Dealers said Japanese retail investors had been squeezed out of long positions in the rand sending the yen steaming higher.

"Contagion risks centre on Spanish, Italian and French banks exposed to Turkish foreign currency debt, as well as Argentina and South Africa," warned analysts at ANZ.

"Turkey's massive pile of corporate debt denominated in foreign currencies, but a rapidly sliding currency – and inflation that's threatening to go exponential – is a toxic combination."

In commodity markets, gold found little in the way of safety flows and was last down at $1,208.21 an ounce XAU= .

Oil prices were mixed with Brent off 14 cents at $72.67 a barrel LCc1 , while U.S. crude added 2 cents to $67.65 CLc1 .

<^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ MSCI and Nikkei chart

http://reut.rs/2sSBRiD

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^> (Editing by Sam Holmes and Eric Meijer)