* World stock index dips from five-month high

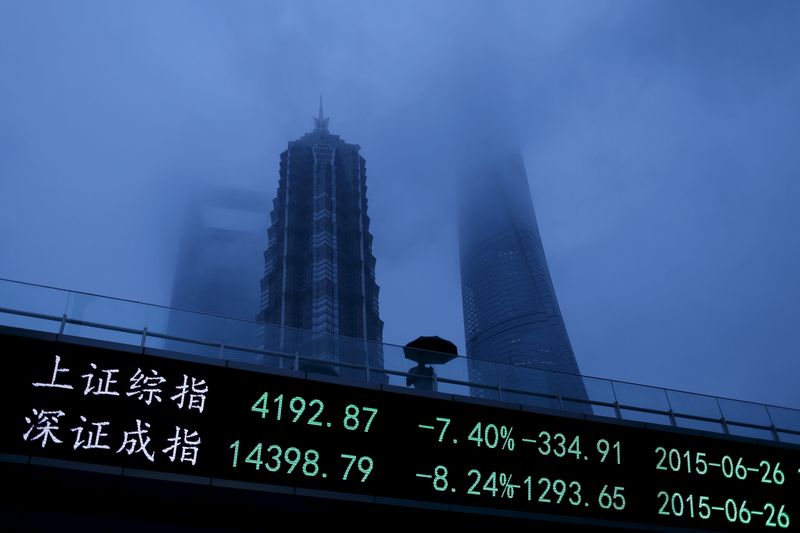

* Chinese stocks drag on Asian, European bourses

* Sterling continues rise on Brexit optimism

* Argentinian peso in the doldrums on request to IMF

* Graphic: World FX rates in 2018 http://tmsnrt.rs/2egbfVh

By Abhinav Ramnarayan

LONDON, Aug 30 (Reuters) - Stock market gains came to a grinding halt on Thursday, held back by concern that China will be left behind as the United States reaches trade agreements with other North American countries and Europe.

Stock markets and major government bond yields rose in recent weeks on hopes that a global trade war could be averted, particularly with the leaders of the United States and Canada optimistic they could reach new North American Trade Agreement by Friday with tariffs beginning to hurt the Chinese economy, Asian stocks lost some of their gains and European shares followed suit on Thursday on concerns over trade relations between the world's two largest economies.

"In all honestly, the NAFTA situation probably reflects a desire to get the agreement over the line before elections in Mexico and the mid-term vote in the U.S.," said Craig Erlam, senior market analyst at OANDA, an FX broker.

"It doesn't mean the U.S. will look for a quick solution with China. There's still a long way to run with these trade situations, and I wouldn't be surprised if we see more tariffs on more goods before it gets better."

A pan-European stock index .STOXX dropped 0.4 percent on Thursday, dragging the MSCI world equity index .MIWD00000PUS , which tracks shares in 47 countries, off a five-month high.

Earlier, a Reuters poll showed activity among China's manufacturers probably slowed for the third straight month in August broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS dropped 0.3 percent, with broad gains across the region offset by losses in China.

The Shanghai Composite Index .SSEC slid 0.9 percent and Hong Kong's Hang Seng .HSI fell 0.8 percent.

"Investors are relatively pessimistic and cautious for now amid low levels of trading volume, as there are still concerns over the development of the Sino-U.S. trade spat," said Yan Kaiwen, an analyst with China Fortune Securities.

U.S. tariffs on another $200 billion of Chinese goods are expected to take effect next month BOOST

The British pound extended its gains against the euro after recording its biggest gain in seven months on Wednesday GBP=D4 . The gains came as European Union negotiator Michel Barnier signalled an more accommodative stance towards London in ongoing talks is a slight change in tone from Barnier and a sign that the EU is very aware of the Brexit deadline and they don't want a no-deal Brexit any more than we do," said Erlam of OANDA.

EMERGING TROUBLES

Yet another emerging market currency is under scrutiny, this time Argentina's, after the country asked the International Monetary Fund for early assistance, alarming investors and hurting the peso and the country's bond prices.

The IMF said it was studying the request from Argentina to speed up disbursement of the $50 billion loan Argentinian peso ARS=RASL dropped more than 7 percent on Wednesday, its biggest one-day decline since the currency was allowed to float in December 2015.

Yields on Argentina's 100-year bond issued last year rose to its highest level yet at 9.859 percent overnight AR163761602= .

The peso's plunge came after a currency crisis hit Turkey earlier in the month, sparking worries about all emerging markets. The Turkish lira TRYTOM=D4 retreated to a two-week low after Moody's on Wednesday downgraded 20 Turkish banks.

In commodities, Brent crude futures LCOc1 extended gains and was up 0.35 percent to $77.40 per barrel. U.S. crude futures CLc1 climbed 0.37 percent to $69.77 per barrel.

Oil contracts had risen more than 1 percent on Wednesday, supported by a drop in U.S. crude and gasoline inventories and as U.S. sanctions reduced Iranian crude shipments. O/R

For Reuters Live Markets blog on European and UK stock markets open a news window on Reuters Eikon by pressing F9 and type in "Live Markets" in the search bar.