- Earnings results continue to surpass expectations

- Russell 2000 hits new high

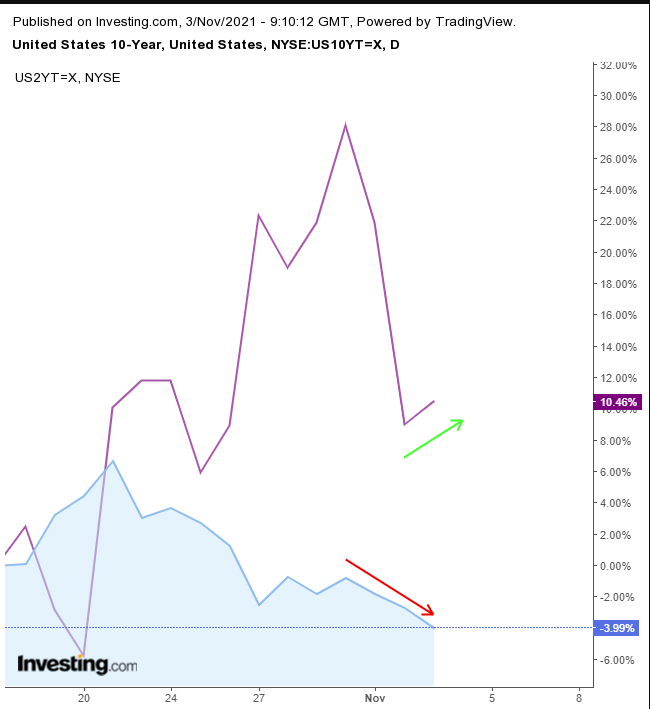

- Yields weaken

Key Events

US futures contracts on the Dow, S&P, NASDAQ and Russell 2000 were mixed in trading on Wednesday, and European stocks were only marginally higher ahead of today's statement from the US Federal Reserve.

The yield curve flattened ahead of an FOMC policy decision which is widely expected to outline a cut to its stimulus policy.

Global Financial Affairs

Futures on the Dow and S&P 500 are slightly in the red while contracts on the NASDAQ and Russell 2000 are trading in the green.

Thanks to upbeat corporate earnings and rising metal prices, European shares also rallied on Tuesday, with the STOXX 600 Index reaching all-time highs, despite a slide in oil stocks.

Shares in BMW (DE:BMWG) rallied after the German carmaker posted a higher quarterly profit, although it repeated its warning on the global chip supply shortage.

Lufthansa (DE:LHAG) climbed more than 5% after the airline reported a return to profit for the first time since the start of the coronavirus pandemic, thanks to easing travel curbs.

Most Asian markets were lower. However, Australia was the bright spot, adding 0.94% to the ASX 200, making it the gauge's best day in a month. The index rallied after the central bank signaled that it will not raise rates imminently. However, bank stocks rose along with miners, suggesting that some believe that high inflation may pressure the Reserve Bank to lift interest rates earlier than anticipated.

China's Shanghai Composite slipped 0.2%, and Hong Kong's Hang Seng dropped 0.3%. The decline followed a warning by China's Premier Li Keqiang that the world's second largest economy is facing further downward pressure while it must also contend with a new outbreak of COVID-19.

The Hang Seng fell for the seventh consecutive day. However, the technical picture offers some encouragement.

The RSI provided a positive divergence, suggesting the possibility of a H&S bottom.

In Tuesday's session, US stocks soared to new all-time highs, just a day before today's Fed's policy statement, which many market observers considered to be a sign of panic buying. It is noteworthy that the Russell 2000 hit a new record for the first time since Mar. 15.

That almost-brazen rally follows strong US corporate earnings. 83% of the 347 S&P 500 listed companies that have reported quarterly results thus far in earnings season have surpassed expectations. It seems many corporates have been profitable by passing costs on to consumers. The strong results have encouraged analysts to raise forecasts for the full year to record levels—there has been a 31% increase in forecasts for this year.

The 2-year Treasury yield rose, while the 10-year yield fell, widening the divergence, as it should.

When investors have confidence in the economy, longer-dated bonds provide higher payouts. Today, the opposite is happening.

The dollar retreated slightly after reaching near-yearly highs.

Investors may have already priced in the ending of stimulus. Now, market observers may look to interest rate hikes.

Despite USD weakness, gold has fallen for the second day in a row.

The precious metal has fallen below its uptrend line.

Bitcoin was little changed after the digital coin jumped close to its record high yesterday.

Crude oil opened lower.

If the price falls below $80, it will have completed a small H&S top.

Up Ahead

- OPEC+ meets on Thursday to make a decision on oil output.

- On Thursday, the Bank of England publishes its rate decision.

- US initial jobless claims are printed on Thursday.

Market Moves

Stocks

- The STOXX 600 was little changed

- Futures on the S&P 500 were little changed

- Futures on the NASDAQ 100 were little changed

- Futures on the Dow Jones Industrial Average were little changed

- The MSCI Asia Pacific Index was little changed

- The MSCI Emerging Markets Index fell 0.1%

Currencies

- The Dollar Index was little changed

- The euro was little changed at $1.1587

- The Japanese yen was little changed at 113.87 per dollar

- The offshore yuan fell 0.1% to 6.3943 per dollar

- The British pound was up 0.3% at $1.3658

Bonds

- The yield on 10-year Treasuries declined three basis points to 1.52%

- Germany's 10-year yield fell two basis points to -0.18%

- Britain's 10-year yield declined two basis points to 1.02%

Commodities

- Brent crude fell 1.7% to $83.27 a barrel

- Spot gold fell 0.3% to $1,782.83 an ounce