- U.S. contracts sharply higher after 4%+ selloffs Wednesday on Wall Street

- Beijing takes advantage of cheap oil to strengthen reserves

- Trump, Cuomo say U.S. virus outbreak will get worse before it gets better

Key Events

Futures for the Dow, S&P 500 and NASDAQ pushed higher on Thursday along with European shares, surprising after yesterday’s sharp selloffs which provided a rocky start to the quarter.

Oil jumped, boosted by China's plans to increase stockpiles. Still, Treasuries rallied, indicating investors aren't yet ready to fully immerse in risk assets.

Global Financial Affairs

After taking a hit during the first three months of 2020, the worst quarter for financial markets since 2008, investors are now weighing their options. Is it better to stay in and not realize sharp losses, or cut and run before stocks fall much lower and corporations stop paying out dividends and halt buybacks?

With COVID-19 still the primary risk factor pressuring global populations and markets—reported cases worldwide are currently above 940,000 and rising, and fatalities now at 47,500+, America is tightening restrictions which could bring the U.S. economy to a halt, possibly for the first time in its history.

With U.S. contracts rising this morning, and European stocks edging higher buoyed by energy shares, it's likely U.S. trade could recover from yesterday's slump.

Earlier Thursday, Asian trading was mixed, with declines in Japan’s Nikkei 225 (-1.37%) and Australia’s ASX 200 (-1.98%) offsetting gains in South Korea’s KOSPI (+2.34).

Wednesday, shares on Wall Street dropped for the third day out of four, on the growing acceptance that the U.S. economy will be shut for longer than initially hoped. Previous national emergencies, such as World War II, lifted the economy, as factories retooled for the war effort, trimming the country's 25% unemployment rate to 10%, practically overnight.

Unfortunately, coronavirus will have the opposite effect: the huge surge in last week's Initial Jobless Claims, and likely today's release as well, along with tomorrow's Nonfarm Payrolls report, will probably be the leading indicators on the job loss front.

All the four major indices in the U.S.—the S&P 500, Dow, NASDAQ and Russell 2000—each dropped at least 4.4% after President Donald Trump warned of a “painful” period ahead. Governor Andrew Cuomo of New York—currently the state hardest hit by the pandemic—said the virus breakout isn't expected to peak before the end of the month. Meaning it’s expected to get exponentially worse, before the curve begins to flatten.

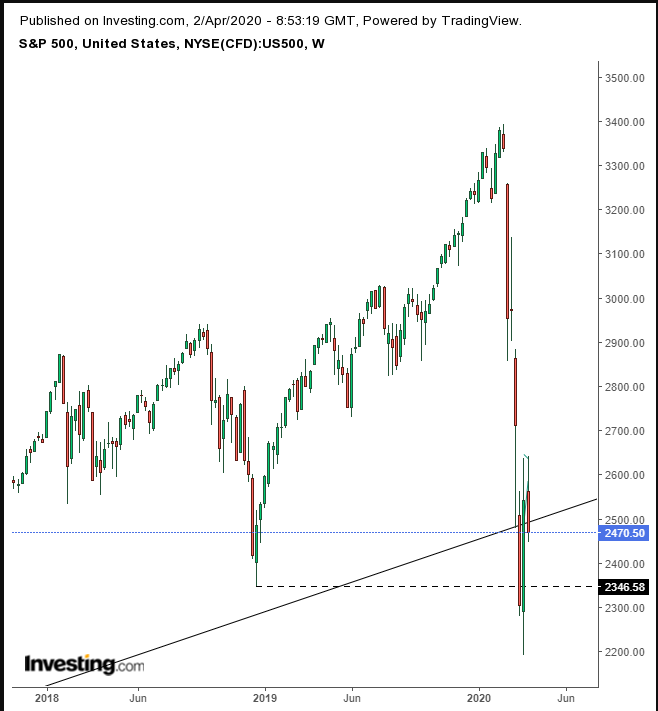

The SPX is struggling to remain above its long-term uptrend line since the 2009 bottom. A break below the 2191.86 level will complete a downtrend on a long-term basis.

Yields on the 10-year Treasury rebounded from a decline that took rates to their lowest point since March 9.

Though they bottomed at that time, this current low increases the chances of another stampede into Treasurys, following two back-to-back bearish patterns.

The U.S. dollar climbed for a second day, heading toward the 100.50 mark. Should that occur, it would establish a new uptrend, despite the Fed's best efforts to weaken the safe haven currency. We're waiting to see if it can break out of its five-day congestion.

China is taking advantage of historically low oil prices to bolster its emergency reserves, which lifted oil to an intraday high of $22.50. Still, the commodity settled below $22.

We think it more likely oil is on track to head lower, after completing back-to-back bearish patterns. Still, the price did reach the bottom of what might be a falling channel and did fall about 35% with no meaningful upward correction.

Up Ahead

- Australia's Retail Sales figures for February will print tonight, and are expected to show an uptick.

- UK Composite and Services PMI will be reported Friday. Both are anticipated to have slipped lower.

Market Moves

Stocks

- Futures on the S&P 500 Index increased 1.7%.

- The Stoxx Europe 600 Index rose 0.4%.

- The MSCI AC Asia Pacific decreased 0.5%.

Currencies

- The Dollar Index dipped 0.2%.

- The euro dipped 0.2% to $1.0939.

- The British pound gained 0.3% to $1.2412.

- The Japanese yen fell 0.1% to 107.30 per dollar.

Bonds

- The yield on 10-year Treasuries climbed two basis points to 0.61%.

- Germany’s 10-year yield rose three basis points to -0.43%.

- Britain’s 10-year yield gained three basis points to 0.344%.

Commodities

- Gold rose 0.1% to $1,593.54 an ounce.

- West Texas Intermediate crude climbed 9.2% to $22.18 a barrel.